The Bottom Line: With one exception, the composition of the top ten sustainable investment funds by assets under management remains unchanged so far this year.

Notes of Explanation: # Index fund. Total net assets as of April 30, 2024. Sources: Morningstar Direct; Sustainable Research and Analysis LLC.

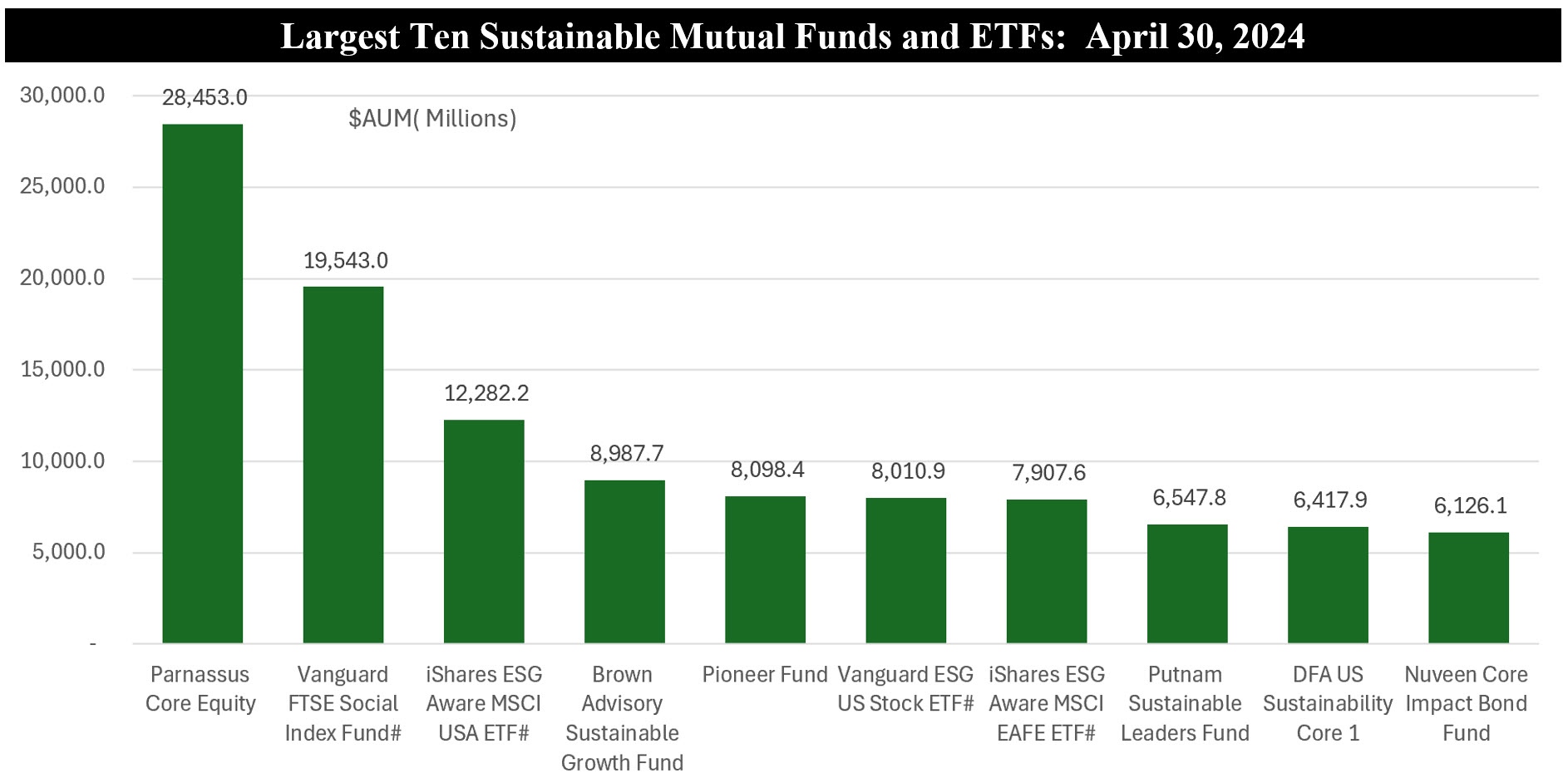

Ten largest sustainable mutual funds and ETFs

The largest ten sustainable mutual funds and ETFs as of April 30th managed $112.4 billion in net assets, or 34% of sustainable fund assets under management that stood at $333.4 billion as of the same date. With one exception, the composition of the top ten funds has remained unchanged since the start of the year. The exception involves the addition of the Putnam Sustainable Leaders Fund to the top ten list. The fund replaced the renamed Nuveen Large Cap Responsible Equity Fund that, effective May 1, 2024 , underwent a name change due to rebranding from the TIAA-CREF Social Choice Equity Fund and a modest investment policy change.

The top funds consist of seven mutual funds and three ETFs, including six actively managed investment vehicles as well as four index funds. All but one are equity funds, classified as Large Blend, Large Growth and Foreign Large Blend funds.

With one bond fund exception, top sustainable funds are all domestic and foreign equity funds

The one equity fund exception is the recently renamed Nuveen Core Impact Bond Fund which prior to May 1st was called the TIAA-CREF Core Bond Fund. This Intermediate Core Bond fund is the largest sustainable bond fund, offering five share classes with a combined total of $6.1 billion in net assets.

Funds employ a variety of sustainable investing approaches

The funds employ a variety of sustainable investing strategies or approaches, ranging from screening and exclusions that characterizes, for example, the Vanguard FTSE Social Index Fund, to ESG integration, applicable to the Parnassus Core Equity Fund, and to the broadest combination, as is the case with the Nuveen Core Impact Bond Fund with sustainable investing approaches that extend from ESG integration, exclusions and impact, that is, investments that provide direct exposure to issuers and/or individual projects that the adviser, through its proprietary analysis, believes have the potential to have social or environmental benefits. Index funds aside, in some cases management firms may also employ engagement practices with companies and other stakeholders to enhance due diligence and monitor the investment thesis.

Top ten funds recorded an average decline of 4.2% but are up an average 20.9% over the trailing 12 months

In April and since the start of the year, the largest funds recorded an average decline of 4.2% and a positive 20.9% total return, respectively. Based on the total returns posted by the best or worse performing share class where applicable, returns in April ranged from -5.51% posted by Brown Advisory Sustainable Growth I to -2.43% recorded by the Nuveen Core Impact Bond Fund Institutional Class. Year-to-date, returns range from a low of -0.04% registered by Nuveen Core Impact Bond Fund Institutional Class to a high of 32.04% achieved by Pioneer Fund A.