The Bottom Line: Sentiment around ESG is taking a negative turn and based on various recent developments and actions, ESG is also becoming more politicized.

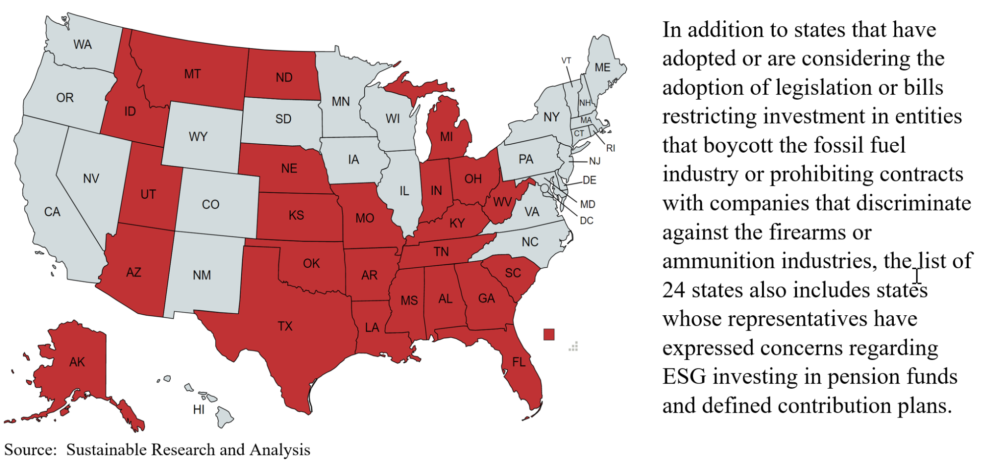

States that have adopted anti ESG legislation, may be considering them or are leaning in that direction

Observations:

Sentiment around ESG has taken a negative turn and ESG is becoming more politicized. In some corners, ESG is being equated with a Communist Chinese-style “social credit scoring system,” where people or corporations are punished if they do not meet ESG requirements. Offered in support of this observation are the following developments and actions:

- The adoption of legislation by various states seeking to penalize managers or other financial institutions that either exclude investments in or discriminate against companies in the fossil fuels, firearms and ammunition sectors. As many as 25 states have either banned or are considering a ban on practices involving the inclusion of ESG in investment decisions.

- 16 states recently sent a letter to President Biden requesting he withdraw the U.S. Securities and Exchange Commission’s (SEC) proposal that would force publicly traded companies to account for and share data on so-called climate change risks and greenhouse gas emissions for themselves and the companies in their supply chains. In their letter, various governors argue that the proposal is unjustified, is outside the SEC’s authority, would harm U.S. business competitiveness, and would reduce returns to investors, including already woefully underfunded public pension funds.

- The State of Utah’s recently public voiced its objection to any ESG ratings, ESG credit indicators, or any other ESG scoring system that calls out ESG factors separate from, in addition to, or apart from traditional credit ratings. This was in response to the publication by S&P Global Ratings of ESG credit indicators as part of its credit ratings for states and state subdivisions.

- The introduction in Congress of the Investor Democracy is Expected (INDEX) Act that aims to deconsolidate the voting power amassed within a small number of the largest advisers of passively managed funds to neutralize their dominance by turning voting power in corporate governance to individual investors. While motivated by anti-ESG sentiments, this Act, if adopted, could actually accrue to the benefit of individual sustainable investors.