The Bottom Line: Average size of newly launched sustainable ETFs has been significantly larger than mutual funds in 2023, offering investors the benefit of scale.

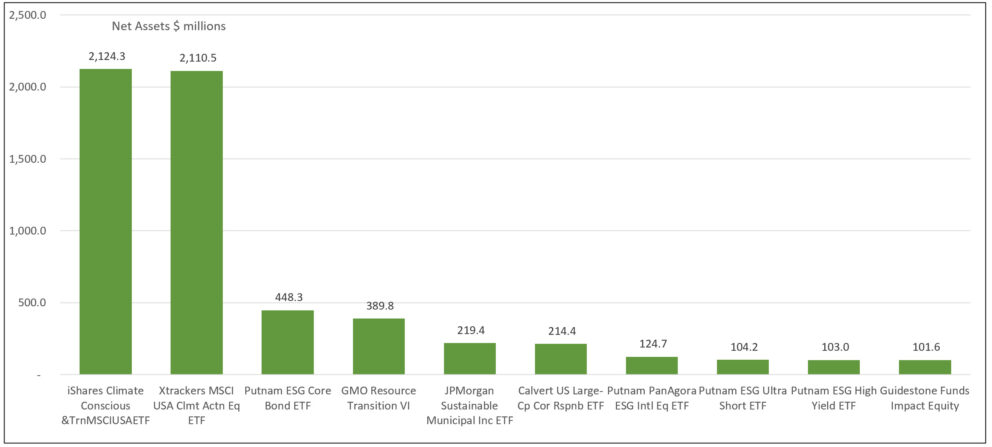

Net assets of top 10 newly listed (2023) sustainable mutual funds and ETFs: October 31, 2023

Notes of Explanation: Net assets as of October 31, 2023. Mutual fund assets combine all share classes. Source: Morningstar Direct, Sustainable Research and Analysis LLC.

Observations:

- Sustainable fund assets dropped to $305 billion at the end of October, according to Morningstar. Of this sum, $X is managed in mutual funds while $89.8 billion is sourced to ETFs, or 29.4% of sustainable fund assets under management. Yet, even with a lower number of fund launches in 2023 to-date, versus mutual funds, newly listed ETFs attracted about eight times more assets than mutual funds. In part, this is due to large institutional investors lining up in advance to support a particular themed investment product, such as one focused on the transition to low carbon economy.

- 33 new sustainable ETFs were launched through the end of October versus 42 new mutual funds, consisting of 153 share classes (excluding new share class additions). Based on assets garnered since inception to the end of October, ETFs accumulated $5.8 billion as compared to $682.7 million for sustainable mutual funds, or a significant differential of $5.1 billion. The largest ten newly launched funds, all with assets more than $100 million, include eight ETFs and only two mutual funds. These are the GMO Resource Transition Fund VI (GMOYX) and the GuideStone Funds Impact Equity Fund Institutional and Investor shares (GMEZX and GMEYX). The median sizes of newly launched sustainable mutual funds and ETFs at the end of October stood in sharp contrast at about $697,000 versus $19 million, respectively.

- Eight new ETFs drew in $5.4 billion and accounted for 93% of net new assets. Two of these ETFs alone, including the stock index tracking $2.1 billion iShares Climate Conscious & Transition MSCI USA ETF (USCL), managed by BlackRock, and the $2.1 billion Xtrackers MSCI USA Climate Action Equity ETF (USCA), managed by DBX Advisors, accounted for three-quarters of this sum. The two funds, subject to expense ratios of 0.08% and 0.07%, respectively, are almost identical in their construction. They screen stocks from the same underlying index, the MSCI USA Index and they both rely on MSCI qualifying opinions. One differentiating factor, however, is that USCL extends the eligibility of issuers to include any that have approved science-based targets for emissions reduction or are assessed as having a “credible track record” of reduced emissions.

- Larger fund sizes benefit investors in conventional as well as sustainable mutual funds and ETFs. In general, larger funds advantage investors from their economies of scale as they can be managed more efficiently and in a less costly manner and they are less likely to be terminated in the event fund sizes fail to reach break-even, especially when offered by fund management firms that don’t enjoy deep pockets or view the funds as strategic to the organization.