The Bottom Line: Small sustainable fund firms may introduce unique or innovative investment opportunities, but investors should exercise caution when considering making investments in them.

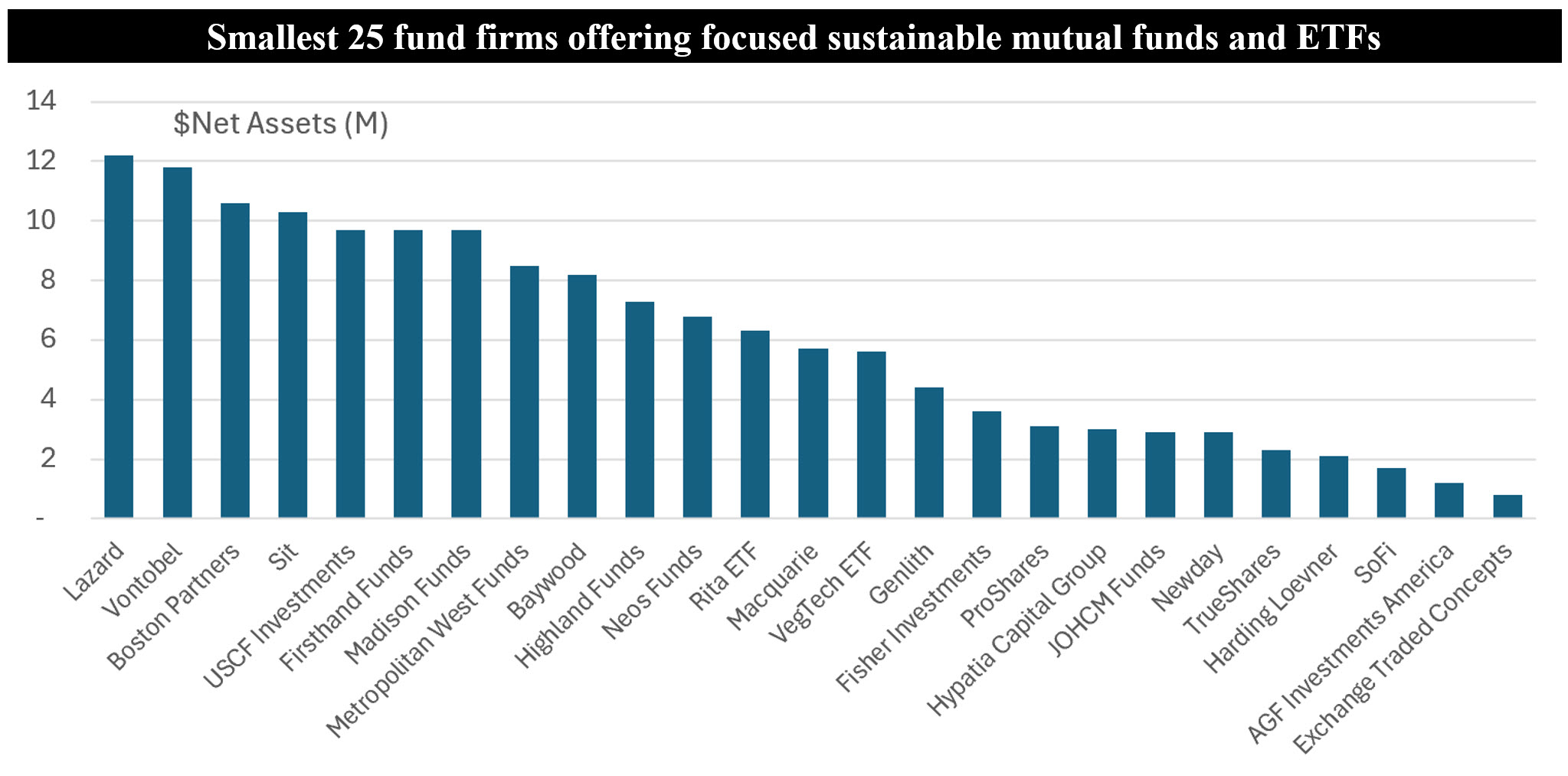

Notes of Explanation: Fund firms listed in descending order based on total net assets as of April 30, 2024. Sources: Morningstar Direct; Sustainable Research and Analysis LLC.

Observations:

- Management of focused sustainable fund assets under management are highly concentrated, with 90% of net assets in the US controlled by 25 firms. This, out of a total of 154 firms with sustainable fund offerings, either mutual funds or ETFs or both. At the other end of the range, the bottom 25 firms manage just $150.5 million in assets, or less than 1% of assets. These firms and their funds, which most often includes just one fund, range in size from a low of $0.8 million to a high of $12.2 million.

- Some of the smallest fund firms bring to market unique and innovative products, such as exposure to innovative and sustainable solutions in the food and materials sectors, carbon credits or ocean health-related companies. However, unless the associated small funds in this category are managed by deep pocketed management firms or they succeed in building up their assets under management quickly, they are less likely to survive. For example, between the start of 2023 through April 30, 2024, 12 of the smallest fund firms offered by the bottom 25 funds, or 44%, have been liquidated.

- The smaller funds, on average, tend to subject investors to higher expense ratios and their portfolios may struggle to achieve effective diversification, liquidity, and trading efficiencies. In the process, tracking results could suffer along with performance outcomes. Also, portfolios may shut down without much advance notice.

- Investors attracted to new and unique fund offerings that don’t have reasonable substitutes are encouraged to monitor these new funds rather than invest in them at the time of their launch, unless offered by established management firms with sustainable businesses. That said, this is still not a fail-safe approach. In general, it may be prudent to avoid such investments until the funds reach about $30 to $50 million in net assets under management.