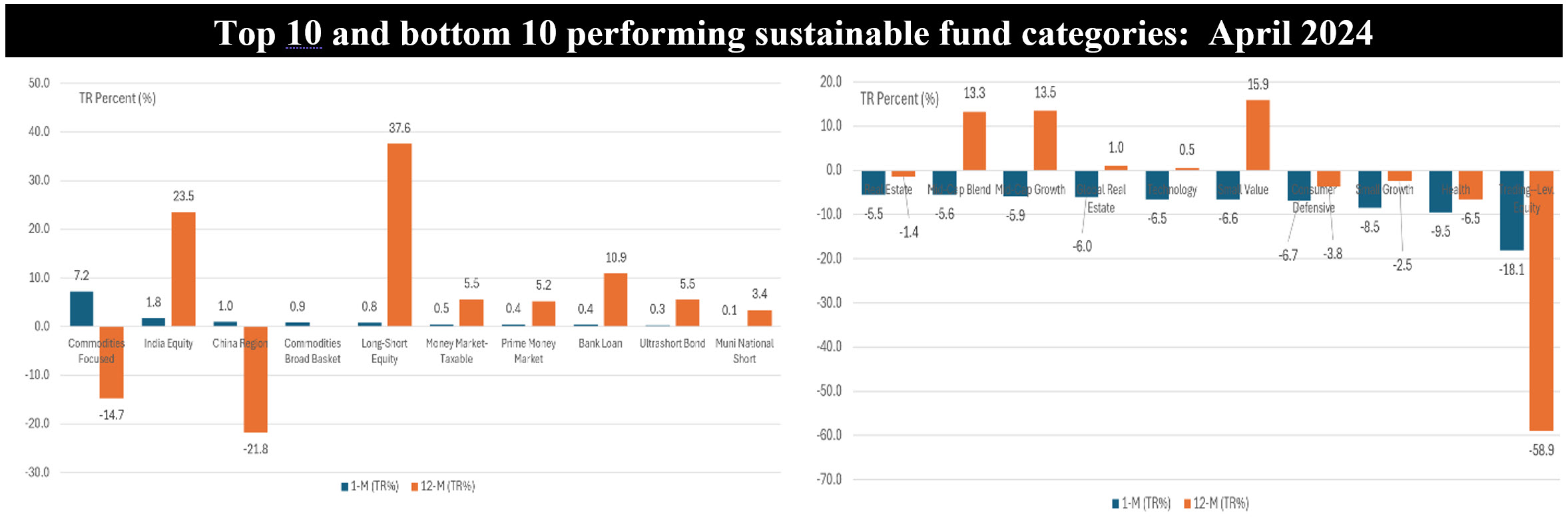

The Bottom Line: Sustainable funds posted an average -3.2% in April, while the leading Commodity Funds category added 7.2% and the lagging category dropped 58.9%.

Notes of explanation:

Notes of Explanation: Sustainable funds fall into one of 75 fund categories, as determined by Morningstar Direct. Returns are the average returns for each category for April 2024 and trailing 12-months. Sources: Morningstar Direct and Sustainable Research and Analysis LLC.

Investor optimism shifted to lower gear in April, but corporate earnings provided some ballast

Investor optimism during the first quarter of the year shifted to lower gear in April as investors came to realize that interest rates are not likely to move lower any time soon and Middle East tensions escalated. Investors, who had expected as many as six interest rate cuts in 2024, have come to realize that rate cuts may not be implemented this year due to a lack of further progress on the inflation front and stronger than expected economic growth, jobs, and higher wages. At the same time, corporate earnings came in above the 1% estimated gain and provided some ballast to the equity market which gained 1.4% after April 19th to end the month on better footing. All three major indices declined in April, with large cap growth stocks outperforming value stocks but the reverse was true for small cap stocks. The S&P 500 Index recorded a 4.08% total return decline, while the Dow Jones Industrial Index and NASDAQ Composite gave up 5.05% and 4.38%, respectively. The Russell 2000 Index, consisting of small companies, dropped even lower, giving up 7.04%. Ten of the eleven large cap index sectors reflected declines in April, with the Real Estate sector posting the lowest return at -8.62% while the Utilities sector was positive at 1.59%.

Intermediate investment grade bons gave up 2.53% in April and registered a year-to-date decline of 3.28%.

After finally recording a monthly gain of 0.9% in March, bonds sold off as 10-year Treasury’s posted the highest yield so far this year, ending the month at 4.69% versus 4.20% as of March 28, 2024. Against this development, the Bloomberg US Aggregate Bond Index gave up 2.53% and registered a wider year-to-date decline of 3.28%.

Bolstered by emerging markets, stocks outside the U.S. dropped by 1.8%.

Outside the U.S., the MSCI ACWI ex U.S. registered a decline of 1.8%, benefiting from the stronger performance in emerging markets that recorded an increase of 0.45%.

Sustainable funds registered an average decline of 3.2%, with over 93% of funds posting declines

Against this backdrop, focused sustainable mutual funds, and ETFs, including money market funds, a total number of 1,523 funds/share classes, 75 fund categories or fund classifications, and $333.4 billion in assets under management at the end of April, as classified by Morningstar, registered an average decline of 3.2%. Focused long-term sustainable funds produced similar one-month results. Returns across taxable bond funds, international equity funds and U.S, equity funds varied, ranging from an average decline of 1.6%, to -3.1% and -4.7%, respectively. Only 97 funds/share classes, or 6.4% of sustainable funds recorded positive results for the month.

The ten top performing sustainable fund categories, all posting positive average returns, gained an average return of 1.3% in April while the ten worst performing categories registered an average decline of 7.9%.

Commodities Focused funds and Trading-Leveraged Equity fun ds were the best and worst performing sustainable fund categories in April

Commodities Focused funds, ten funds in total, posted the best average return, up 7.2%. The category, tracking mutual funds, ETFs and ETNs, was led by the highly volatile iPath Global Carbon ETN (GRNTF). This small $4.7 million exchange trade note that tracks the performance of the most liquid carbon-related credit plans in the global marketplace gained 11.88% in April but still failed to overcome its underperformance that on a trailing 12-month basis still left the fund in red by -22.4%. The next best performing fund in the same category is the $14.4 million iShares Transition-Enabling Metals ETF (TMET), up 11.47%. The index fund seeks investments that gives it exposure to metals that are essential to a wide range of clean energy technologies supporting the transition to a low-carbon economy.

At the other end of the spectrum, two small ETFs that make up the worst performing Trading-Leveraged Equity funds, the $3.9 million Direxion Daily Electric and Autonomous Vehicles Bull 2X ETF (EVAV) and the $3.3 million Direxion Daily Global Clean Energy Bull 2X Shares ETF (KLNE) , registered declines of 62.9% and 55%, respectively.