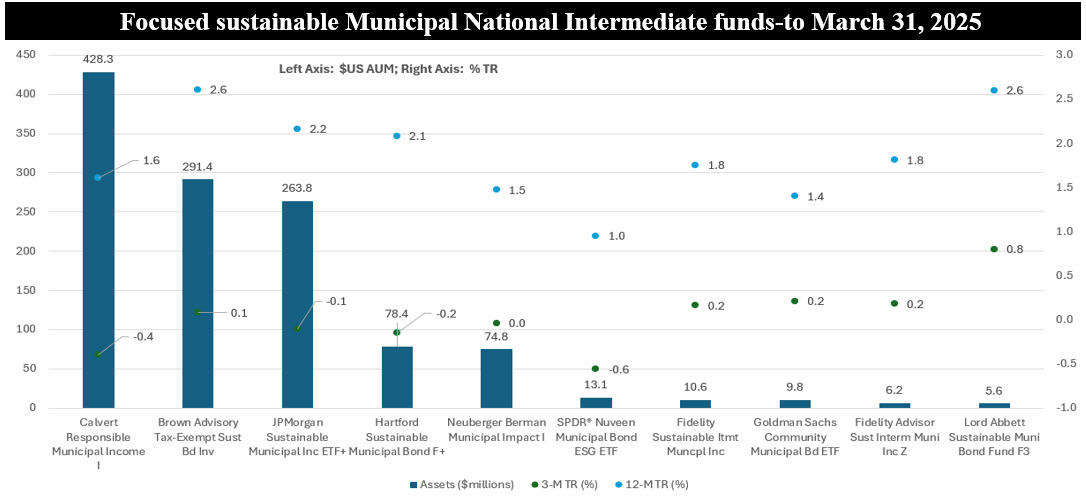

Sustainable Bottom Line: While the segment is small, a number of focused sustainable Municipal National Intermediate funds offer investors a range of sustainable investing approaches.

Notes of Explanation: Funds are listed in order of their total fund assets under management. In the case of mutual funds, total return performance applies to the identified highest performing share class. In the case of Lord Abbett Sustainable Municipal Bond Fund, performance of F3 share class is identical to I share class. +Fund is rated A based on a combination of factors, including management company, years in operation, performance, expense ratio and fund size. Sources: Morningstar and Sustainable Research and Analysis LLC.

Notes of Explanation: Funds are listed in order of their total fund assets under management. In the case of mutual funds, total return performance applies to the identified highest performing share class. In the case of Lord Abbett Sustainable Municipal Bond Fund, performance of F3 share class is identical to I share class. +Fund is rated A based on a combination of factors, including management company, years in operation, performance, expense ratio and fund size. Sources: Morningstar and Sustainable Research and Analysis LLC.

Observations:

• Except for short-term funds, focused sustainable municipal bond funds, including Municipal California Intermediate funds, Municipal National Intermediate funds and Municipal National Long funds, posted negative average total returns in March and zero to negative results in the first quarter—the only fixed income categories to register negative returns in Q1. Returns registered by these investment categories in March were -1.4%, -1.3%, and -1.9%, respectively, while Q1 results were -0.1%, 0.0% and -0.6%. Short-term municipals averaged 0.2% in March and 0.8% in the first quarter.

• For context, these results can be compared against the performance of the municipal bond market as measured by the Bloomberg Municipal Bond Index that posted a slightly negative result for the first quarter of 2025. January and February saw positive returns supported by healthy inflows of funds and steady demand, however, returns posted in March reversed those gains. Factors such as heavy new bond issuance and softening demand combined with elements like tax-season selling, fund outflows and concerns regarding potential shifts in tax policy led to a drop of 1.69% in March and -0.22% in the first quarter. Unlike treasury yields that declined, municipal yields were pushed higher, especially further out on the curve for 10- and 30-year yields.

• A small group of 39 funds/share classes with $1.7 billion in assets, including mutual funds and ETFs, comprises the focused sustainable municipal funds segment. The largest of these is the Municipal National Intermediate segment consisting of 10 funds/25 share classes with $1.2 billion in assets that account for 71% of assets under management (AUM). The number is slated to decline by one fund as the $5.6 million Lord Abbett Municipal Income Fund with its five share classes announced in February the upcoming closure of the fund around the Spring of 2025.

• Within the segment’s nine remaining funds, five funds, all with assets over $30 million*, account for 97% of assets under management and offer investors a range of sustainable approaches. These include the integration, identification and consideration of sustainable investment-related risks and opportunities using a sustainable investment research assessment employed by Brown Advisory in connection with the Brown Advisory Tax-Exempt Sustainable Bond Fund to seeking to invest in securities that fund positive social and environmental outcomes in the case of J.P. Morgan Investment Management, Neuberger Berman and Wellington Management, subadvisor to the Hartford Sustainable Municipal Income Fund. Lastly, the Calvert managed Calvert Responsible Municipal Bond fund is guided by Calvert’s Principles for Responsible Investment which provides a framework for considering ESG factors to advance risk as well as value-based considerations. The fund’s investments include municipal securities that Calvert believes may have a positive environmental and/or social impact, such as obligations that fund education, healthcare, community services, housing, water, public transportation and other public purposes. Two of these funds/share classes, including the JPMorgan Sustainable Municipal ETF and the Hartford Sustainable Municipal Bond F are A rated by Sustainable Research and Analysis.

*Fund size-the fund’s total net assets should range above $30 million—so that it may be managed more efficiently and to provide some protection against the fund’s closure.