The Bottom Line: During the month of February, there were closures or re-brandings of 25 focused sustainable fund/share classes managed by ten investment management firms.

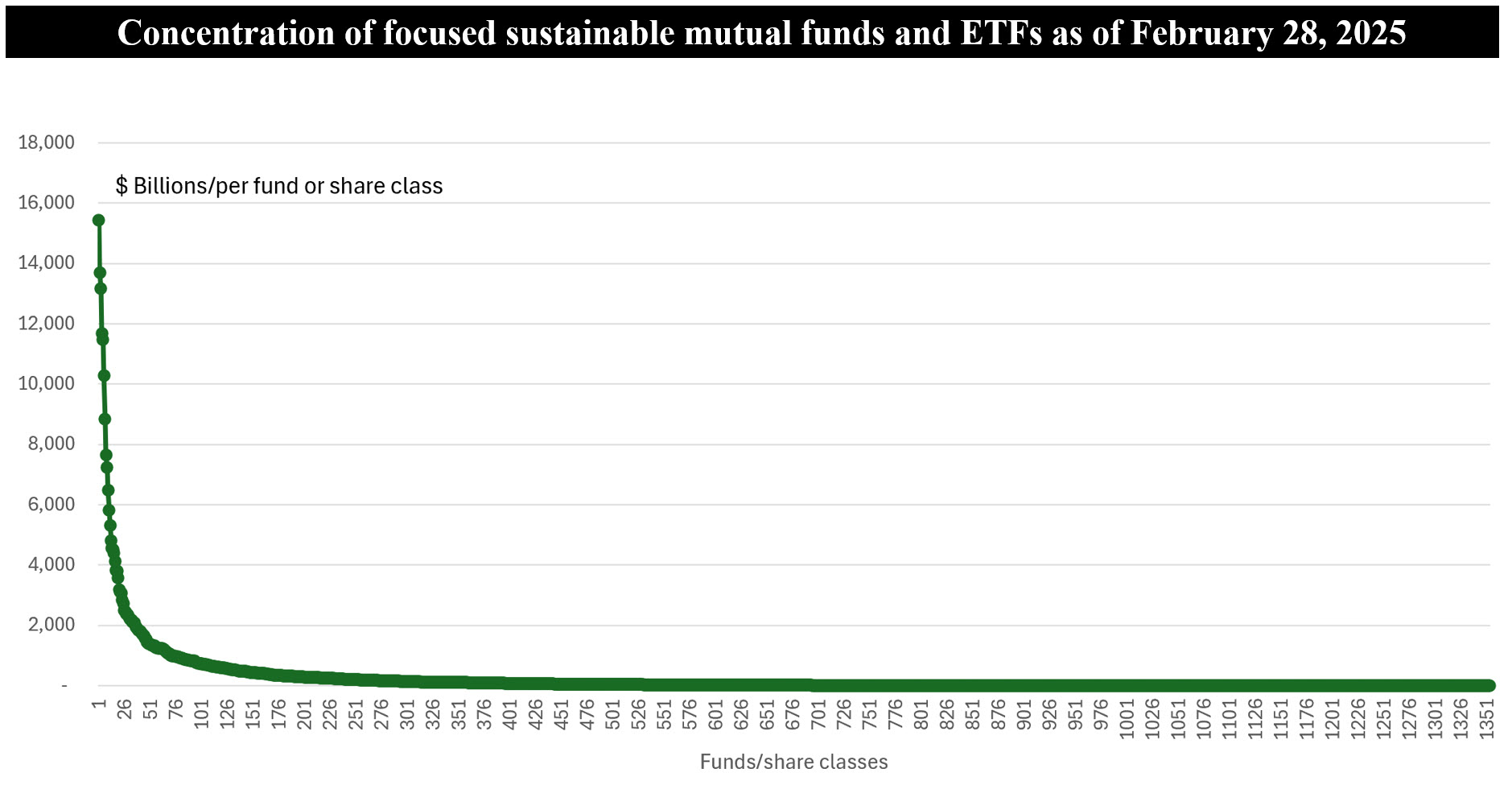

Notes of ExplThe above chart combines focused sustainable long-term mutual funds and ETFs. Regarding mutual funds with multiple share classes, the data reflects assets under management by share class. Concentration levels are even higher if the assets of fund share classes are combined. Sources: Morningstar Direct and Sustainable Research and Analysis LLC.

Observations:

• From January 31st through the month of February, a larger than average number of focused sustainable fund closures along with fund re-brandings were observed. 25 funds/share classes closed or were re-branded. These represented 13 funds that were managed by ten firms, including four firms that exited the focused sustainable funds segment entirely.

• Except for three fund re-brandings, the funds subject to closures were all smaller in size. The average size of a closing fund was $10.9 million, skewed higher due to the closing of three fixed income funds managed by PGIM, each with $24.5 million, $26.3 million and $27.8 million in assets under management prior to their closing. These three funds with assets at the higher end of the range likely included the management firm’s initial seed capital which was being withdrawn because the funds were unable to attract investors and raise assets under management to levels approaching financial break-even. Excluding these three funds lowers the average size of closing funds to $4.3 million.

• Fund firms whose funds/share classes were closed or re-branded include: Aberdeen, Amundi US, Global X, Harding Loevner, Kayne Anderson, Madison Asset Management, New York Life Investment Management, PGIM Investments (Prudential), and Thrivent.

• The three exceptions were: (1) the $283.7 million less than $30 million Thrivent Small-Mid Cap ESG ETF that as of January 31, 2025 changed its name to the Thrivent Small-Mid Cap Equity ETF and adjusted its investment strategy by dropping its ESG mandate which sought to identify, as a principal investment strategy, issuers that have a demonstrated commitment to ESG policies, practices and outcomes and make other related changes to its principal investment strategies, and (2) the $63.5 million NYLife MacKay ESG High Income ETF that dropped its ESG mandate, and (3) Aberdeen that preserved the fund’s ESG Mandate but renamed the Aberdeen Global Impact Fund to the Aberdeen Focused Emerging Markets ex-China Fund and redefined its investment mandate.

• The focused sustainable investments segment is comprised of 1,355 funds/share classes with $355.6 billion in assets under management at the end of February, according to Morningstar. The segment is highly concentrated, with only 30 funds/share classes accounting for 50% of long-term assets*. Included in the combined total number of funds/share classes are 789 funds/share classes, or 58%, with assets equal to or less than $30 million in assets. This is about the financial break-even point for individual funds.

• For sustainable investors, fund size should continue to serve as a selection screen when a fund is under consideration for investment. That said, small funds managed by large, deep pocketed management firms have more sticking power. The closings during February highlight the risk of investing in a smaller sized fund that may be subject to liquidation due to poor profitability considerations. Such a fund can be liquidated at any time without shareholder approval and/or at a time that may not be favorable for all shareholders. Such a liquidation could result in transaction costs and have negative tax consequences for shareholders.

*The level of concentration is even higher if the analysis is conducted on a fund basis rather than taking a share class approach.