Sustainable Bottom Line: Three focused sustainable target-date funds offer investors clear choices for evaluation based on their risk appetite, sustainability approaches and varying cost structures.

Notes of Explanation: Total net assets as of June 30, 2025. Sources: Morningstar and Sustainable Research and Analysis LLC.

Observations:

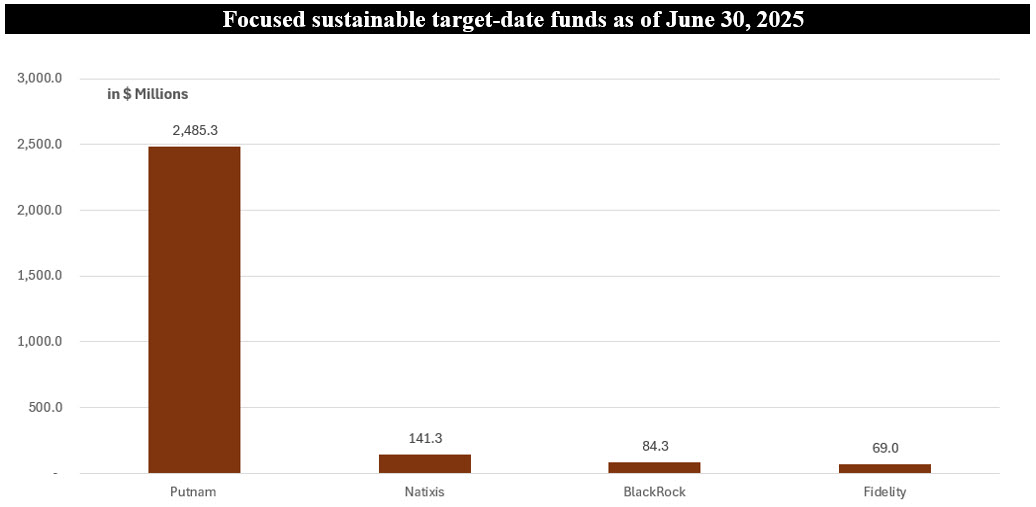

• Sustainable target-date funds or lifecycle funds have been available since 2017. Designed to simplify retirement planning and management for investors by automatically adjusting their portfolio’s asset allocation over time to shift from more aggressive to conservative profiles as the target retirement date approaches, focused or self-described sustainable target date funds are today offered by four firms. These include BlackRock, Fidelity, Natixis and Putnam Management (a subsidiary of Franklin Templeton). Together, these four firms have accumulated a combined total of $2.8 billion in assets under management across 166 funds/share classes, as defined by Morningstar, with Putnam accounting for an outsized 89% of the assets. This is a rather small 1% slice of the total focused long-term sustainable funds segment with assets of $358.7 billion at June 30, 2025, and it’s about to get even smaller. The Board of Trustees of the first to be offered sustainable Natixis target-date funds has approved a plan to liquidate the funds on or about July 29, 2025.

• The three remaining sustainable target-date funds deliver a very different combination of investment architecture and strategy, sustainable investing approach, risk exposure and cost, considerations that should be evaluated within the context of each investor’s goals and objectives before a fund selection is made. To this, investors should add consideration of historical performance results. These fund options are summarized below, in alphabetical order.

• BlackRock LifePath ESG Index Fund. This is a $84.3 million index tracking “fund of funds” that consists of various underlying iShares MSCI sustainable index tracking funds. The all-index recipe keeps turnover and fees minimal and produces the most “transparent” look-through exposure in the group. The fund’s glide-path, or shape of the curve that represents the shifting of equity and fixed-income allocations over time, starts with a steep exposure to equities at 99 % for retirements in 2065, yet the path flattens to ~50% at retirement for current 2025 retirements. This puts Blackrock in the middle of the pack when compared to Fidelity and Putnam Management. The sustainable investing approach relies on index screening and optimization: controversial sectors are excluded, then the portfolio is re-weighted to maximize aggregate ESG scores with minimal tracking error. The funds’ fees range from 0.20% to 0.50%, depending on share class and target market. At 0.20 % for Class K eligible shareholders, the fee is the clear low-cost leader.

• Fidelity Sustainable Target Date Fund. The fund is comprised of the firm’s in-house actively managed “Series Sustainable” equity and fixed-income mutual funds with a sprinkling in tactical tilts of up to 10 percentage points when its asset-allocation team spots opportunity. The mix can also hold niche buckets (commodities, high-yield, EM debt) up to 25% of assets, which gives the series more flexibility than a pure index option. Fidelity is slightly more moderate early on with a 90% equity allocation for its 2065 retirement date fund and a slightly higher 52% equity allocation (compared to BlackRock) at age 65, but then keeps easing risk for another decade, finishing near 30%. This “through” design may suit investors who plan to stay invested well into retirement. Fidelity layers its own proprietary ESG ratings atop third-party data and applies hard exclusions for tobacco, controversial weapons and certain fossil-fuel activities. Managers can still deviate tactically, so the final footprint may not mirror a pure-play “fossil-fuel-free” index. Fidelity also offers three share classes with expense ratios that range from 0.21% to 0.41%.

• Putnam Sustainable Retirement Fund. The largest of the funds, with $2,485.3 million in assets largely sourced directly or indirectly to employer-sponsored retirement plans and other institutional investors, was reconstituted in Q1 2023 from a conventional to a sustainable-oriented target-date fund. The fund is invested in actively managed sustainable ETFs that are advised by Putnam and PanAgora Asset Management (for international and emerging markets). Of the three funds, Putnam offers the most conservative target-date fund option during the accumulation period leading to retirement. It starts off with a 26% allocation to equities for current 2025 retirees and 95.1% for 2065 retirees. This conservative approach has contributed to lagging returns. Putnam focuses on ETFs that score well on “positive sustainability characteristics,” but still carries mainstream sector exposure. The strategy leans more on fundamental ESG research than negative screens. Putnam’s fees, which range from 0.5% to a high of 1.6% across eight offered share classes that range from retail to institutional, making its funds the most expensive option.