The Bottom Line: Sustainable funds in February benefited from the strong equity markets continuing since January, with 61 sub-categories, or 83%, posting positive average returns.

Notes of Explanation: Average performance of sub-sectors covers sustainable mutual funds and ETFs. Sources: Morningstar Direct and Sustainable Research and Analysis LLC.

Notes of Explanation: Average performance of sub-sectors covers sustainable mutual funds and ETFs. Sources: Morningstar Direct and Sustainable Research and Analysis LLC.

Observations:

- Sustainable fund assets under management attributable to mutual funds and ETFs, including money market funds, a total of 1,564 funds/share classes based on Morningstar classifications, closed the month of February 2024 with $337.2 billion in assets. These funds recorded an average total return of 2.7% in February, 1.9% year-to-date and 12.3% over the trailing twelve months.

- For the most part, sustainable funds in February benefited from the strong equity markets since the start to the year, with the S&P 500 Index recording its fourth consecutive monthly gain. Along with other major indices, the S&P 500 registered a new 52-week high in February. On the other hand, the US bond market retreated as concerns that the Federal Reserve may be less inclined to lower interest rates amid economic strength led to rate reduction expectations being adjusted from March to June.

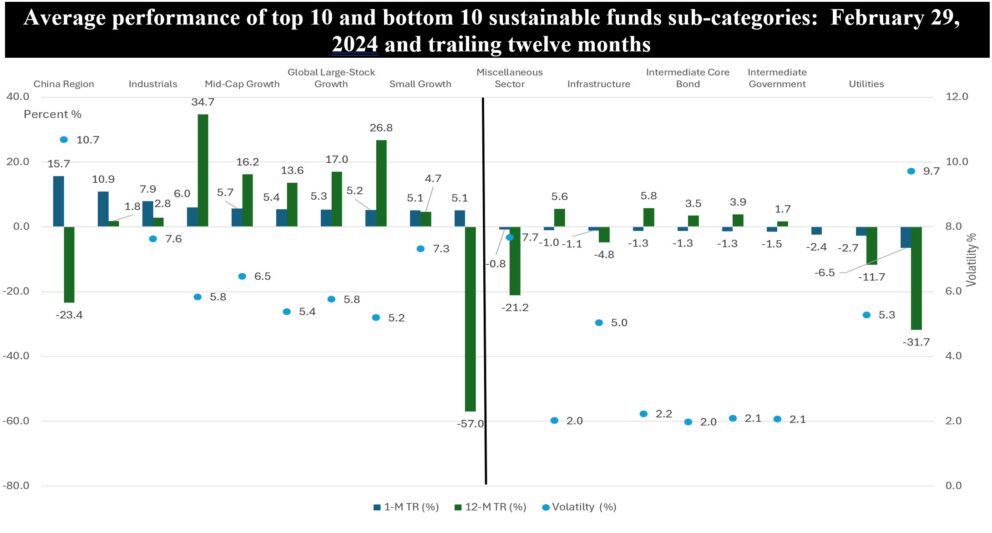

- Sustainable funds, classified across 10 broad fund categories, fall into 75 sub-categories. Of these 61 sub-categories, or 83%, posted positive average performance results in February. These ranged from a low of 1.1%, on average, recorded by high yield bonds to a high of 15.7% reached by one fund comprising China region funds. The top 10 fund sub-categories are dominated by growth funds, posted an average return of 7.2% in February, pushed up by the performance of five of the Magnificent 7 members (Amazon, Meta, Microsoft, Tesla and Nvidia), with Nvidia, in particular, gaining 28.6% for the month and representing 20% of the February total return for the S&P 500 and 26% YTD.

- The 10 lagging fund categories are led by bond funds, with average returns ranging from a low of -6.5% recorded by Commodities Focused funds to a high of -0.76% posted by the miscellaneous sector.

- The top performing fund sub-categories as well as the laggards are dominated by the most volatile categories, based on their average 3-year monthly standard deviation of returns.