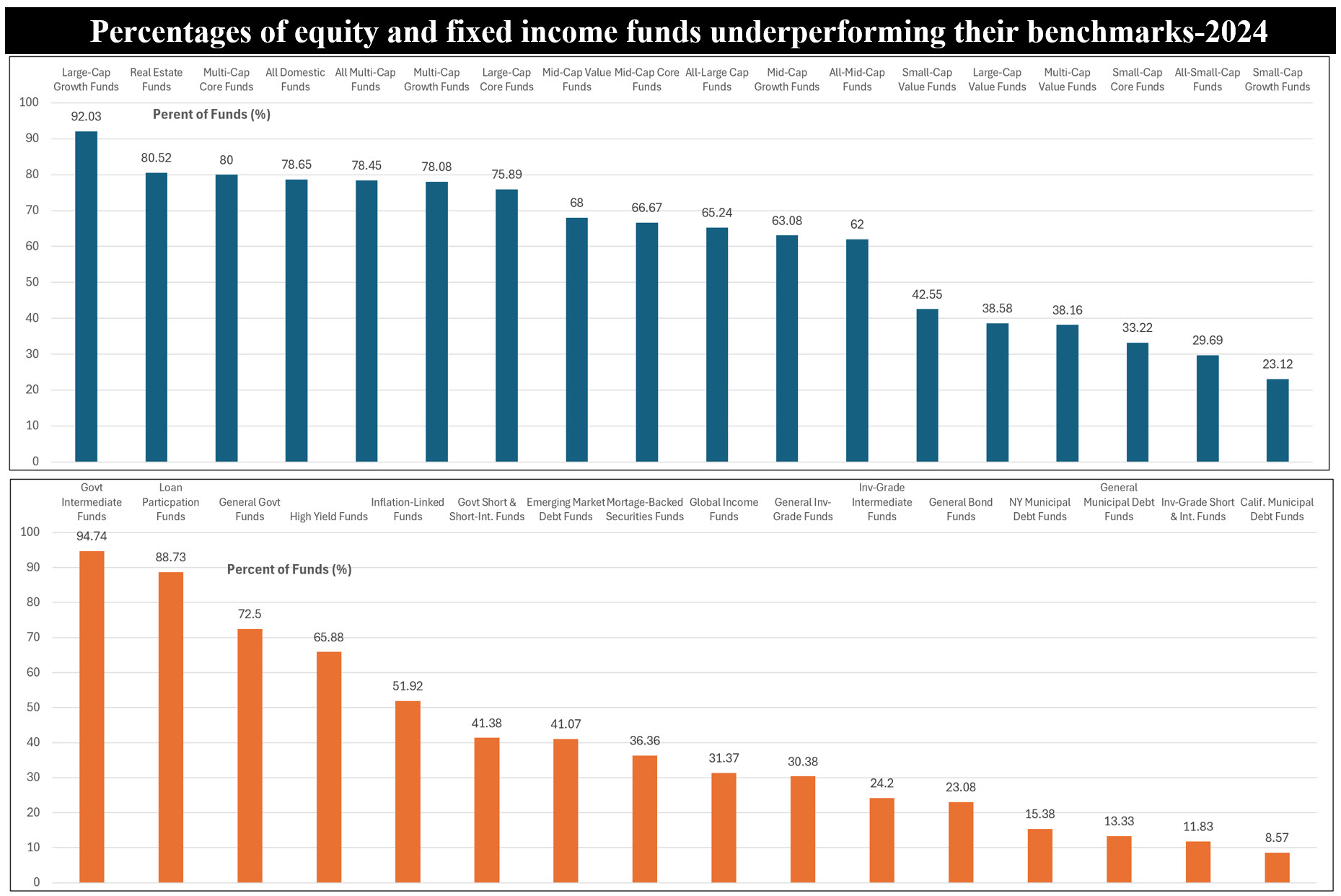

The Bottom Line: A majority of actively managed equity funds underperformed their assigned benchmarks in 2024 while fixed income fund managers had a mixed year.

Notes of Explanation: Sources: S&P Global SPIVA US Scorecard, Sustainable Research and Analysis LLC.

Observations:

•According to the most recently published S&P Index Versus Active (SPIVA) Scorecard, a semi-annual report published by S&P Dow Jones Indices that evaluates the performance of actively managed funds against their respective benchmark indices over different time horizons, a majority of actively managed equity funds underperformed their assigned benchmarks in 2024. At the same time, fixed income managers had a mixed year, with certain categories experiencing high levels of outperformance.

• The 2024 report shows that 65% of all active large-cap U.S. equity funds underperformed the S&P 500 Index, worse than the 60% rate observed in 2023 and slightly above the 64% average annual rate reported over the 24-year history of S&P’s SPIVA Scorecards. Across all categories, equity fund results in 2024 reflected an average one-year underperformance rate of 61%. At the same time, five categories of funds, including All Small-Cap Funds, Large-Cap Value Funds, Small-Cap Growth Funds, Small-Cap Core Funds and Multi-Cap Value Funds experienced significantly lower levels of underperformance. Only 30% of All U.S. Small-Cap funds underperformed. That was their lowest underperformance rate across more than two decades of annual SPIVA Scorecards.

• Fixed income fund results were generally better, with an average one-year underperformance rate of 41% across all bond fund categories. Investment-Grade Intermediate Funds that are compared to the widely followed Bloomberg US Aggregate Index, experienced a relatively low level of underperformance at 24.20% of funds. Several municipal bond funds reflected even lower underperformance results.

• Across asset classes, underperformance rates typically rose as time horizons lengthened. At the one-year horizon, 7 of 22 equity categories and 11 of 16 fixed income categories saw majority outperformance. Over the 15-year period ending December 2024, there were no categories in which a majority of active managers outperformed.

• For investors, SPIVA’s latest report reinforces the conclusions that a majority of actively managed funds underperform their benchmarks over longer periods and that underperformance tends to increase with longer time horizons, meaning fewer active funds sustain long-term success. Lower-cost index funds tend to outperform higher-cost actively managed funds due to expense ratios and trading costs. While focused sustainable funds are not isolated for analysis by SPIVA, the takeaway conclusions should be similar: Employ low-cost index funds in fund categories experiencing high levels of underperformance while actively managed funds should be considered in categories reflecting high or higher levels of outperformance. Based on 2024 results, examples include small cap funds, investment-grade intermediate funds, municipal bond funds and emerging market debt funds. That said, active managers should be monitored and reevaluated on a regular basis.