Sustainable Bottom Line: The expansion of Vanguard’s pass-through voting program, and others like it, offers various sustainable investors another avenue to express their sustainability preferences.

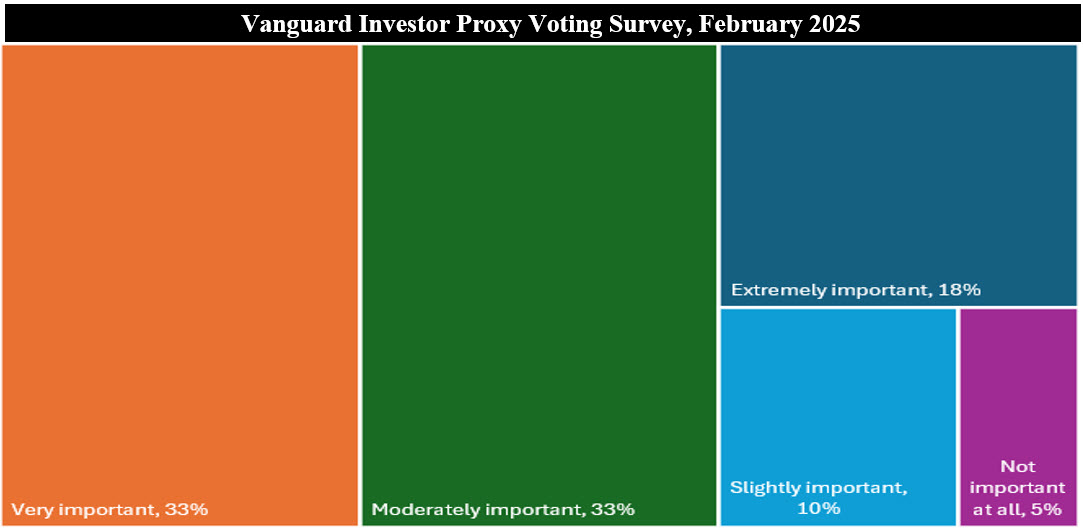

Notes of Explanation: Source: Vanguard Investor Proxy Voting Survey, February 2025, in response to the question: How important do you think it is for mutual fund/ETF managers to consider investor preferences when casting votes for their fund? and Sustainable Research and Analysis LLC.

Notes of Explanation: Source: Vanguard Investor Proxy Voting Survey, February 2025, in response to the question: How important do you think it is for mutual fund/ETF managers to consider investor preferences when casting votes for their fund? and Sustainable Research and Analysis LLC.

Observations:

• At the end of May, Vanguard announced that it was expanding its Investor Choice pilot program to include 12 participating funds representing nearly $1 trillion in assets under management and reach nearly 10 million investors. Vanguard’s pass-through voting program, and at least two other similar programs offered by BlackRock and State Street, gives investors a greater voice in proxy voting and offers various sustainable investors, even if they are investing in conventional funds, an avenue to express their sustainability preferences. Originally launched as a pilot program in 2022, the Vanguard program allows institutional and retail investors to vote shares of public companies owned indirectly in mutual funds, ETFs and other investment vehicles.

• In addition to eight previously available Investor Choice eligible index funds, including Vanguard ESG US Stock ETF, Vanguard S&P 500 Growth Index, Vanguard Russell 100 Index, Vanguard Mega Cap Index, Vanguard Dividend Appreciation Index, Vanguard High Dividend Yield Index, Vanguard Tax-Managed Capital Appreciation, and Vanguard Tax-Managed Small- Cap, the four expanded funds to be offered under the Investor Choice program in the second half of this year will cover the Vanguard Value Index Fund, Vanguard Growth Index Fund, Vanguard Mid-Cap Index Fund and Vanguard Large-Cap Index Fund.

• Under the current program, investors are offered five voting options to choose from. These are to vote as the company’s Board recommends, to rely on guidance from two proxy advisory firms, Eagan Jones and Glass Lewis & Co., LLC, to allow Vanguard to continue to vote on their behalf (the default option if no other choice is made) and to vote in approximately the same proportions as votes cast for the meeting by other shareholders of the security, to the extent that any such votes can be reasonably executed.

• Vanguard’s is one of the top three firms that dominate the index fund management business, and the other two firms, BlackRock and State Street Global Advisors, also offer their own forms of pass-through voting programs. Launched in 2021 and 2022, respectively, these two programs have also been expanding to cover additional investment vehicles and investors.

• According to a Vanguard Investor Proxy Voting Survey conducted in February 2025 with a sample of more than 1,000 investors, more than 80% of investors believe it’s important for asset managers to consider their preferences when casting votes, and 57% said they were interested in participating in proxy voting choice programs. That said, the uptake has so far yielded limited results among retail investors but that is expected to change with the benefit of further education and greater awareness.