The Bottom Line: A limited number of worthy focused sustainable small-cap blended investment funds is available to various investors once screened against five key characteristics.

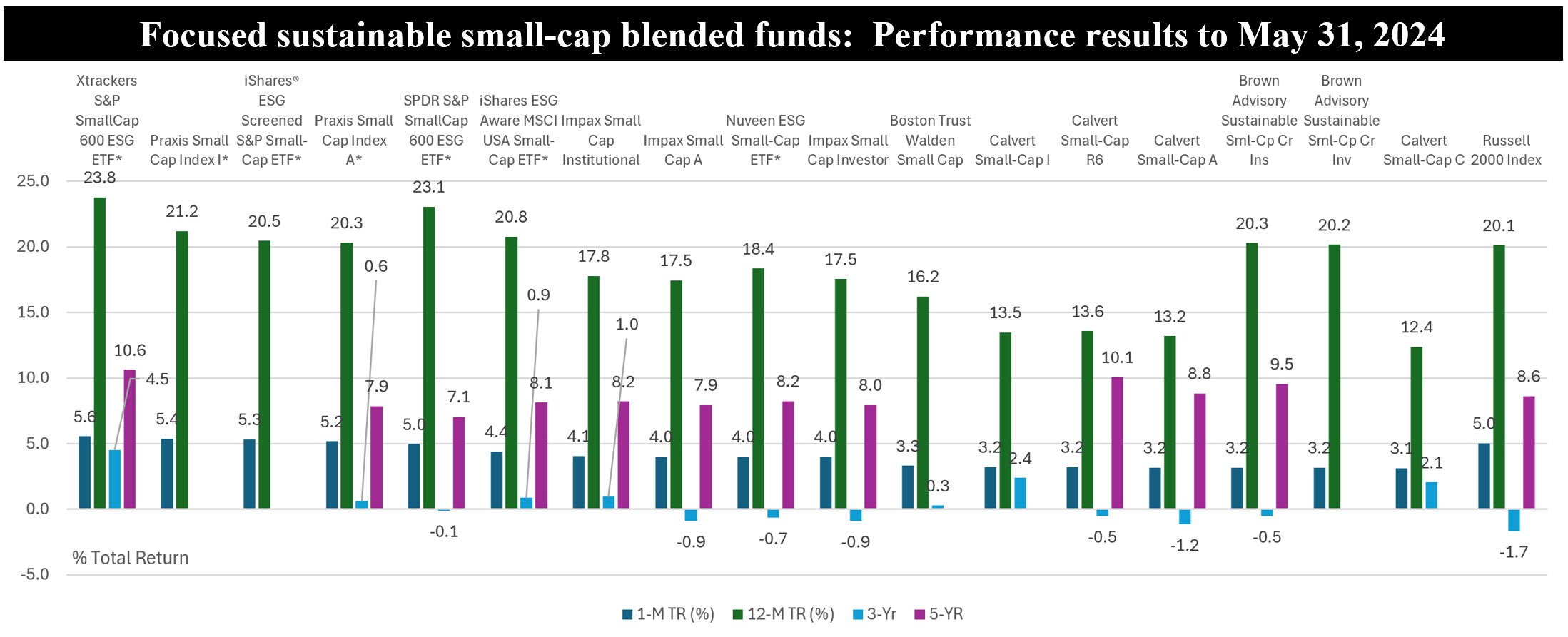

Notes of Explanation: Funds arrayed in descending order based on May 2024 total return performance results. Small cap blended funds consist of non-thematic small cap funds defined by their prospectus. * Indicates index fund. Sources: Morningstar Direct; fund prospectus; Sustainable Research and Analysis LLC.

Observations:

- May was a strong month for stocks as well as bond market indices, reversing April’s declines. All three major stock benchmarks, the S&P 500 Index, Dow Jones Industrial Average and the Nasdaq Composite, reached new all-time highs and recorded, by month-end, gains of 5.0%, 2.6% and 7.0%, respectively. Ten of the eleven S&P 500 sectors ended the month on a positive note. The Tech sector gained 10%, Utilities added 9% while the Energy sector, due to falling oil prices, declined 0.4%. At the same time, all mid- and small-cap sectors recorded positive results. While well short of its high value achieved in November 2021, the small-cap Russell 2000 index managed to post a gain slightly above 5.0% in May that edged out its large-cap counterpart by six basis points.

• Against this backdrop, focused sustainable small-cap blended funds, consisting of non-thematic small-cap funds defined by their prospectus, recorded an average gain of 4.1% in May, narrowly trailing the 4.3% average total return achieved by large-cap blended funds.

• The narrow miss belies a wider average performance disparity extending some five plus years. Over the previous one-, three- and five-year intervals, the average performance of focused sustainable blended small-cap funds has trailed their large-cap counterparts by 8.4%, 7.1% (annualized) and 6.2% (annualized), respectively.

• In addition to being burdened by higher interest rates in recent years, the small-cap sector hasn’t benefited from the performance of mega-tech stocks that have driven the performance of large-cap indices.

• Consisting of a total of 10 active and passively managed funds (17 funds/share classes) with total net assets of $8.3 billion, the universe of focused sustainable small-cap blended funds, including mutual funds and ETFs, offers investors a limited number of worthy investment options when subjected to screening based on management company considerations, years in operations, fund size, performance track record and expense ratio.