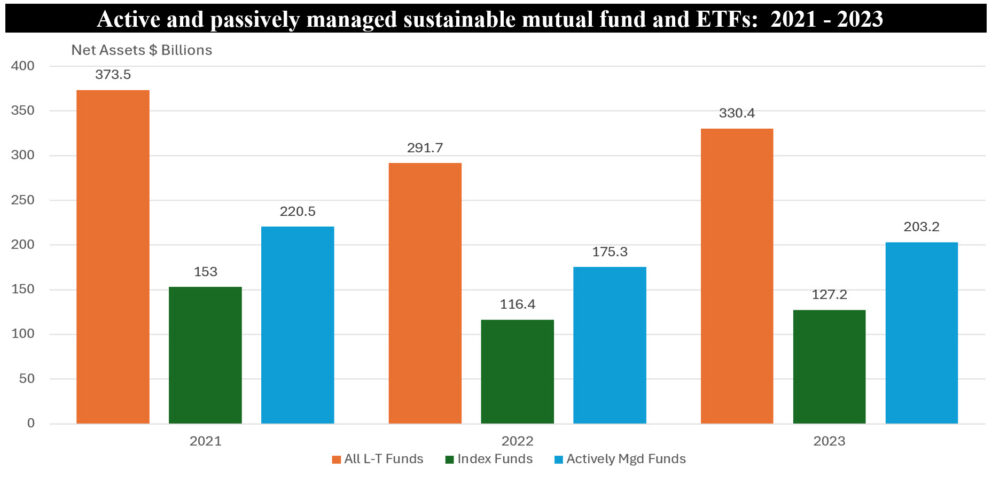

The Bottom Line: Passively managed mutual funds and ETFs surpassed actively managed conventional funds in 2023 but sustainable funds are still dominated by active strategies.

Notes of explanation: Sources: Long-term funds exclude sustainable money market funds. Morningstar Direct, Sustainable Research and Analysis LLC.

Notes of explanation: Sources: Long-term funds exclude sustainable money market funds. Morningstar Direct, Sustainable Research and Analysis LLC.

Observations:

- According to Morningstar, passively managed funds, or index funds, surpassed actively managed funds for the first time at the end of 2023. This means that of about $27.7 trillion in long-term mutual fund and ETF assets under management, more than $13.8 trillion in assets are now passively managed¹. This is not yet the case with sustainable funds.

- The total assets under management in passive index funds have grown significantly over the past decade, a result of the fact that actively managed funds rarely beat securities market indices, For example, according to S&P/Dow Jones Indices², only 39% of large-cap funds outperformed the S&P 500 Index over the one-year period ended June 30, 2023, and the percentage of large-cap funds outperforming over the three, five and 10-year intervals declined to 14%. That said, in less efficient markets, active managers can exploit mispriced securities or market anomalies and deliver above index returns. For instance, small-cap stocks, foreign shares, and high yield bonds have shown better performance for active funds compared to other segments. According to S&P/Dow Jones Indices³, 55% and 34% of high yield funds outperformed over trailing three and five-year intervals.

- Consistent underperformance on the part of actively managed funds, along with their higher fees, have pushed retail and institutional investors toward low-cost passive investment strategies.

- The same, however, can’t be said for sustainable fund assets in mutual funds and ETFs at the end of last year. Based on data as of December 2023, index mutual fund and ETF assets reached 127.2 billion, or 38.5% of sustainable fund assets. This percentage has been declining, having stood at 41% at the end of 2021 and 40% at the end of 2022.

- It may be that some sustainable approaches are best implemented via actively managed funds, such as impact, issuer engagement or proxy voting, however, over time, performance considerations are likely to prevail in sustainable investing too and the balance of active management versus index investing is likely to converge in line with conventional funds.

¹ Source: ICI.org. ² S&P/Dow Jones Indices SPIVA reports. ³ S&P/Dow Jones Indices SPIVA reports.