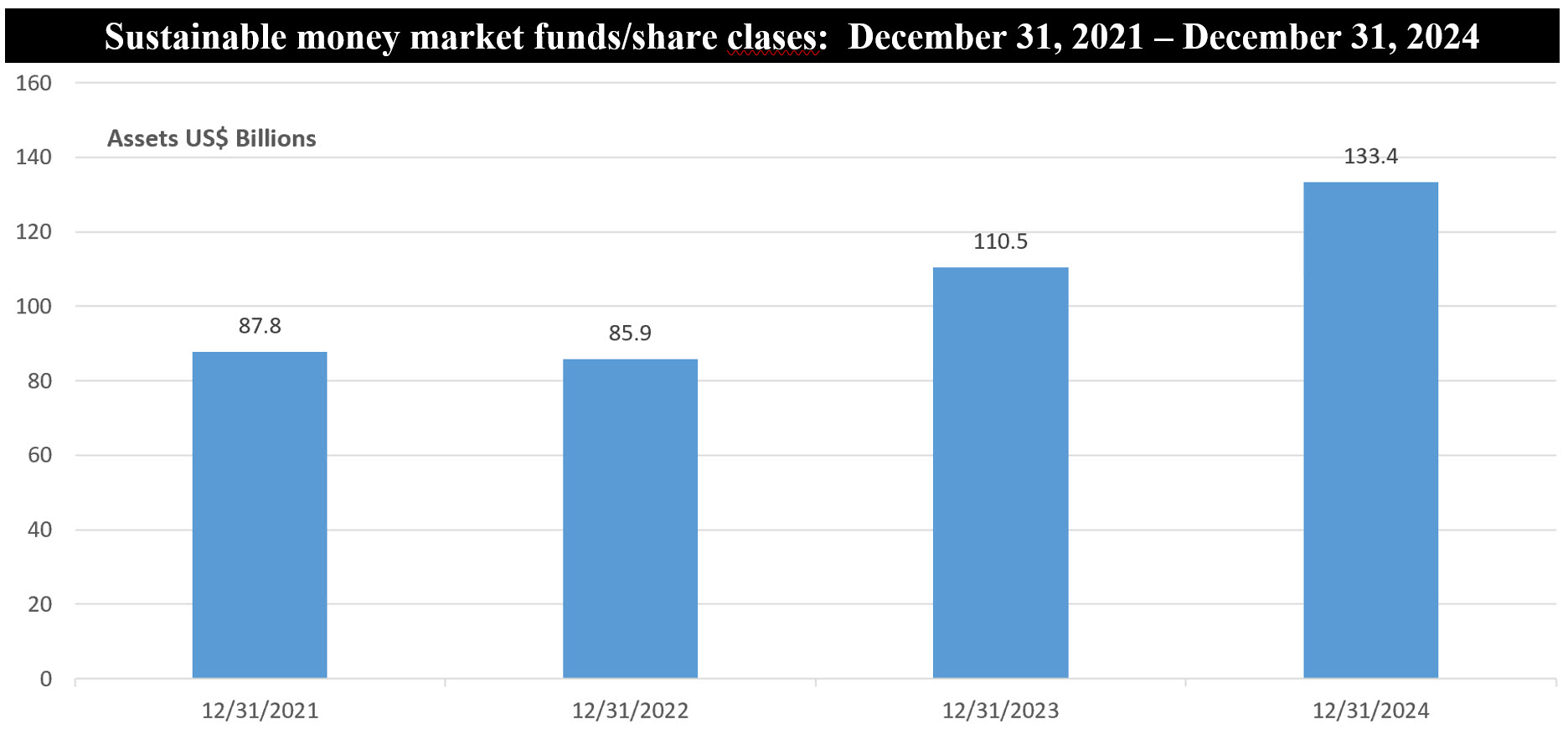

The Bottom Line: Assets of sustainable money market funds, largely sourced to institutional investors, have achieved new highs recently, reaching $133.4 billion at YE 2024.

Notes of Explanation: Assets cover money market funds and designated money market fund share classes. Sources: Crane Data and Sustainable Research and Analysis LLC.

Observations:

• Assets of sustainable money market funds and/or designated share classes, which are largely but not entirely sourced to institutional investors, have achieved new highs recently, reaching $133.4 billion at the end of 2024*. This is up from $87.8 billion at the end of 2021, for a gain of $45.6 billion or an increase of 52%.

• More generally, money market fund assets have surged to an all-time high of approximately $7 trillion in recent months. This significant growth is attributable to several key factors, the most important being attractive yields and elevated short-term interest rates and, more recently, market volatility and economic uncertainty.

• Based on their classification by Crane Data, sustainable money market funds and/or designated share classes fall into five categories, including ESG, Social, Social and Veterans, Directed Donation and D&I MMF Managers.

• An example of an ESG classified money market fund is the BlackRock Wealth Liquid Environmentally Aware Fund (LEAF). The fund, which is also available for purchase by retail investors, integrates ESG factors into its investment strategy, with a pronounced emphasis on environmental considerations. The Fund will not invest in securities issued or guaranteed by entities that derive more than 5% of their revenue from fossil fuels mining, exploration or refinement, or that derive more than 5% of their revenue from thermal coal-based power generation. Also, BlackRock or its affiliates will use at least 5% of BlackRock’s net revenue from its management fee from the fund to purchase and then retire carbon credits either directly or through a third-party organization, but the policy may be terminated by BlackRock.

• An example of a fund classified as a Social Money Market Fund is the Dreyfus Government Securities Cash Management Fund Institutional Shares (DIPXX) that integrates a social mandate focused on promoting diversity and inclusion within its trading practices. The fund is committed to directing, over time, a majority of its aggregate dollar value of purchases and sales orders to dealers that are minority, women, disabled or service-disabled veteran-owned businesses or other qualified and recognized diversity and inclusion groups.

• An example of a fund classified as a Social and Veterans Money Market Fund is the Morgan Stanley Institutional Liquidity Funds ESG Money Market Portfolio (CastleOak Share Class). The fund integrates environmental, social, and governance (ESG) factors into its investment management process. Further, the fund excludes investments in issuers significantly involved in fossil fuel activities. However, it may invest in green commercial paper from such companies if the proceeds are dedicated to environmentally beneficial projects, ensuring they do not finance fossil fuel generation capabilities. The fund also seeks to place purchase orders with broker-dealers owned by minorities, women, disabled persons, veterans, and members of other recognized diversity and inclusion groups. This approach aims to support and promote diverse financial institutions while maintaining best execution standards.

• An example of a Directed Donation MMF is the Allspring Government Money Market Fund’s Tribal Inclusion Class that incorporates a charitable component aimed at supporting Native American communities. Allspring Funds Management commits to donating 15% of its management fee revenue—net of any waivers or reimbursements—derived from assets in the Tribal Inclusion Class. These donations are directed to nonprofit organizations that provide financial assistance to Native American and Alaska Native students pursuing higher education, including undergraduate, graduate, and professional degrees. One primary recipient of these donations is the Native Forward Scholars Fund, an organization dedicated to empowering students from over 500 tribes across the U.S. by offering scholarships for higher education. This initiative underscores Allspring’s commitment to fostering educational opportunities within Native American communities. Additionally, Wells Fargo collaborates with Allspring by offering the Tribal Inclusion share class exclusively to its corporate clients. In celebration of the fund’s launch, Wells Fargo donated to the Native Forward Scholars Fund, further supporting educational advancement for Native American students.

• Lastly, an example of a D&I Money Market Fund Manager, of which there is only one, is the Ramirez Government Money Market Fund, managed by Ramirez Asset Management, Inc. (RAM). Founded in 2002, the firm specializes in fixed income and equity asset management and provides investment advisory services to institutional investors. RAM is a certified minority owned business enterprise, headquartered in New York City with an office in Chicago, Illinois. Ramirez is an affiliate of Samuel A. Ramirez & Company, Inc., one of the oldest Hispanic-owned full-service investment firms in the United States.

* Net assets declined to $131.4 billion as of January 31, 2025.