Sustainable Bottom Line: Focused Short-Term sustainable bond funds served as a haven for sustainable investors during April’s market volatility, adding $111 billion in net assets.

Notes of Explanation: Sources: Morningstar and Sustainable Research and Analysis LLC.

Notes of Explanation: Sources: Morningstar and Sustainable Research and Analysis LLC.

Observations:

• Equity and fixed income fund flows in April were influenced by tariff-induced market volatility. The S&P 500 gave up as much as 11.2% through April 8th only to recover and end of the month with a narrow decline of 0.68% while foreign markets were up 4.56% according to the MSCI ACWI ex USA Index.

• Focused sustainable US Equity fund assets dropped by $5.3 billion, or 2.6%, from $201.1 billion to $195.8 billion. International Funds, on the other hand, added $393.1 million to end April with $60.6 billion in net assets.

• On the fixed income side, 10-year treasury yields ended the month at 4.17%, just 6 basis points lower, after dropping to 4.01% and bouncing as high as 4.48%. Assets of sustainable long-term taxable funds also dropped, declining by $445.4 million to end the month of April with $48.2 billion in net assets while investor sentiment shifted toward the shorter end of the yield curve.

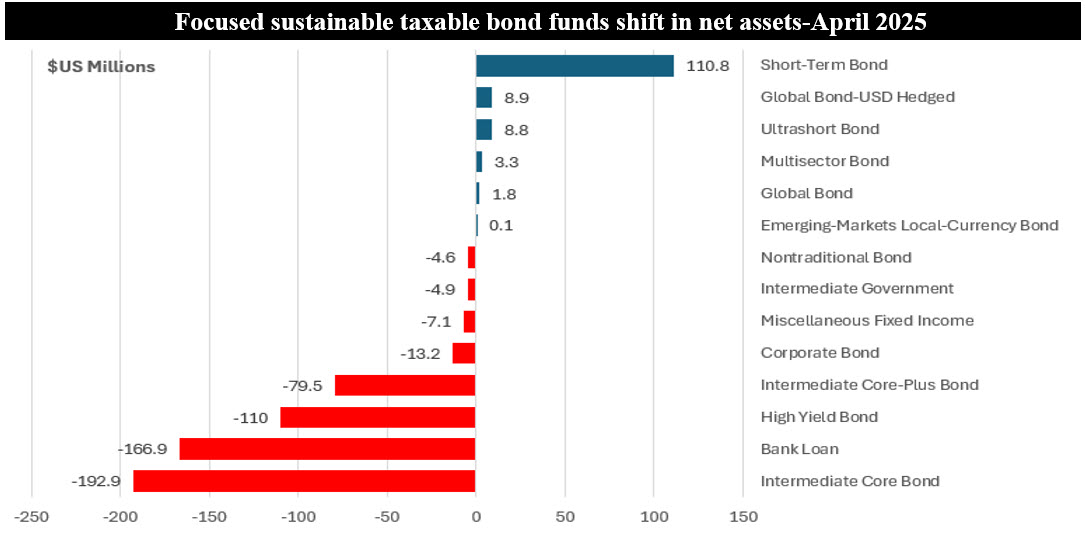

• The largest gain in assets across the focused sustainable taxable fixed income segment was recorded by Short-Term Bond funds, a segment consisting of 8 funds/22 share classes, which ended the month with $4.3 billion in assets, after adding $110.8 million in net assets (and 202.5 million year-to-date). Ultrashort Bond funds posted a net gain of only $8.8 million in April and $18.4 million year-to-date to end the month at $1.5 billion. In April, Short-Term Bond funds registered a gain of 0.6% and 2.2% year-to-date.

• Three investment categories which exposed investors to higher potential volatilities, or risks, experienced net asset value declines in excess of $100 million in April. These included Intermediate Core-Plus Bond funds, Bank Loan funds and High Yield funds which experienced declines in net assets in the amounts of $192.9 million, $166.9 million and $110 million, respectively.