The Bottom Line: Focused sustainable Intermediate Core-Plus Bond funds, the second-best performing bond funds category, offer a higher Sharpe ratio and can enhance portfolio returns.

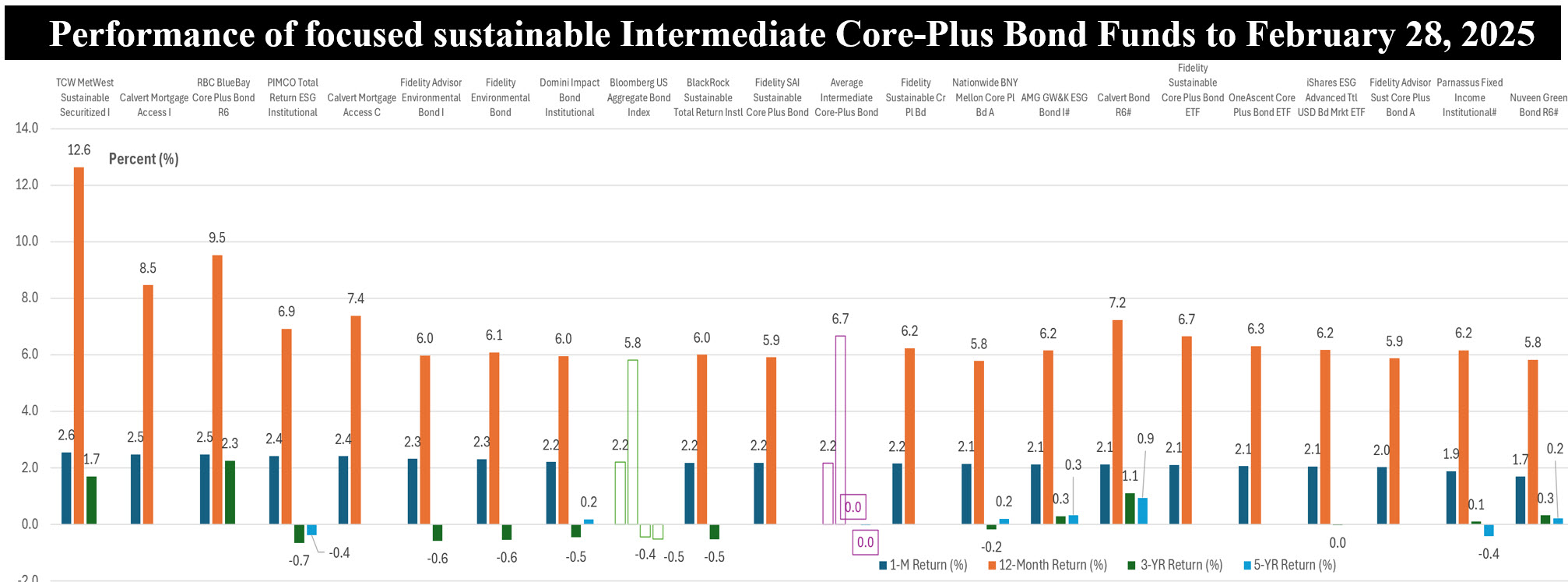

Notes of Explanation: Funds/share classes listed in descending order based on February 2025 performance results. Average annual performance displayed for three- and five-year intervals. In the case of funds with multiple share classes, the chart displays the best performing share class only. # indicates A rated fund/share class. Ratings of A apply to specific share classes. A rated share classes not shown include AMG GW&K ESG Bond N and Calvert Bond I. Sources: Morningstar Direct, Sustainable Research and Analysis LLC.

Observations:

• The average performance of focused sustainable Intermediate Core-Plus Bond funds ranked as the second-best performing investment category across bond funds in February and fifth best within the universe of focused sustainable equity and bond funds. Sustainable Intermediate Core-Plus Bond funds, the second largest bond fund category after Intermediate Core Bond funds, with $7.8 billion in assets, posted an average return of 2.17% in February and 6.7% over the trailing twelve months. The results were achieved at slightly higher levels of volatility, yet sustainable Intermediate Core-Plus Bond funds still offer a higher average risk-adjusted rate of return or Sharpe ratio. This suggests that the expected returns of a sustainable portfolio consisting of mutual funds and ETFs, where the contribution of Intermediate Core-Bond Funds might account for between 5% to 35% of portfolio allocations, can be enhanced with some level of exposure to Intermediate Core-Plus Bond funds (1).

• According to Morningstar, Intermediate Core-Plus Bond funds invest primarily in investment-grade U.S. fixed-income issues, including government, corporate, and securitized debt, but generally have greater flexibility than core offerings to hold noncore sectors such as corporate high yield, bank loan, emerging-markets debt, and non-U.S. currency exposures. Their durations typically range between 75% and 125% of the three-year average of the effective duration of the Morningstar Core Bond Index. Intermediate core bond portfolios, on the other hand, invest primarily in investment-grade U.S. fixed-income issues, including government, corporate, and securitized debt, and typically hold less than 5% in below-investment-grade exposures. Their durations typically range between 75% and 125% of the three-year average of the effective duration of the Morningstar Core Bond Index.

• Against a backdrop of falling 10-year Treasury yields (33 bps lower on the month) as a sustained flight to quality bid was driven by fiscal policy concerns, softening economic data, and geopolitical issues, the Intermediate Core-Plus Bond category of bond funds posted returns that ranged from a low of 1.58% to a high of 2.55% recorded by the TCW MetWest Sustainable Securitized I Fund. The same very small $15.9 million fund that was launched as of September 30, 2021 and was largely invested in mortgage-backed and various asset backed securities, including securitized labeled and unlabeled sustainable debt instruments, delivered a return of 12.64% over the trailing twelve months and an average 1.7% for the trailing 3-year interval. These excess returns, however, were not sufficient to qualify the fund for an overall Sustainable Research and Analysis investment rating due to the fund’s size below $30 million (3).

• Within the Intermediate Core-Plus Bond funds investment category consisting of 19 funds and 53 share classes(2) that includes only two index tracking funds organized as ETFs, sustainable investing practices cover a range of offerings, from funds that take on broad positive ESG factors, as is the case with the top performing TCW MetWest Sustainable Securitized Fund, to the thematic Nuveen Green Bond Funds to the Calvert Mortgage and Calvert Bond Fund that are managed pursuant to a socially responsible framework that also seeks to achieve impacts, integrates ESG factors and engages with fixed income issuers.

• Against a backdrop of falling 10-year Treasury yields (33 bps lower on the month) as a sustained flight to quality bid was driven by fiscal policy concerns, softening economic data, and geopolitical issues, the core plus segment of bond funds posted returns that ranged from a low of 1.58% to a high of 2.55% recorded by the TCW MetWest Sustainable Securitized I Fund. The same very small $15.9 million fund that was launched as of September 30, 2021, delivered a return of 12.64% over the trailing twelve months and an average 1.7% for the trailing 3-year interval.

Notes of Explanation

(1) Based on modeling of expected returns constructed for low, medium and high-risk tolerance portfolios over a 10-year time horizon.

(2) The number of funds is expected to decline to 18 funds as Parnassus has announced the liquidation of the Parnassus Fixed Income Fund effective on Wednesday, April 30, 2025.

(3) Ratings based on a scale that runs from A to E reflect the application of the following five screens: (a) Management company-The fund should be offered and managed by an established firm with a reputation for quality—to ensure effective fund operations and instill trust and confidence in the organization. (b) Years in operation-The fund should be in operation for at least five years and managed pursuant to the same investment strategy—to provide a sufficiently long but not too long view against which to evaluate the fund’s operation, strategy, and performance. (c) Total return performance-the fund should have generated a total return equal to or greater than the relevant comparative index for the five-year interval—to evaluate tracking relative to market based financial outcomes over an interval based on a relatively consistent approach and methodology. (d) Expense ratio. The fund should be offered at an expense ratio below the average for the category—since a fund’s expense ratio directly affects the fund’s total return performance over time, and even a small difference in expense ratios can have a significant effect on net investment outcomes, and (f) Fund size-the fund’s total net assets should range above $30 million—so that it may be managed more efficiently and to provide some protection against the fund’s closure. One scored, fund ratings are distributed as follows: Top 10%=A, next 20%=B, next 30%=C, next 20%=D and final 10%=E.