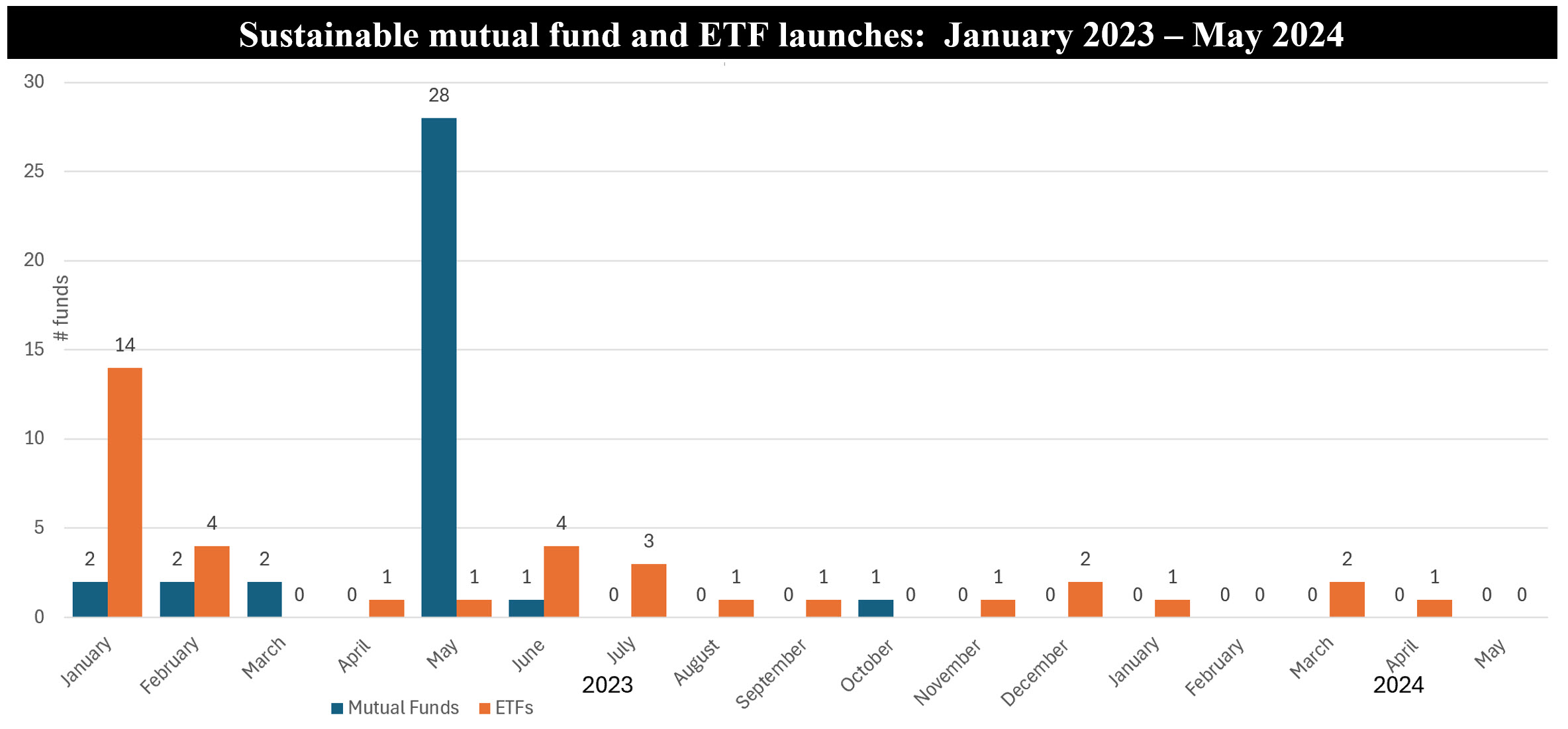

The Bottom Line: The drought in sustainable investment fund launches continued through May, during which there were no new listings of mutual funds or ETFs.

Notes of Explanation: Number of mutual fund launches excludes share class introductions. Morningstar Direct; Sustainable Research and Analysis LLC.

Observations:

- The drought in focused sustainable investment fund launches continued through the end of May. During the latest month, there were no new listings of sustainable mutual funds or ETFs.

- So far this year, there have been a total of only four new fund introductions. These consisted entirely of ETFs. By way of comparison, 54 new funds were launched during the same period in 2023, including a combined total of 29 funds listed in May alone. In the following seven months, 14 funds were launched, and the number of monthly listings trended lower in succession.

- Year-to-date, two new funds were launched by BlackRock/iShares and one each by Nuveen and Tidal Investments (Carbon Collective). Of these, Nuveen’s Sustainable Core ETF and Tidal Investments thematic Carbon Collective Short Duration Green Bond ETF are both actively managed while the iShares Paris-Aligned Climate MSCI World ex USA ETF and iShares Storage and Materials ETF are both passively managed.

- The scarcity in sustainable fund launches, starting after May of last year may be attributable to the fact that anti-ESG movement in the US had gained momentum in the second quarter of 2023 and fund companies may have opted to lower their profile by curtailing focused fund offerings. At the same time, commitments to ESG integration do not appear to have subsided, based on reporting by the largest fund companies.