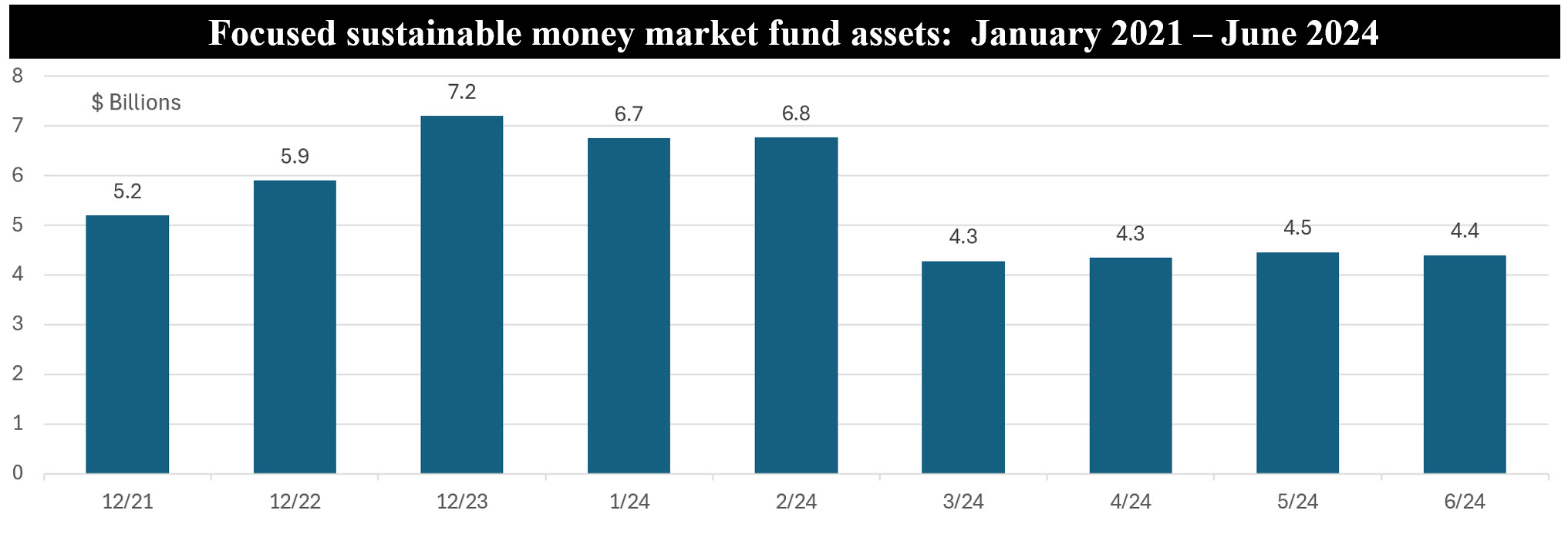

The Bottom Line: Focused sustainable money market fund assets are disappearing while non-focused sustainable money market funds are expanding along with conventional money fund assets.

Notes of explanation: Focused sustainable money market fund assets include the assets of funds that have been liquidated between 12/21 and 6/24. Sources: Morningstar Direct; Sustainable Research and Analysis LLC.

Investors have been powering up the assets of money market funds to record levels

Investors have been powering up the assets of money market funds to record levels since the Federal Reserve Bank began raising interest rates, reaching $6.15 trillion as of July 2nd around quarter-end and the holiday weekend, according to the Investment Company Institute. The Fed has raised the federal funds rate eleven times from near zero since March 2022 to a range between 5.25% and 5.5% on July 24, 2023, in an effort to cool the economy and bring down the rate of inflation. Short-term rates at these levels are at their highest in two decades and money market fund investors are currently realizing 12-month yields that have reached as high as 5.5% at the end of June. Almost 50% of funds at the end of June are recording 12-month yields equal to or greater than 5%.

At the same time, the number and assets of focused sustainable money market mutual funds are disappearing

The number of funds and assets under management of focused sustainable money market mutual funds have been shrinking. These are funds classified by Morningstar as sustainable money market funds in large part on the basis that they explicitly describe a fund’s sustainable investing approach or strategy* in the fund’s prospectus within its investment objective and investment policy or Statement of Additional Information (SAI). The segment now consists of just three funds/17 share classes, largely institutional prime funds. However, the segment continues to decline further. DWS has announced the termination and liquidation of the DWS ESG Liquidty Fund on or about August 14, 2024 while BlackRock has disclosed that the BlackRock Liquid Environmentally Aware Fund will liquidate on or about September 5, 2024. Following these liquidations, and assuming no new focused sustainable fund formations, the segment will be reduced to just one fund—the BlackRock Wealth Liquid Environmentally Aware Fund and its five share classes. The fund considers factors such as emissions, energy and water intensity, waste generation, green revenues and environmental disclosure levels in evaluating the environmental performance of an issuer or guarantor.

Retail and institutional investors have other sustainable money market fund options

While focused sustainable money market funds have now been reduced to just one fund offering, retail and institutional investors have other sustainable money market fund options beyond focused money funds. According to Crane Data, there are currently 14 firms offering 47 funds/share classes that systematically integrate financially material ESG factors into their investment decisions (along with other relevant factors) with the goal of managing risk and improving long term returns and/or offer dedicated share classes that screen out particular types of sectors or companies or that meet specific sustainable investment goals, such as social goals. For example, the Federated Hermes Government Obligations Fund SDG share commits to donating, via Federated Hermes and/or its affiliates, 5% of the quarterly management fee revenue and administrative fee revenue attributable to the SDG class, net of any waivers to a designated organization whose mission is aligned with one or more of the United Nations Sustainable Development Goals (UN SDGs).

With a combined total of $99 billion in net assets, up from $87.8 billion at the end of 2021, these funds/share classes are largely offered to institutional investors, but they are also available to retail investors either directly or through financial intermediaries.

*Sustainable investing is an umbrella term that encapsulates various strategies or approaches, including values-based investing, ESG screening and exclusions, impact investing, thematic investing, ESG integration, shareholder engagement and proxy voting. These approaches are not mutually exclusive.