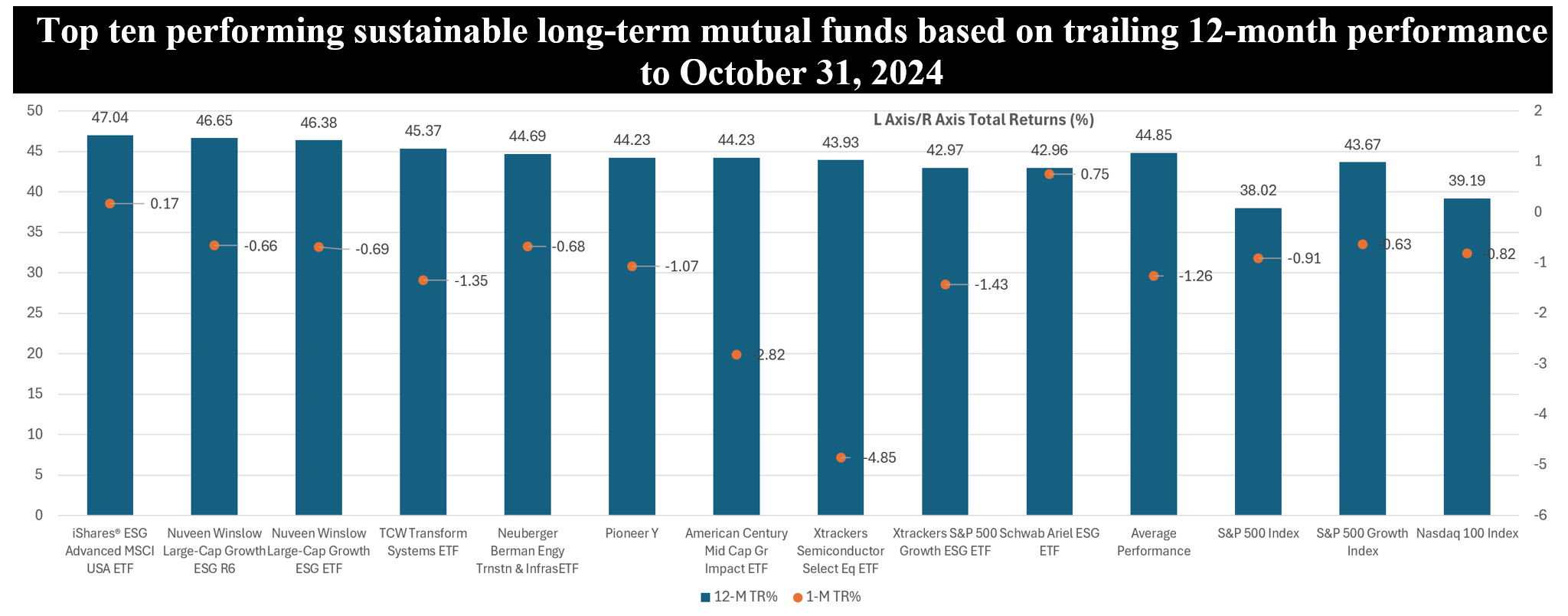

The Bottom Line: The average performance of the top ten performing focused sustainable funds over the trailing twelve months has exceeded the S&P 500 post-election.

Notes of explanation: Notes of explanation: Funds listed in order of descending 12-month results. Included in top ten funds are only the top performing share class in the case of mutual funds. Sources: Morningstar Direct and Sustainable Research and Analysis LLC.

Observations:

• The top ten performing focused sustainable funds over the trailing twelve months to October 31, 2024, a combination of active and passively managed mutual funds and ETFs, registered an average return of 44.84%, even after dropping an average of -1.3% in October. This compares to the S&P 500 gain of 38.02% during the 12-month interval, gains of 43.67% for the S&P 500 Growth Index, and 39.19% for the Nasdaq 100 as well as an increase of 33.68% generated by focused sustainable US equity funds.

• Returns for the ten funds ranged from a high of 47.04% recorded by the iShares ESG Advanced MSCI USA ETF (USXF) to a low of 42.96% registered by the Schwab Ariel ESG ETF (SAEF).

• Sustainable large cap growth funds benefited from exposures, in some cases to a significant degree, to one or more of the Magnificent 7 companies that have had a material impact on the S&P 500 during the last twelve months. These include Alphabet (GOOG)(GOOGL), Amazon (AMZN), Apple (AAPL), Microsoft (MSFT), Meta Platforms (META), Nvidia (NVDA) and Tesla (TSLA).

• The iShares ESG Advanced MSCI USA ETF, an index fund investing in large- and mid-cap U.S. stocks with favorable environmental, social, and governance (ESG) ratings that avoids exposure to companies with low ESG ratings and severe controversies while applying extensive screens, including fossil fuel-related activities, benefited, from its 17.3% exposure to Nvidia Corp that gained 194.99% during the twelve-month interval. Nvidia is the only Magnificent 7 company to carry an AAA (Leader) ESG rating from MSCI while Tesla (BBB-Average) and Meta (B-Laggard) are the lowest rated.

• Since the election of Donald Trump, the S&P 500 has gained 3.6% to November 11, 2024. At the same time, the top ten twelve-month performers registered an average gain of 4.4%. It’s too soon to tell, but might the election results galvanize sustainable investors?

*Sources: MSCI ESG ratings