Sustainable Bottom Line: Qualified sustainable investors can make direct and potentially measurable impacts in the form of tax efficient charitable contributions via Qualified Charitable Distributions.

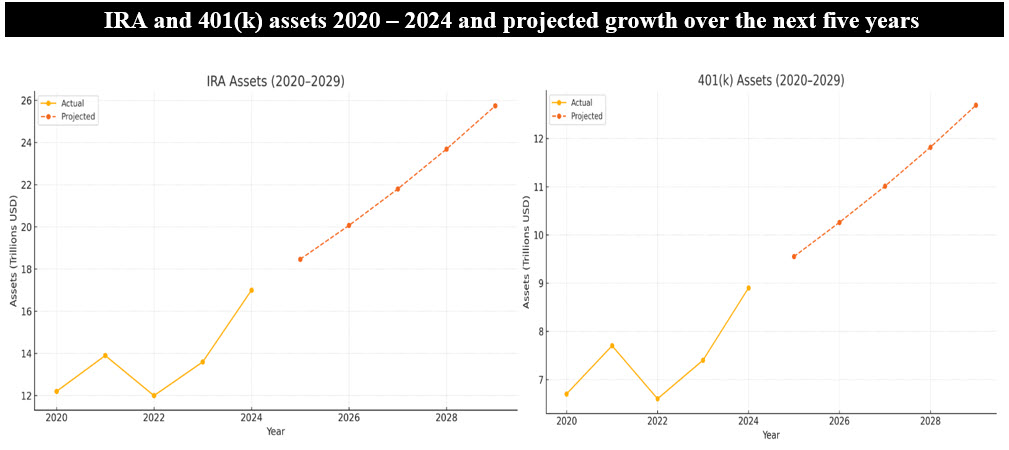

Notes of Explanation: Projections over the next five years are based on the calculated compounded annual growth rates from 2020-2024: IRA=8.5% and 401(k)=7.3%. These growth rates are “steady state” assumptions; market downturns or policy changes could move the numbers materially higher or lower. Sources: Data from 2020 to 2024 per ICI.org. Sustainable Research and Analysis LLC.

Observations:

CORRECTION: RMDS from 401(k) and other similar plans are not eligible for QCDs.

• Sustainable investing is an approach that incorporates ESG considerations, i.e. environmental, social and governance factors, into investment decision making with the dual aim of achieving financial returns and positive social and environmental outcomes leading to value creation over time. For individual investors, this investment approach, which is broadly defined to include responsible investing, positive and negative screening and exclusions, thematic investing, impact investing, ESG integration, proxy voting and shareholder engagement, has been most typically considered within the context of tax-deferred retirement plans during an investor’s asset accumulation phase. These include but are not limited to IRA accounts and 401(k) plans which, on a combined basis, reached almost $26 trillion in assets under management at the end of 2024. While the pursuit of such an approach doesn’t end upon retirement, sustainable investing during post-retirement seems to receive much less attention. Yet, qualified investors who have reached the distribution stage when they are drawing down their tax-deferred retirement accounts, can take advantage of a tax-efficient strategy to achieve a direct impact via Qualified Charitable Distributions (QCDs).

• Retired investors with tax-deferred retirement accounts such as IRAs and 401(k)s as well as other similar plans(1) who have reached the age of 73 years(2) are required under IRS rules to commence annual withdrawals from these accounts. Charitably minded sustainable retirees, or conventional ones, taking withdrawals to meet their Required Minimum Distribution (RMD) obligations but who don’t need the full amount of their RMDs for living expenses, can take advantage of rules applicable to QCDs that permit charitable contributions to qualified charitable organizations.

• According to IRS regulations, individuals who are at least 70½ years old on the date of the gift, can make charitable contributions to a qualified organization, defined as a 501(c)(3) public charity(3) up to $108,000(4) annually from IRAs, 401(k)s or other certain retirement accounts to qualified charities via a Qualified Charitable Distribution. This counts towards an investor’s RMD and is excluded from taxable income at the Federal level(5) , making QCDs one of the most tax-efficient ways to fulfill both charitable and RMD obligations at the same time. Also, the transaction serves to reduce adjusted gross income which may also impact Medicare premiums and taxation of Social Security benefits.

• Importantly, an additional benefit includes the ability to personally direct charitable contributions to qualified organizations of choice. These can be selected based on their mandate, including those involved in environmental and/or social impact-oriented activities, as well as location (in cases of preferences for local giving), thereby achieving a direct impact and potentially a measurable one.

• According to one rough estimate, around $300 billion a year is being withdrawn from retirement accounts to meet the IRS RMD requirements. Of this sum, only a small single-digit slice of the roughly $300 billion in annual RMDs is being sent straight to charities. The best publicly available window into that number all cluster in roughly the $7 billion to $12 billion a year range, or some 2% to 4% of total RMD dollars. As such, it wouldn’t require a wide swing to shift significantly more dollars to charitable organizations and achieve an even greater overall impact, even without considering the uptick due to the growth in IRA and 401(k) assets over the next five years that is projected to reach $41 trillion by 2029, assuming steady state growth rates(6) .

Notes:

(1) Other similar plans include SEP IRAs, SIMPLE IRAs, 403(b)s and 457(b) plans. (2) Or 75 years of age for retirees born in 1960 or later. (3) Donor-advised funds, supporting organizations, or private foundations are excluded. Link to IRS listings of qualified charitable organizations i: https://www.irs.gov/charities-and-nonprofits. (4) On an inflation adjusted basis, this sum per person is up from $105,000 in 2024 annually and is doubled for married couples with separate IRAs. (5) Outside of a handful of “full-exemption” states, most retirees can shelter at least part—and sometimes all—of their annual RMD from state (and local) income tax by using age-based exclusions or deductions. (6) These are assumed to be annual compounded rates of 8.5% for IRAs and 7.3% for 401(k)s.