The Bottom Line: The Municipal National Intermediate funds category, which offers investors a core focused sustainable municipal funds holding option, posts negative results in May.

Notes of Explanation: For each mutual fund with multiple share classes, only the best performing share class is displayed. May performance results arrayed in descending order. Results over 3-year and 5-year intervals are average annual performance results. Data to May 31, 2024. Sources: Morningstar Direct; Sustainable Research and Analysis LLC.

Observations:

May was a strong month for stocks as well as bond market indices, reversing April’s declines. With one exception, each of the 77 investment categories that comprise the focused sustainable investment funds universe, as defined by Morningstar, posted zero to positive average total returns, as high as 12.7% recorded by two leveraged equity funds investing in clean energy and EV technologies.

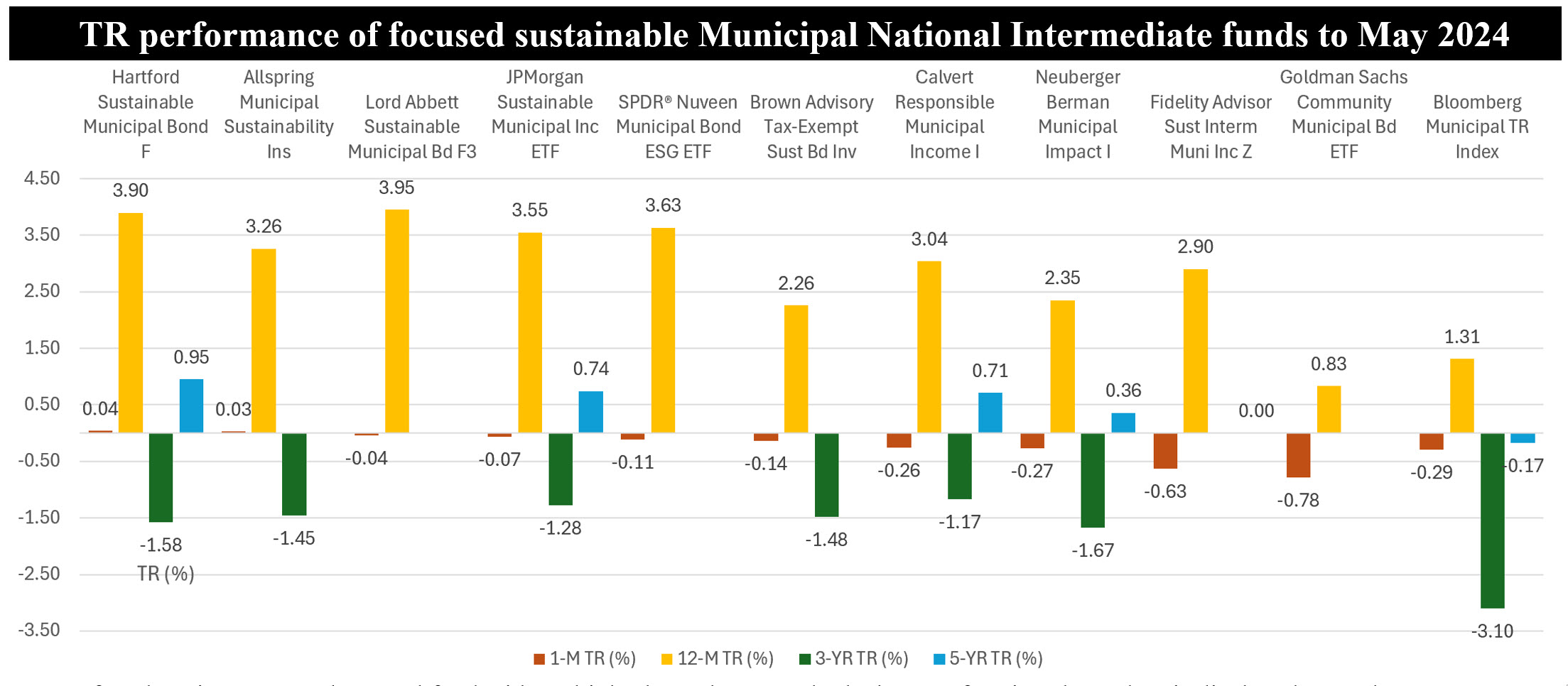

The one exception is the Municipal National Intermediate funds category made up of 11 funds (30 share classes) with $1.2 billion in net assets that registered a negative average return of 0.2%. Beyond the month of May, across the one-, three- and five-year time intervals, Municipal National Intermediate funds posted average returns of 3.1%, -1.7% and 0.3%, respectively. Funds falling into this category offer investors a core municipal holding option that should be qualified, in addition to fundamentals and sustainable investing preferences, based on management firm, years in operation, past performance results, fund size as well as fund expenses.

Municipal National Intermediate funds, along with Municipal National Long, Municipal California Intermediate and Municipal National Short, make up the sustainable municipal bond funds segment with a combined total of 19 funds and $1.7 billion in net assets. Unlike the funds that make up the Municipal National Intermediate fund category, these other three categories posted zero to positive returns in May.

Tax-exempt yields were mixed in May, with yields in the five-to-ten-year segment of the curve rising as much as 34 bps, while the shortest and longest maturities experienced modest yield declines. The longest maturity segment had a positive return, outperforming both short and intermediate segments. Lower quality bonds, particularly BBB and high yield debt outperformed higher-quality issues in May. Against this backdrop, returns in May for the Municipal National Intermediate funds category ranged from a low of -0.77% to a high of .04%, with only five funds/share classes posting positive results for the month. In general, positive to higher returns were achieved by funds with longer average maturities and exposure to lower rated municipal bonds.

For example, the Hartford Sustainable Municipal Bond Fund Class F and I ($1 million minimum investment), charging lower than median expenses for the investment category, were both up 0.4% in May, likely assisted by the fund’s average BBB credit quality and longer average maturity. At almost $87 million in net assets with four share classes, the fund, which is sub-advised by Wellington Management, employs an ESG integration approach and emphasizes bonds of issuers with positive sustainable initiatives. The worst performing fund in May is the $9.8 million passively managed Goldman Sachs Community Municipal Bond ETF. Posting a negative 0.78% total return in May, the fund screens for securities that take into account certain social or environmental factors using negative screens that may include sectors, sources of funds and use of proceeds to select securities of issuers that foster community and investing in essential services (including education, healthcare and clean water) along with positive screens that include pre-refunded securities or those with potentially environmentally or socially beneficial outcomes. While the fund’s 0.15% expense ratio is the lowest in the category, its average A credit quality may have detracted from its performance in the month of May.