The Bottom Line: S&P removed Tesla Inc. from the S&P 500 ESG Index in May but limited transparency regarding the decision contributes to ESG confusion.

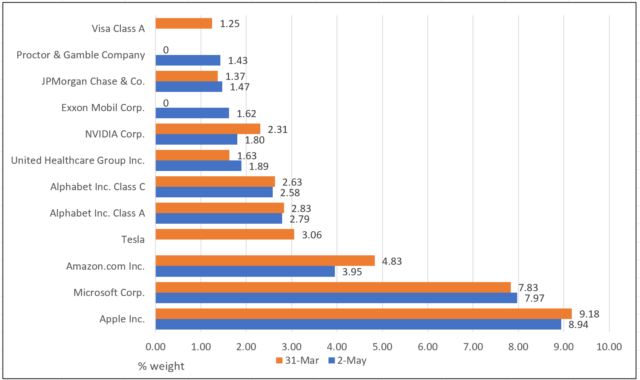

S&P 500 ESG Index top 10 holdings prior to and following removal of Tesla Inc. (TSLA) Source: S&P Down Jones reports and various index fund holdings reports. Percentages as of May 2 are approximate.

Source: S&P Down Jones reports and various index fund holdings reports. Percentages as of May 2 are approximate.

Observations:

- On April 22, 2022, S&P Dow Jones Indices announced changes in the composition of the S&P 500 ESG Index following the April rebalance that became effective prior to the open of trading on May 2, 2022. The S&P 500 ESG Index is a broad-based market cap weighted index that measures the performance of securities in the S&P 500 that meet the firm’s sustainability criteria.

- 36 stocks were added and 35 were removed, including Tesla Inc. (TSLA). Prior to its removal, the stock accounted for a significant 3% or so of the index weight and represented one of the top ten stocks.

- While the decision was not accompanied by a clear explanation, according to follow-on reporting by Reuters, the stock was removed because Tesla’s ESG score had fallen behind while the scores of other companies improved. Contributing factors included poor working conditions at the company’s U.S. Freemont factory, claims of racial discrimination and its handling of a U.S. government probe into multiple deaths and injuries linked to its autopilot technology. At the same time, Exxon Mobil Corp. remains a top 10 holding.

- Elon Musk responded to the news by rejecting ESG scores as a “scam,” adding that ESG “has been weaponized by phony social justice warriors.” This, combined with the simultaneous addition of some companies, such as oil and gas producers, the limited transparency in the shift in Tesla’s rating as well as the ratings of other index constituents and the intricacies of reaching an aggregate rating or score, add to the confusion regarding ESG.