Sustainable Bottom Line: Investors in sustainable international passive funds that consider ESG-related criteria should expect to realize performance bonuses or penalties relative to conventional benchmarks.

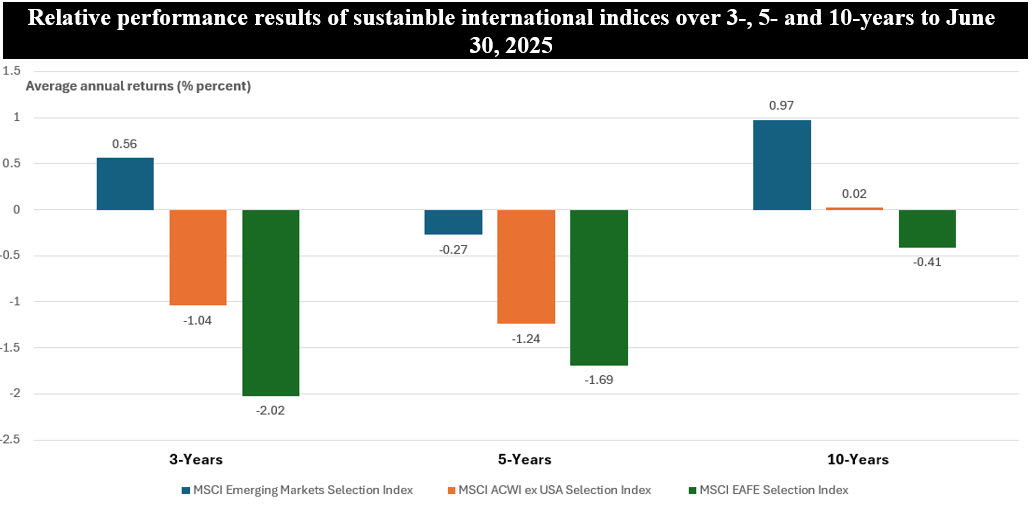

Notes of Explanation: Relative performance results are average annual returns. Comparisons are to underlying indices, including MSCI Emerging Markets Index, MSCI ACWI ex USA Index and MSCI EAFE Index. Sources: MSCI and Sustainable Research and Analysis LLC.

Observations:

• Non-U.S. developed and emerging market equities or equity funds can today account for an average of between 18% of diversified portfolios to around 33%, depending on an investor’s risk reward profile and investment time horizon, ranging over the intermediate to long-term. Such strategic asset allocations are informed by capital market assumptions reflecting that non-U.S. equity returns, especially in emerging markets, are currently expected to exceed those of the U.S. over the long term.

• Investors in international passive funds that consider environmental, social and governance (ESG)-related criteria (sustainable investing criteria) should expect to realize some performance bonuses or penalties. These will range from modest bonuses or penalties to wider variations relative to conventional or underlying benchmarks.

• This observation is based on the intermediate to long-term performance of three international indices maintained by MSCI, the MSCI EAFE Selection Index (tracking large and mid-cap companies across developed markets), the MSCI ACWI ex USA Selection Index (tracking large and mid-cap companies in both developed and emerging markets) and MSCI Emerging Markets Selection Index (tracking large and mid-cap companies across 24 emerging markets)(1) relative to their conventional counterparts to June 30, 2025. The Selection indices, which maintain investment profiles, fundamental characteristics and liquidity measures that tend to limit but not eliminate tracking errors, invest in companies with favorable risks and opportunities-oriented ESG ratings, the exclusion of companies based on involvement in specific business activities, for example controversial weapons, tobacco, and coal, to mention just a few, and limiting exposure to companies with ESG business controversies.

• The criteria applied to the construction of the Selection indices shaved an average annual 41 basis points off EAFE returns across the trailing 10 years and between an average annual 1.69% and 2.02% over the trailing five- and three-year intervals to June 30th. At the same time, average annual returns were virtually neutral for the MSCI ACWI ex USA Selection Index but lagged by an average annual 1.24% and 1.04% for the trailing five and three years. The MSCI Emerging Markets Selection Index achieved the best relative results, adding 0.97% and 0.56% in the trailing ten and three years and was virtually neutral for the last five years.

• Sustainable indices have systematically underweighted fossil fuels energy and overweighted large-cap technology and communications services companies, such that when energy soared (+64 % for the S&P 1500 Energy sector) and tech slumped (-32 % for the NASDAQ Composite) in 2022, nearly every broad ESG benchmark fell behind its underlying counterpart index. This has introduced more volatility to sustainable benchmarks over shorter time intervals.

(1)These were renamed from ESG indices to meet European regulations.