The Bottom Line: J.D. Power 2024 investor satisfaction study finds a significant year-over-year increase in investor satisfaction but lower levels of younger investor client loyalty.

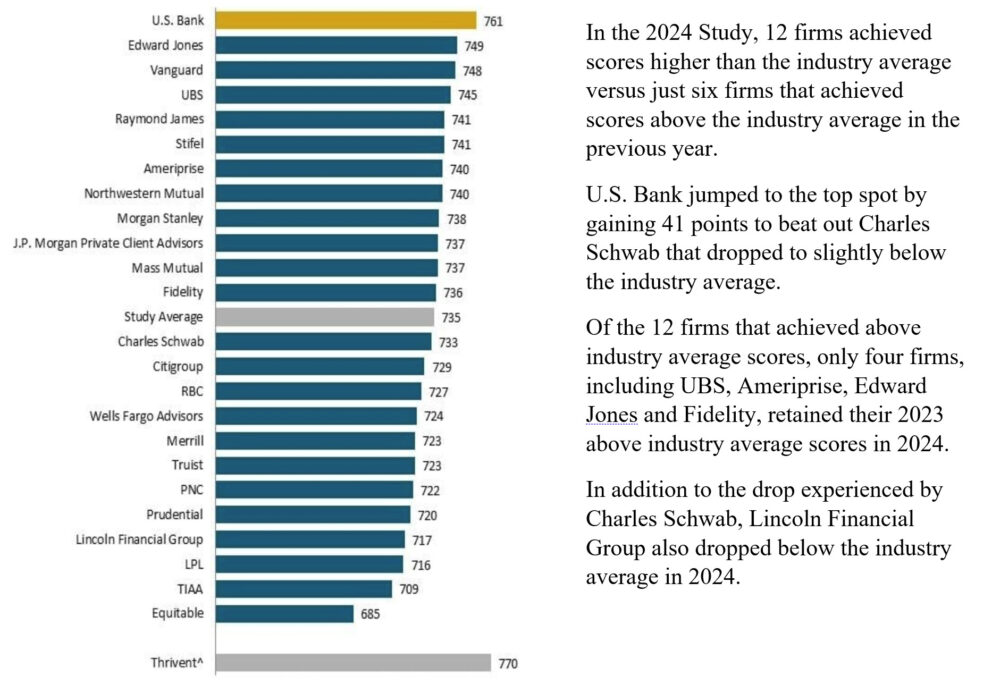

J.D. Power 2024 U.S. Full-Service Investor Satisfaction StudySM-Overall Customer Satisfaction Index Ranking

Notes of explanation: Index ranking is based on a 1,000-point scale. ^Brand is not rank eligible because it does not meet study award criteria. Sources: J.D. Power 2024 U.S. Full-Service Investor Satisfaction StudySM Investment and 2023 U.S. Full Service Investor Satisfaction Study.

Observations:

- The just released J.D. Power U.S. Full-Service Investor Satisfaction StudySM based on responses from 9,951 investors who work directly with a dedicated financial advisor or teams of advisors that were collected between January 2023 and January 2024, shows that there has been a significant 8-poiint year-over-year increase in investor satisfaction. This is up to a score of 735 from a score of 727 the previous year, on a 1,000-point scale, and is “consistent with the long-term trend of investor satisfaction moving in concert with stock market performance and illustrates a potential risk factor for advisors whose perceived value is dependent on market forces.”

- According to the Study, financial advisors are exposed to the highest flight risk from younger affluent clients. Attrition rates tend to be very low among clients with advisors, especially among Gen X, the demographic cohort born between 1965-1976), as well as older clients. At the same time, more than one-third (36%) of Millennials (born between 1982-1994) with more than $1 million in investable assets say they are likely to change firms in the next year. A potential factor in this lack of loyalty is that 70% of affluent Millennials have a secondary investment firm. This number is significantly lower among older affluent cohorts.

- The Study finds that technology and digital solutions have become increasingly critical to enabling advisor efficiency and empowering more proactive client engagement. Furthermore, advisors who take the time to help clients understand and engage with digital channels are consistently driving higher levels of investor satisfaction. Advisors who fail to clearly explain digital options are perceived more negatively and get half the number of referrals as their more digitally supportive peers.

- In addition, the Study reports that the rapid growth of AI puts the spotlight on advisor relationships. As AI-enabled investment advisory solutions rapidly gain traction in the marketplace, advisors need to be clear on what differentiates them. In 2024, 41% of advised clients’ experiences fall into the transactional category on the J.D. Power advice continuum. This group is put at the greatest risk by technology-enabled solutions that can effectively compete on price and efficiency. Delivering truly personalized guidance that addresses a client’s unique goals and challenges, major life changes and investment strategies that transcend returns are keys to insulating the business from future competitive threats.