Sustainable Bottom Line: Foreign large blend funds have been outperforming the S&P 500 recently and should continue to do so based on capital market projections.

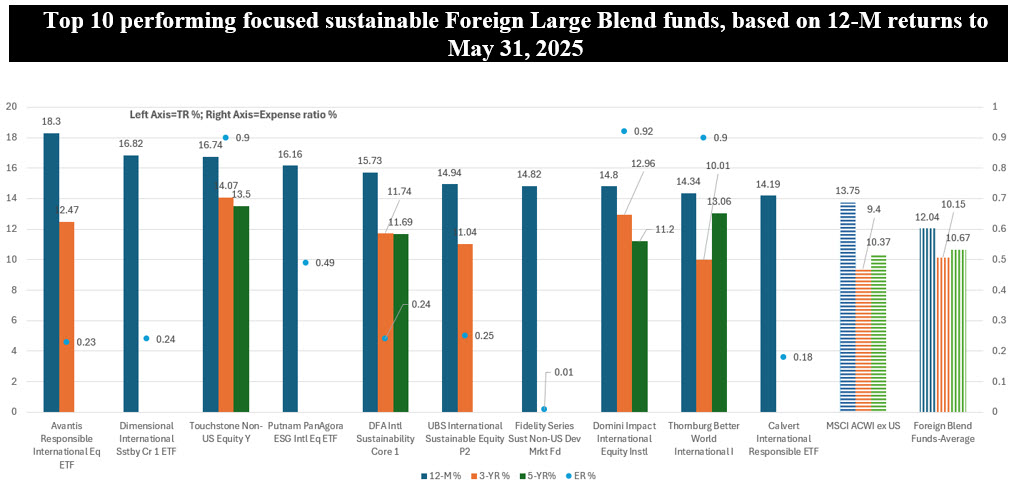

Notes of Explanation: Top 10 performing funds are based on trailing 12-month returns to May 31, 2025. In the case of mutual funds with multiple share classes, only the best performing share class is displayed. Performance results cover a fund’s years in operation, some of which don’t extend to three and five years. 3-year and 5-year results are average annual. Sources: Morningstar and Sustainable Research and Analysis LLC.

Observations:

• After a long period of underperformance relative to U.S. stocks, international stocks and international mutual funds have pulled ahead on a year-to-date as well as trailing 12-month basis and are once again boosting globally diversified portfolios. With forward expectations advocating continued outperformance, sustainable investors who may wish to consider international diversification or who have allowed their investment targets to get out of alignment in terms of U.S. versus international weightings, can turn to focused sustainable international funds, or the Foreign Large Blend category of funds per Morningstar, to fortify their portfolios. The category consists of 33 focused sustainable Foreign Large Blend funds and 72 share classes with a combined total of almost $32 billion in assets under management.

• While Foreign Large Blend funds trailed US equity funds in May, posting an average return of 4.57% versus 6.20%, respectively, they continue to lead on year-to-date and trailing 12-month basis by an average of 14.5% and 2.6%, respectively. These results also mirror the performance of security market indices. The MSCI ACWI ex USA Index recorded gains of 14.03% and 13.75% year-to-date and over the trailing 12 months while the S&P 500 lagged with returns of 1.06% and 13.52% over the same time intervals.

• These results are admittedly short-term oriented, however, according to several asset management firms, non-U.S. developed markets are expected to outperform U.S large-cap equities over the next ten years. For example, JP Morgan Asset Management’s in its 2025 capital market analysis projects that US large-cap equities are expected to return 6.7% nominally over a 10- to 15-year horizon while non-US developed-markets equities are expected to return 8.1% nominally over a 10- to 15-year horizon.

• Focused sustainable Foreign Large Blend funds are offered by 24 management firms, including seven of the top 10 investment management companies offering focused sustainable investment mutual funds and ETFs. The funds include active and passively managed mutual funds as well as ETFs that also offer a range of sustainable investment approaches.

• Covered in the chart above are the top 10 performing Foreign Large Blend funds based on total returns over the trailing 12 months. Nine of the ten funds employ some combination of positive and negative ESG screening and exclusions as well as ESG integration approaches that investors should review to ensure these align with their preferences. At the same time, the Domini Impact International Equity Fund goes further by applying a combination of exclusionary screens (e.g., weapons, fossil fuel extremes), positive SDG-aligned criteria as well as active share-owner engagement on ESG issues.