Sustainable Bottom Line: Of five new fund listings in 2025, two new Brown Advisory June ETF listings replicate the strategy of two existing mutual funds.

Notes of Explanation: Sources: Morningstar and Sustainable Research and Analysis LLC.

Observations:

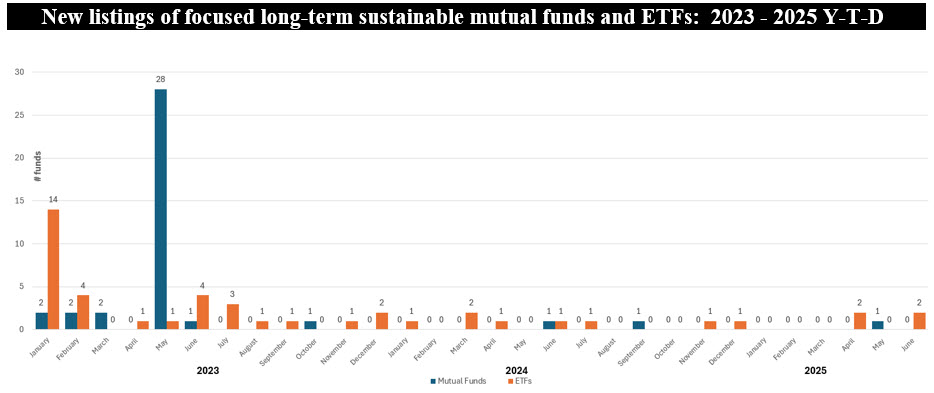

• Two new focused sustainable fund launches were recorded in June, bringing to five the number of new fund listings since the start of the year (excluding new share classes and re-brandings). This compares to six new listings during the same period in 2024 and 59 in 2023, reflecting the dramatic slowdown in new sustainable fund offerings starting in mid-2023 to date.

• Of the five new listings this year, four were ETFs and one was a mutual fund. The two new launches are both managed by Brown Advisory, an independent largely employee-owned firm, and the tenth largest provider of focused sustainable mutual funds and ETFs with $10.0 billion in assets under management at the end of June. The funds are sub-advised by Vident Asset Management, a firm that provides portfolio trading, execution, and implementation services for Brown Advisory’s ETFs.

• The ETFs are actively managed, concentrated funds that include the $489.2 million Brown Advisory Sustainable Growth ETF (BASG) as well as the $127.3 million Brown Advisory Sustainable Value ETF (BASV). Both funds charge 61 basis points.

• The Brown Advisory Sustainable Growth ETF is a bottom up, fundamentally driven fund that emphasizes primarily domestic mid-to large cap companies with strong earnings growth potential, disciplined capital returns (dividends/share buybacks), and controlled valuations over full market cycles. The value-oriented counterpart, the Brown Advisory Sustainable Value ETF, uses a value oriented disciplined approach to target large-cap companies with strong free cash flow, prudent capital deployment, and attractive valuation metrics.

• Applicable to both funds, Brown Advisory seeks companies “that are building powerful business models on a foundation of sustainable business advantages, sustainable cash flow advantages by embedding sustainability into their operations—across products, processes, or people—to drive margins, revenues, and brand strength.” Integral to its ESG due diligence, Brown is actively engaged in company interactions and proxy voting.

• In the absence of performance track records, investors interested in the new ETFs can extrapolate from the results achieved by Brown Advisory’s two corresponding mutual fund offerings. These are the Brown Advisory Sustainable Growth Fund, launched in 2012, and the Brown Advisory Sustainable Value Fund, launched more recently in early 2023. These two funds replicate nearly the identical investment philosophy, securities selection criteria, sustainability integration, and portfolio structure. In terms of performance results, both actively managed funds, with the exception of one share class, have largely underperformed their designated Russell 1000 growth and value securities market indices over the previous twelve months and in, the case of the growth fund, also the trailing three- and five-year time intervals. Versus the best performing share class, minimum variations ranged from 0.06% to -6.2% on an average annual basis.