The Bottom Line: Top financial results achieved by sustainable funds in June, as well as more generally, are driven largely due to fundamental investment strategies.

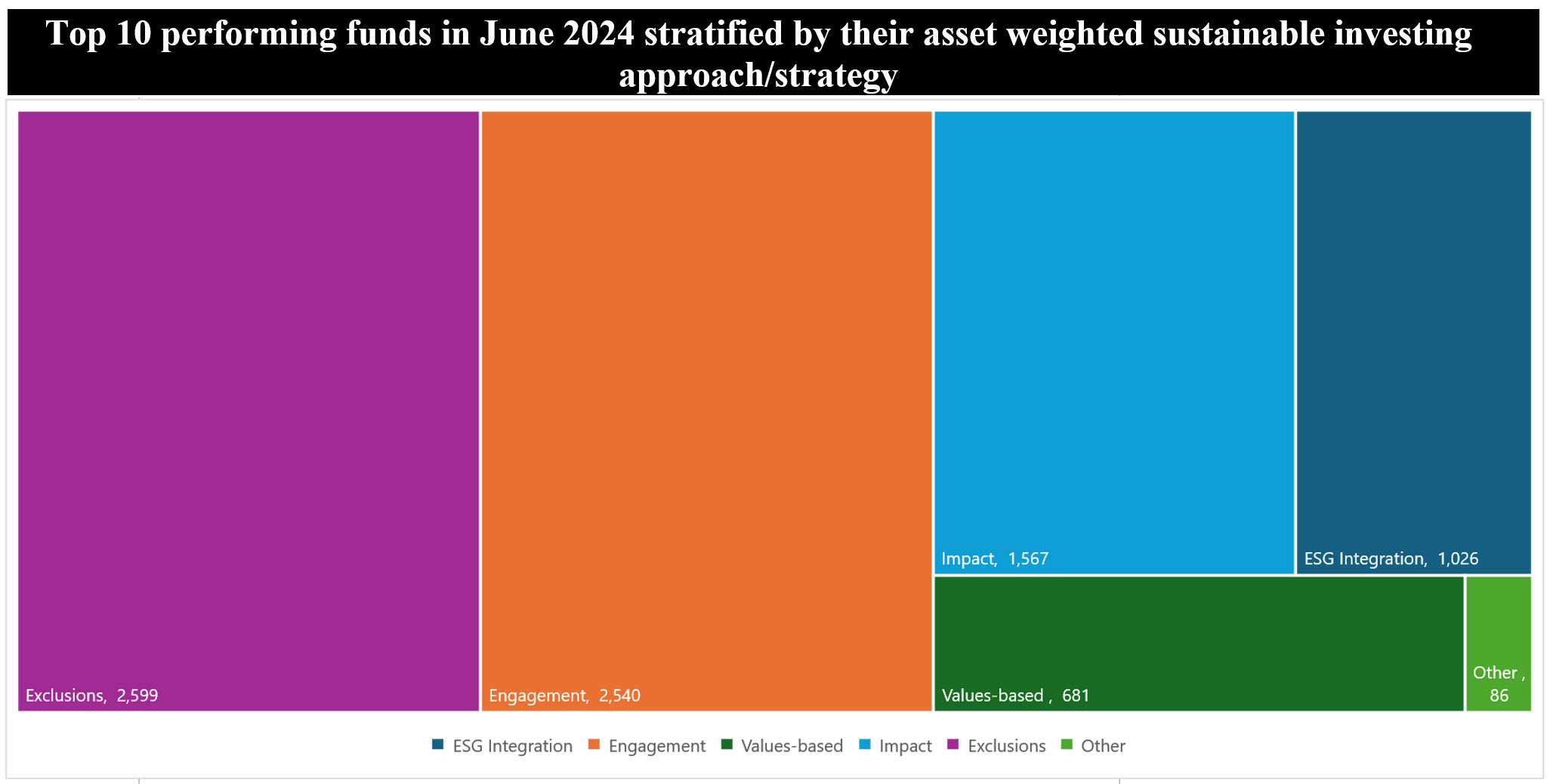

Notes of explanation: Chart displays the asset weighted sustainable investing approach/strategy of the top 10 performing funds in June 2024. Assets in US$ billions as of June 30, 2024. Funds include: iPath® Global Carbon ETN 8.95%), Nuveen Winslow Large-Cap Growth ESG I (7.85%), Praxis Growth Index I (7.07%), iShares ESG Aware MSCI USA Growth ETF (6.91%), Invesco ESG NASDAQ 100 ETF (6.82%), Calvert Emerging Markets Fcs Gr I (6.73%), ALPS/Kotak India ESG II (6.59%), Xtrackers Cybersecurity Select Eq ETF (6.28%), American Century Sustainable Growth ETF (6.14%) and Invesco Real Assets ESG ETF (6%). Some funds employ multiple sustainable investing strategies and, in such cases, the funds’ total net assts (including all share classes) are fully accounted for under each of the strategies. The category Other includes Thematic, ESG screening and exclusions and ESG screening approaches. ESG screening covers both positive and negative screening approaches. Sources: Morningstar Direct; Sustainable Research and Analysis LLC.

Observations:

• The top ten performing focused sustainable funds in June 2024, all equity and commodity-oriented funds, posted average total returns of 6.9% and 23.6% in June and over the trailing 12-months. Returns ranged from a low of 6% recorded by the Invesco Real Assets ESG ETF to a high of 8.95% achieved by the iPath Global Carbon ETN. This compares to returns of 0.47% and 10.6% achieved by all sustainable funds during the same time intervals.

• The top ten performing funds in June 2024 pursue various fundamental investment strategies, including active and passive investing approaches as well as the following fundamental strategies: carbon credits investing (classified as commodity investing), large-cap growth, technology, emerging markets equity, country specific India focus, cybersecurity and real assets that invest in companies that are either principally engaged in real estate, infrastructure, natural resources or timber industries, or support such businesses. The dominant strategy, however, emphasized large-cap growth stocks.

• Fueled by enthusiasm for AI and expected interest-rate cuts before the end of the year in the light of softening economic data, the S&P 500 continued to register gains in June. After recording a 5% total return in May, the index posted seven new closing highs in June and ended the month up 3.6%, with five of the eleven S&P sectors also registering advances, led by Information Technology, up 9.3%. At the other end of the range, Utilities trailed and gave up 5.8%. This was the benchmark’s fifth monthly gain this year, for a year-to-date increase of 15.9% and a trailing twelve-month return of 24.6%. At the same time, the S&P 500 ESG index, designed to meet S&P’s sustainability criteria while maintaining similar overall industry group weights as the S&P 500, was up 3.4% in June. While trailing in June, the ESG index is ahead of the S&P 500 with returns of 15.8% year-to-date and 25.1% over the trailing twelve-months. The performance of the conventional large cap index and ESG version have been driven by a small number of growth-oriented technology companies that now dominate the index, including Microsoft Corp., Amazon.com Inc., Meta Platforms Inc., Apple Inc. Alphabet Inc., Nvidia Corp. and the recovering Tesla Inc. The so-called Magnificent Seven accounted for 79% of the benchmark’s total return in June while on an equally weighted basis, the index was down 0.45% in June and only up 11.8% over the last twelve months—less than half the S&P 500 return. This occurrence led to the success in June achieved by five of the top performing sustainable funds that focus on large-cap growth stocks. For example, the second-best performer in June, the Nuveen Winslow Large Cap Growth ESG Fund I, had a 44.4% exposure to five of the Magnificent Seven stocks, including Microsoft Corp., Amazon.com Inc., Apple Inc. Alphabet Inc and Nvidia Corp.

• While some of the top ten performing sustainable funds in June engage in multiple strategies, eight distinct sustainable investing strategies characterize the ten funds, with five strategies accounting for the largest share of assets under management calculated on an asset weighted basis. In order of their respective weights, these include Exclusions, Engagement, Impact, ESG Integration and Values-based investing approaches. These strategies add up to a combined total of $8.4 billion in assets, or 99% of the asset weighted assets attributable to the top 10 funds. Three additional approaches, classified as Other, include ESG screening and exclusions, ESG screening and thematic investing.

• That said, the impact on the performance results in June achieved by any of the top 10 sustainable funds, or for that matter any other sustainable funds based on their sustainable investing approach, is difficult to tease out. The one exception involves thematic funds, or funds that invest with a focus on a particular idea or unifying ESG-related concept. In June, carbon credits experienced a rebound and drove the 8.95% total return results posted by the $5.1 million iPath Global Carbon ETN. The fund, however, has been closed. Barclays Bank PLC, the issuer, announced that it will exercise its issuer call option and redeem the note series in full.