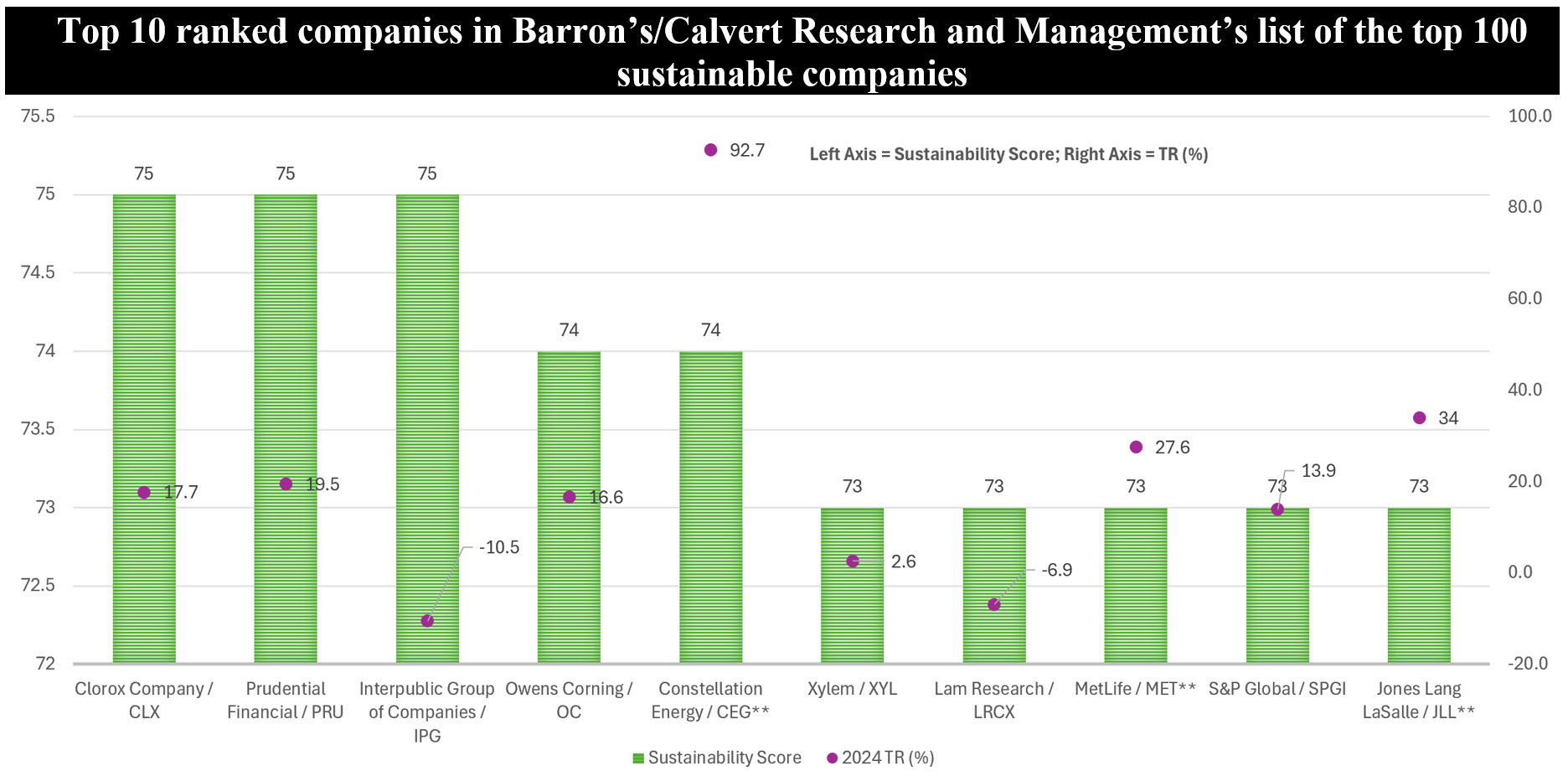

Notes of Explanation: **Designates companies that beat the S&P 500 Index performance in 2024=25.02%. Sources: Barrons’s/Calvert Research and Management and Sustainable Research and Analysis LLC.

Observations:

• Last week Barron’s published a list of the top 100 sustainable companies in the US, based on research conducted by Calvert Research and Management. To evaluate all the companies, Calvert considered practices under five themes—the planet, workplace, customers, community, and shareholders—and assigned each company weightings for the categories based on what is most relevant to their business operations and risks.

• The top 10 ranked companies out of 100, which are displayed in the graph above, all achieved scores equal to or above 73. This is based on a scale that runs from zero to 100. Six of the ten companies are newcomers to the top 10 list and there were 36 newcomers to the overall list, pointing to a high level of turnover that seems at odds with the long-term nature of building and maintaining a sustainable company. That said, the researchers at Calvert attribute the turnover to the fact that it has become easier to drop down or off the list because the degree of difference between companies has narrowed as more data has become available to help companies take care of their ESG practices. Another contributing factor, however, may be the subjective elements of the ratings.

• According to Barron’s “ the common thread for the diverse group of 100 companies is that sustainability is deeply embedded in their corporate strategies—not for the singular goal of being do-gooders, but because sustainability is often synonymous with efficiency and good business.” Calvert Research also notes that its research indicates that most companies with commitments to sustainability goals “are not backing off them, and many are making significant advancements.” “We’re in this for the long game,” says Walt Kozlowski, senior director of industrial sustainability solutions at Xylem, a Washington, D.C.–based water technology company that rose to No. 6 on this year’s top 100 list from No. 15 last year. “Our path doesn’t change based on anything going on from a regulatory standpoint or what the current administration is doing around ESG.” Echoing this outlook, research conducted in December 2024 by Kearney, a global management consulting firm alongside WeDontHaveTime AB, a Swedish media platform for climate action, based on a survey of more than 500 CFOs across several geographies, including the UK, the US, the UAE, and India, found that 92% of CFOs say they will invest more in sustainability. More than half said they will significantly increase their investments. Nearly two-thirds of the survey respondents said they planned to allocate more than 2.1% of their revenue to sustainability in 2025.

• Calvert whittled the 1,000 largest publicly traded companies, not including real estate investment trusts, down to 100 by looking at five weighted categories—planet, workplace, customer, community, and shareholder—according to 230 performance indicators from rating companies including Institutional Shareholder Services, MSCI, Sustainalytics, and Thomson Reuters Asset4. It then used sector experts to refine the rankings by analyzing how well companies are moving toward their sustainability targets.

• A total of 28 topics are considered across the five categories. For example, “community” includes access to medicine, food sourcing and supply chain, human rights, and animal welfare. “Planet” covers toxic reduction and elimination, resource efficiency, energy use and efficiency, and greenhouse-gas emissions. Calvert assigned a score of zero to 100 in each category, based on company performance. All companies on the list scored above the bottom quartile in each category that is relevant to their businesses.