Sustainable Bottom Line: For investors interested in sustainable municipal ETFs, the availability of limited options suggests focusing instead on mutual funds or separately managed accounts.

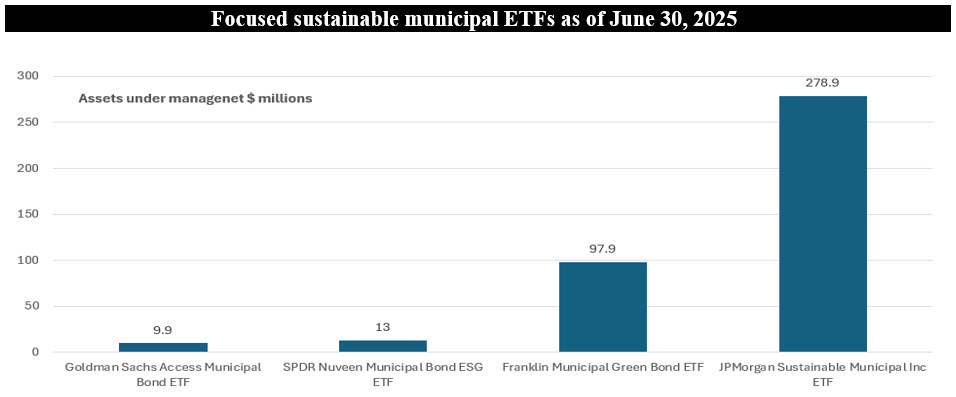

Notes of Explanation: Total net assets as of June 30, 2025. Sources: Morningstar and Sustainable Research and Analysis LLC.

Observations:

• On or about June 25, the $11.2 million VanEck HIP Sustainable Municipal ETF was liquidated and terminated pursuant to the approval formalized by the fund’s Board of Trustees earlier that month. The fund, which was launched in September 2021, couldn’t gain traction and was shut down after almost four years in operation. The fund’s liquidation highlights once again the risk of investing in funds that fail to grow assets under management and achieve scale. Refer to Chart of the Week – June 2, 2025: Risks of small sized funds.

• The focused sustainable municipal funds segment with its 16 mutual funds and ETFs, or a total of 33 share classes, stood at $1.7 billion in assets at the end of June 2025, however, it is comprised almost entirely of sustainable mutual funds. Following the latest liquidation, only four focused sustainable municipal ETFs remain in operation. These include the index tracking Goldman Sachs Access Municipal Bond ETF (that effective June 30 underwent a name change from Goldman Sachs Community Municipal Bond ETF and revised investment parameters) and the actively managed SPDR Nuveen Municipal Bond ESG ETF, with $9.9 and $13 million in assets, respectively. The other two funds, both actively managed, include the Franklin Municipal Green Bond ETF(1), a thematic green bond fund, and JPMorgan Sustainable Municipal Income ETF (2), a fund that invests in sustainable municipal securities whose use of proceeds provides positive social or environmental benefits. The two funds account for 94.3% of the focused sustainable municipal ETF segment’s assets. That said, the assets attributable to these two, the largest funds in the segment, were largely carried forward from predecessor funds as part of a rebranding and reorganization. It seems that sustainable municipal ETFs have not been successful in preserving and attracting new assets, but this is also the case for the broader sustainable municipal mutual funds segment. In the last two years, the assets of sustainable municipal funds more generally have declined, dropping from almost $2.3 billion to the current level of $1.7 billion at the end of June.

• In large part, declines in the number of funds and assets under management attributable to the segment of municipal sustainable bond funds generally and ETFs more specifically may be attributable to the growing popularity of active, separately managed accounts (SMAs) that have also siphoned assets away from sustainable municipal funds. According to some estimates, the assets under management by actively managed municipal SMAs reached $1.6 trillion at the end of 2024 and, while data quality is uneven, the asset base of sustainable municipal SMAs stood at roughly $12-15 billion as of the same date, or up 5-6X from pre-pandemic levels.

• Trends driving SMA growth include: (a) Customization, impact and impact reporting. SMA’s allow sustainability-oriented high-net-worth households that seek to invest in assets that align with their sustainability preferences, such as climate resilience, affordable housing, or environmental-justice projects, to mention just a few, to screen for qualifying investments on a security-by-security basis and track outcomes, (b) Broker-dealer technology has evolved along two dimensions. Innovative trading technologies have made it possible to offer and manage SMA accounts at lower minimum account values. Also, wider electronic odd-lot liquidity lets managers trade hundreds of small-lot sustainable bonds more efficiently, keeping tracking-error low, and (c)Tax-aware investing. SMAs can employ targeted strategies such as tax-loss harvesting overlays to create opportunities for tangible after-tax alpha.

(1) The Franklin Liberty Federal Tax-Free Bond ETF was rebranded and renamed as of May 3, 2022.

(2) The fund commenced operations after the assets of another investment company advised by the J.P. Morgan Investment Management, the JPMorgan Sustainable Municipal Income Fund (the predecessor fund), were transferred to the fund in a tax-free reorganization as of the close of business on July 14, 2023.