Sustainable Bottom Line: The recent liquidation of the only two ocean-focused thematic funds highlight the risks of investing in funds that do not achieve scale.

Notes of Explanation: Net assets as of April 30, 2025. Net assets reflect the combined value of funds in the event more than one fund is managed. Sources: Morningstar and Sustainable Research and Analysis LLC.

Observations:

• Ahead of the upcoming World Ocean Day, a broad campaign to catalyze collaborative action to address the threat of climate change and the risks posed to the world’s oceans, it seemed like a good time to revisit the small segment of thematic sustainable mutual funds and ETFs focused on the water industry generally and more specifically ocean-focused funds. Unfortunately, the thematic segment that until early April was comprised of 12 mutual funds and ETFs has been reduced to ten funds due to the liquidation of the only two ocean-focused investment funds. Dedicated exclusively to investing in ocean-related companies, or firms that offer products and services targeting solutions which contribute to the protection or achievement of cleaner oceans, are users of such products or services, or are engaged in activities with ocean-related sustainability objectives, the two funds, both under $10 million in assets under management, were liquidated in April and May. These included the $1.4 million KraneShares Rockefeller Ocean Engagement ETF and the $4.6 million NYLI Clean Ocean Fund that was scheduled to close on or about May 20.

• Their liquidation highlights once again the risks of investing in funds that fail to grow assets under management and achieve scale. Smaller funds, on average, tend to subject investors to higher expense ratios and their portfolios may struggle to achieve effective diversification, liquidity, and trading efficiencies. In the process, tracking results could suffer along with performance outcomes. Also, portfolios may shut down without much advance notice at a time that could be disadvantageous to remaining fund shareholders.

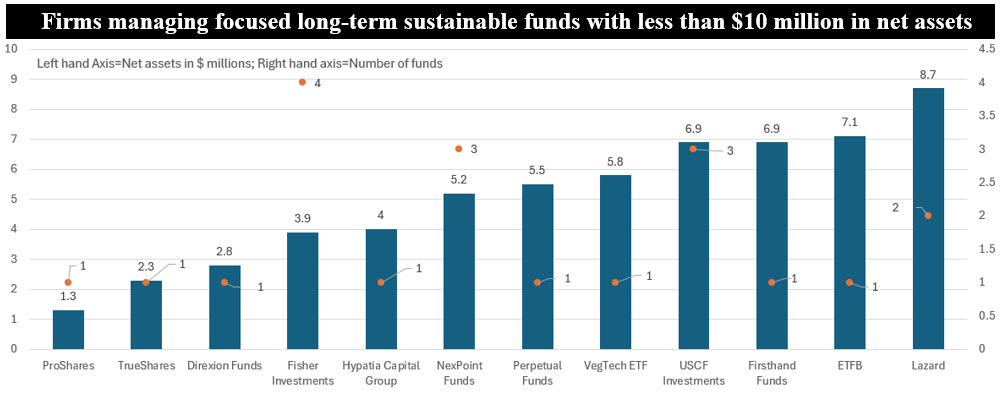

• The political push back in the US against ESG investing has had dampening effects on the focused long-term sustainable funds segment, which can be observed, in part, in tepid fund flows, a noticeable decline in new fund launches as well as an acceleration in fund closures and reorganizations along with fund company exits from the space. This development has had a particular impact on smaller fund management firms and smaller funds. Of the 25 smallest fund firms with focused long-term sustainable fund assets on a combined basis, in cases of more than one fund, at or below $10 million as of a year ago when this topic was last analyzed (http://(https://sustainableinvest.com/chart-of-the-week-may-27-2024-smallest-sustainable-funds/),12 firms, or 48% of firms, shuttered their funds. That number rises to 60% when focus in narrowed to cover the smallest 10 funds.

• Some of the smallest fund firms bring unique and innovative products to market, such as exposure to innovative and sustainable solutions in the food and materials sectors, carbon and carbon reduction strategies, clean transport or ocean health-related companies. However, unless the associated small funds in this category are managed by deep pocketed management firms or they succeed in building up their assets under management quickly, they are less likely to survive.

• Investors attracted to new and unique fund offerings that don’t have reasonable substitutes are encouraged to monitor these new funds rather than invest in them at the time of their launch, unless offered by established management firms with sustainable businesses. That said, this is still not a fail-safe approach. In general, it may be prudent to avoid such investments until the funds reach about $30 to $50 million in assets under management.