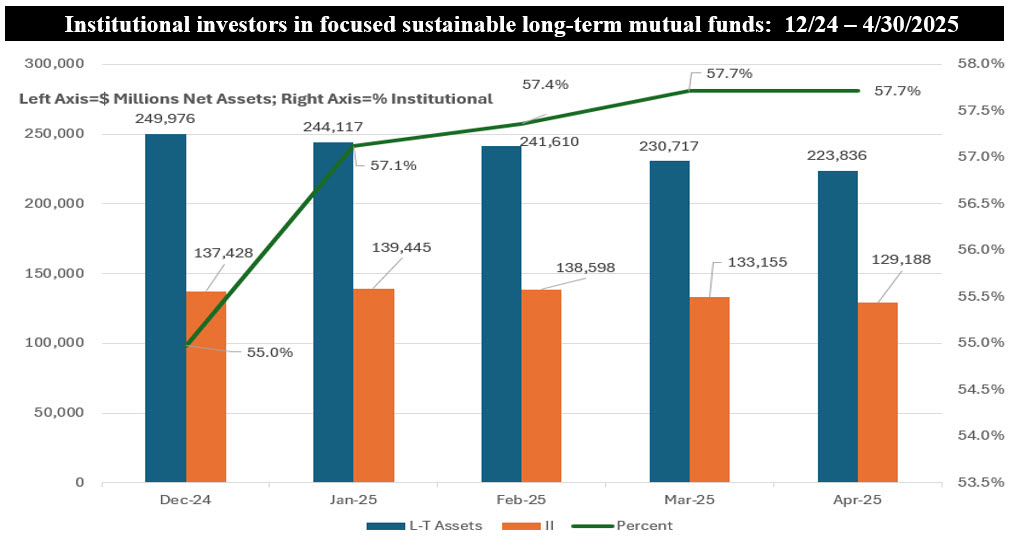

Sustainable Bottom Line: Assets invested in focused sustainable long-term mutual funds sourced to institutional investors tick up slightly during the first four months of 2025.

Notes of Explanation: Long-term funds exclude money market fund assets. Sources: Morningstar and Sustainable Research and Analysis LLC.

Notes of Explanation: Long-term funds exclude money market fund assets. Sources: Morningstar and Sustainable Research and Analysis LLC.

Observations:

•At the end of April 2025, focused long-term sustainable mutual funds with $223.8 billion in assets, sourced 57.7% of their net assets from institutional investors. This represents a slight uptick, from 55% of net assets at the end of 2024, even as absolute assets sourced to institutional investors declined in 2025 from $137.4 billion to $129.2 billion.

• The percentage of institutional investors in funds varies across broad investment categories. For example, 57% of institutional investors in long-term sustainable funds are sourced to U.S. Equity funds while 22% and 16% are sourced to Taxable Bond and International Equity funds. These three investment categories are also the largest sustainable investment categories by assets under management.

• Within the 17 investment categories that make up the long-term sustainable funds segment, the level of institutional participation varies considerably. For example, institutional investors account for 77% of net assets attributable to Taxable Bond funds while the level of institutional participation in International Equity funds and Sector Equity funds is 63% and 62%, respectively.

• Funds with the largest institutional investor concentrations include four equity and one bond fund: Parnassus Core Equity Institutional ($14.3 billion, or 54%), Vanguard FTSE Social Index I ($10.5 billion or 50%), DFA US Sustainability Core 1 ($7.0 billion or 100%), Brown Advisory Sustainable Growth I ($5.8 billion or 71%) and Nuveen Core Impact Bond R6 ($5.1 billion or 78%).

• Institutional investor participation in funds is identified by isolating share classes in funds offered to institutional investors, which typically includes financial intermediaries which also allows individual investors to benefit from lower expense ratios, and defined by the fund’s minimum initial purchase amounts. These can vary. For example, the minimum initial purchase for the institutional shares offered by Parnassus Core Equity Fund is $100,000 while the minimum subsequent investment is considerably lower. On the other hand, the minimum investment amount required to open and maintain an account in the Vanguard FTSE Social Index Fund-Institutional Shares is $5 million. The minimum investment amount required to add to an existing account is generally $1.