Sustainable Bottom Line: Focused sustainable high yield funds ended May as the top performing taxable fixed income funds investment category over the trailing 12 months.

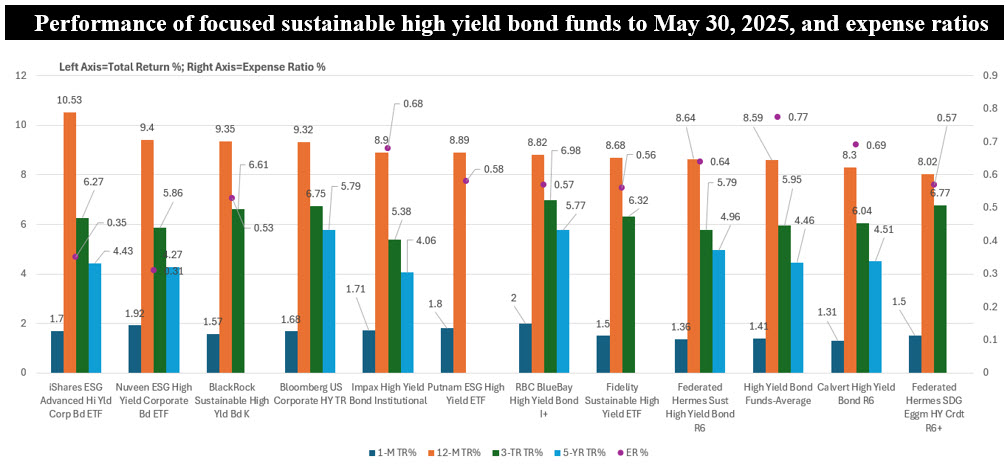

Notes of Explanation: Funds are listed in order of their trailing 12-month total returns through May 30, 2025Total return performance to May 30, 2025. 3-year and 5-year results are average annual. In the case of mutual funds, total return performance applies to the identified highest performing share class over the trailing 12 months. +Fund is rated A based on a combination of factors, including management company, years in operation, performance over the trailing 1, 3 and 5-year intervals, expense ratio and fund size. Sources: Morningstar and Sustainable Research and Analysis LLC.

Observations:

• Focused sustainable high yield bond funds, a universe of 10 funds/22 share classes with almost $3 billion in assets at the end of May ended the month of May with a trailing twelve-month average gain of 8.6%. This result placed high yield bond funds in the best performing sustainable taxable fixed income investment category over the previous twelve months. Further, the average performance of high yield funds exceeded results achieved by sustainable US equity funds (7.84%), international funds (8.48%) as well as taxable bond funds more generally (6.07%).

• High yields bond funds invest in riskier below investment grade bonds and, at 2.3% based on the trailing three years, display above average volatility relative to an average of 1.80% applicable to taxable bond funds.

• Trade war uncertainties initiated by President Trump that fueled fears of a recession not only impacted the stock market but also high yield bonds. Strong positive momentum for high yield bonds at the start of the year reversed course in March but then resumed once Trump pulled back from his most extreme tariff threats. High yield bonds and bond funds recovered to overtake all major taxable bond fund categories in May. Focused sustainable high yield bond funds gained an average of 1.55% in May, following a monthly increase of 0.5% in April, a decline of 0.99% in March and gains of 0.55% and 1.28% in February and January, respectively.

• May’s top performers extend to two actively managed funds, the RBC BlueBay High Yield Bond Fund Classes A and I, up 2.1% and 2%, respectively, and the Putnam ESG High Yield ETF, up 1.8%, as well as the passively managed Nuveen ESG High Yield Corporate Bond ETF, up 1.92%. From a sustainable investing perspective, these funds offer a range of options from ESG integration based on the manager’s ESG ratings, including an emphasis on up/down ratings momentum employed by Putnam to Nuveen’s screening and exclusionary approach to RBC’s screening and exclusions approach combined with ESG engagement to seek to gain insight regarding an issuer’s ESG practices and/or improve an issuer’s ESG disclosure.

• RBC BlueBay’s High Yield Bond Fund Class I also qualified for a top A rating assigned by Sustainable Research and Analysis based on a combination of five factors, including management company, years in operation, total return performance over one, three and five-year intervals, expense ratio and fund size. Also qualifying for the highest A rating is the Federated Hermes SDG Engagement High Yield Credit Fund R6. In addition to excluding companies that generate revenue from the manufacture of tobacco or controversial weapons, or by providing either an essential and/or tailor-made product or service to the manufacturers of controversial weapons, the fund also seeks to invest in securities that contribute to positive societal impact aligned to the United Nations Sustainable Development Goals.