The Bottom Line: Expense ratios levied by active and passively managed sustainable diversified US equity funds are competitive, but size matters for index tracking funds.

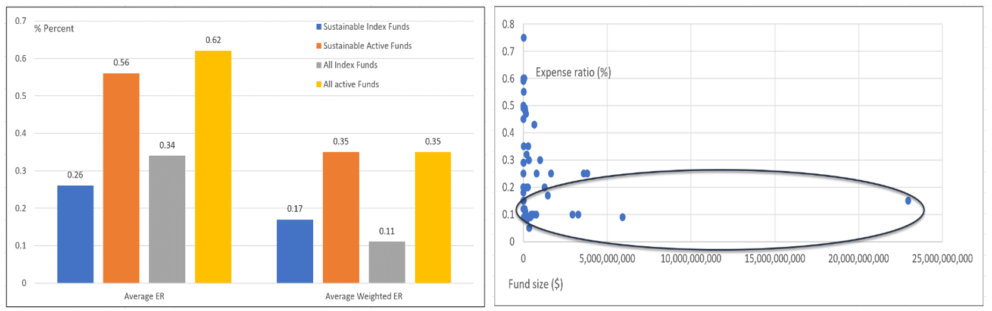

Expense ratio comparisons for active and passively managed diversified US equity ETFs and distribution of expense ratios for sustainable ETFs

Expense ratio comparisons Sustainable index funds: ER distribution

Notes of Explanation: Diversified equity funds include large, mid- and small-cap US equity funds as classified by Morningstar. Comparisons conducted both on an average and average weighted basis. ER=Expense ratio. Data source: Morningstar Direct. Analysis: Sustainable Research and Analysis.

Observations:

- Expense ratios levied by active and passively managed sustainable diversified US equity funds, including large cap, mid-cap and small-cap equity ETFs, a total of 90 funds with almost $58 billion in assets under management as of May 31, 2022¹, are in line with equivalent non-sustainable ETFs. In some cases, these are offered at even lower expense ratios. At the same time, non-sustainable investors benefit from lower expense ratios charged by the largest non-sustainable passively managed ETFs due to their significant scale advantages while the largest sustainable index tracking funds offer similar advantages.

- An analysis of expense ratios recorded by sustainable ETFs versus the overall segment, consisting of 730 ETFs with $3.3 trillion in assets as of May 31, 2022, shows that sustainable funds levy lower expense ratios in the case of both actively managed funds and index tracking funds, based on an evaluation of average expense ratios.

- Average expense ratios for actively managed sustainable ETFs are 0.56% versus 0.62% for the overall segment, or 0.06% lower. The same analysis based on average weighted expense ratios, that accounts for ETF sizes, yields almost identical results.

- Average expense ratios for index tracking sustainable ETFs are 0.26% versus 0.34% for the overall segment, or 0.08% lower. The same analysis based on average weighted expense ratios indicates that sustainable ETFs levy a modestly higher expense ratio of 0.17% versus 0.11% applicable to their non-sustainable counterparts. This differential, however, is largely due to the low expense ratios charged by very large index funds that benefit from scale economies. For example, the largest 10 ETFs account for slightly over 50% of the assets in the non-sustainable US equity ETF segment. These funds levy a low average expense ratio of 0.06%, ranging from 0.03% to 0.19%, and contribute meaningfully to the average weighted expense ratio applicable to the entire segment that would otherwise come in at 0.16%. They also offer investors more variety in terms of factor-based investment approaches.

- That said, discerning sustainable investors can find investing options charging even lower fees, starting at 0.1%.

¹This segment represents 39% of listed sustainable ETFs (232) and 52% of sustainable ETF assets ($111.1 billion) as of May 31, 2022.