The Bottom Line: The recent reconstitution of the Dow Jones Industrial Average (DJIA) with two substitutions leaves the benchmark’s Average ESG risk rating largely unchanged.

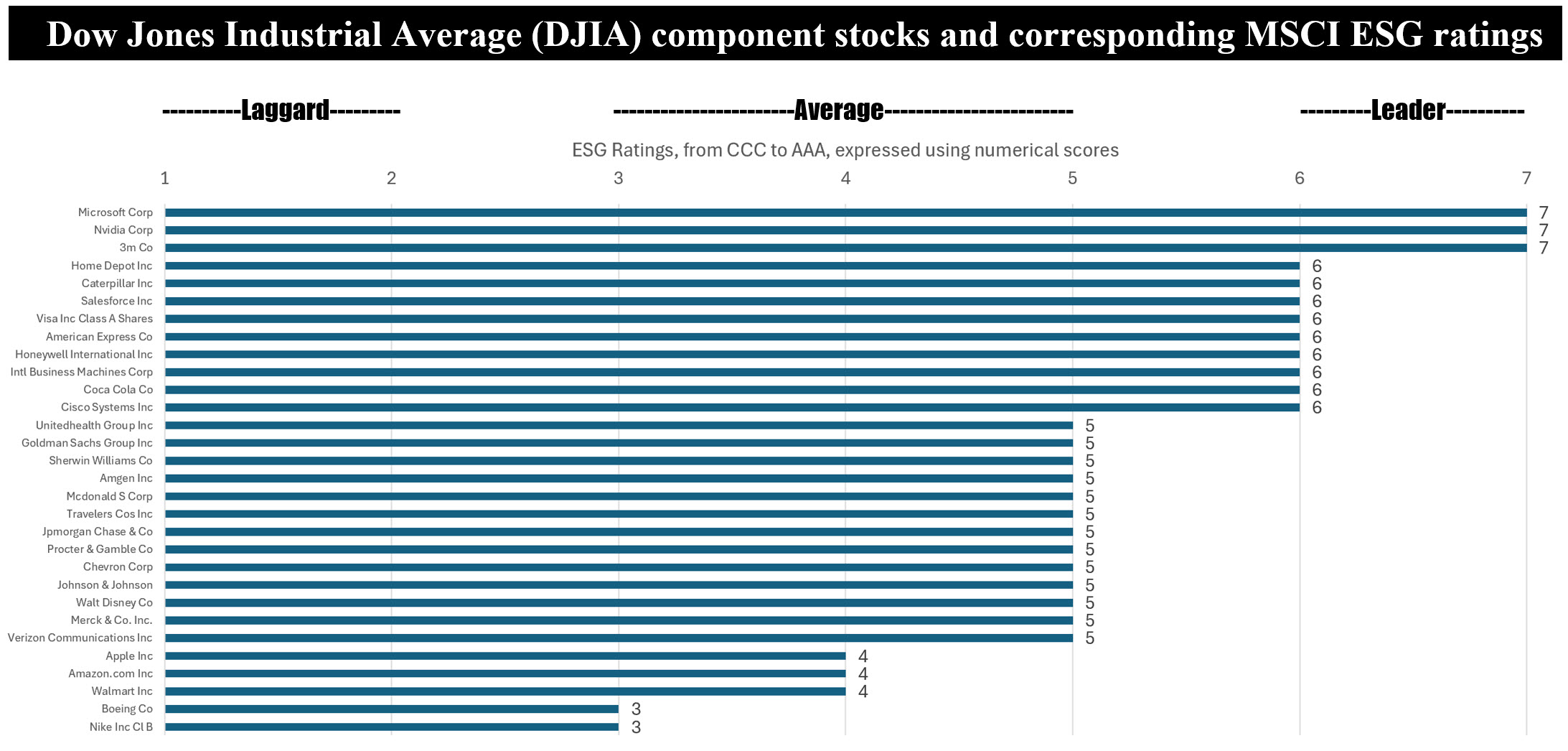

Notes of explanation: ESG score of 3 =BB or Average, ESG score of 4=BBB or average, ESG Score of 5=A or average, ESG Score of 6=AA or Leader and ESG score of 7=AAA or Leader. ESG score source: MSCI, otherwise, Sustainable Research and Analysis LLC.

Observations:

• Earlier this month, on November 8, 2024, the Dow Jones Industrial Average (DJIA) saw some changes in its lineup. Both Nvidia (NVDA) and Sherwin-Williams (SHW) were added to the index. Nvidia replaced Intel (INTC), while Sherwin-Williams took the place of Dow Inc (DOW). These changes reflect the evolving landscape of the U.S. economy, with Nvidia’s strong position in the AI sector and Sherwin-Williams’ prominence in the paint and coatings industry. The substitutions hardly impacted the benchmark’s ESG risk profile*.

• While the selection of constituent companies that make up the Dow Jones Industrial Average does not explicitly account for environmental, social and governance (ESG) considerations, a growing segment of investors likely have an interest in understanding the sustainability profile of the index as well as individual companies that comprise the index. When viewed through the prism of financial risk exposure, current and future investors in DJIA-linked investment products, such as mutual funds, ETFs, separate accounts, futures and options, will likely wish to understand their exposure to various ESG risks, such as climate change risks, labor disputes, or governance, to mention just a few. By some accounts, the estimated assets under management (AUM) tracking the Dow Jones Industrial Average is around $30 billion to $40 billion. In addition, the ESG risk profile of the DJIA, a price-weighted measure of 30 U.S. blue-chip companies, excluding transportation and utility firms, offers a proxy for quantifying the ESG risk profile of the some of the largest listed companies in the US.

• Using MSCI’s ESG ratings**, which aim to measure a company’s resilience to long-term, financially relevant ESG risks using a seven-point scale that runs from CCC to AAA, the average ESG rating computed for the DJIA falls lightly above A or at the high end of the Average rating category but below the Leader category. According to MSCI, ratings of AA and AAA fall into the Leader rating category, ratings of BB, BBB and A fall into the Average category and ratings of CCC and B are considered Laggards. At the present time, three companies within the index are rated AAA. These include Microsoft Corp (MSFT), 3M Co (MMM) and Nvidia that was just added to the index and which replaced Intel Corp. that was also rated AAA. Nine companies are rated AA, for a total of 12 companies that fall into the Leader category. Otherwise, the remaining 18 companies fall into the Average category, with two companies, including Boeing and Nike that carry the lowest Average ratings of BB.

• The most recent rebalancing of the DJIA also included the substitution of AA rated Dow Inc for the single A rated Sherwin Williams. Before the substitution, the average ESG rating of the DJIA was nearly identical.

• Weighting ESG scores by stock prices, in line with the computation of the benchmark, shifts the results slightly higher but it still remains just about halfway between an ESG rating of A and AA, in the Average category.

*ESG ratings can have many different meanings which is one of the reasons for varying ESG scores and low correlations. In this instance, ESG ratings sourced to MSCI address financially relevant risks. Sources: MSCI ESG ratings.

**ESG ratings were converted into numerical scores from 1-7 for purposes of these calculations.