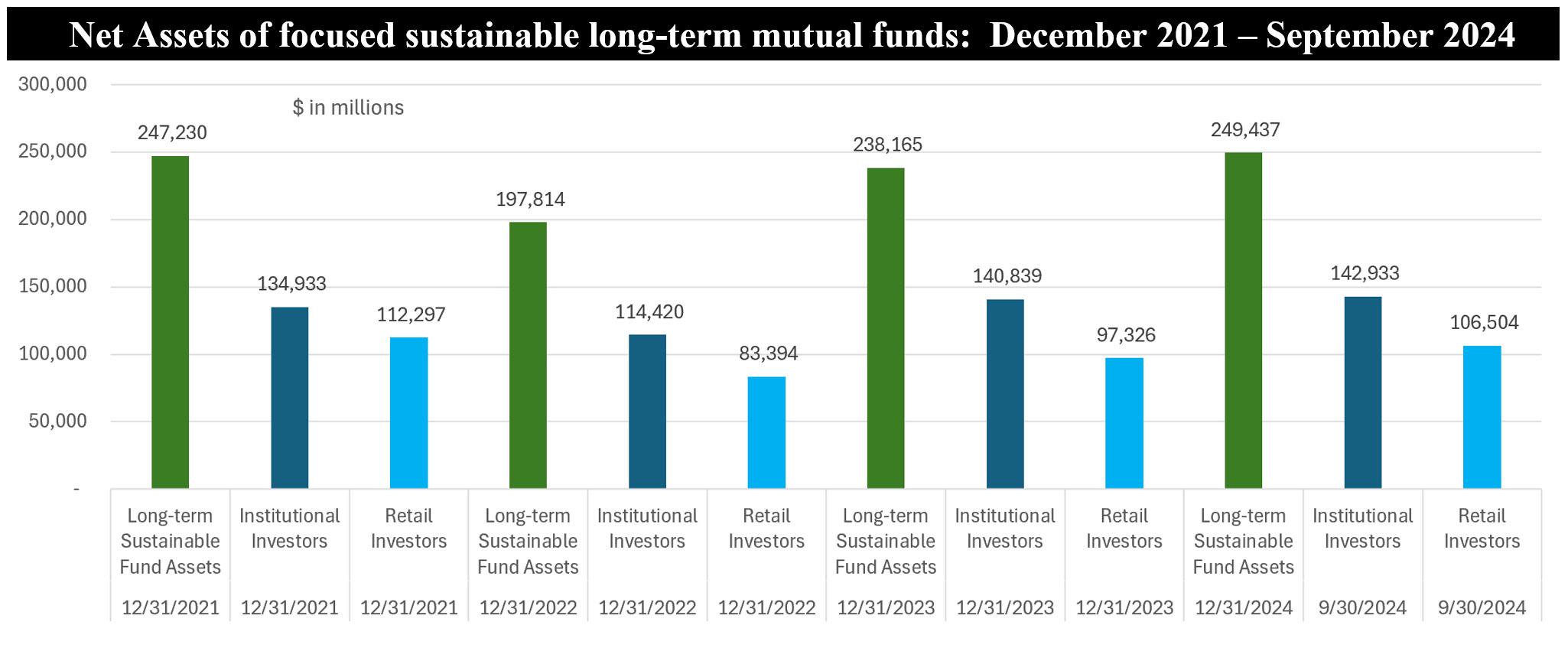

The Bottom Line: Institutional investors in focused sustainable mutual funds account for $142.9 billion in assets, or 57% of AUM, and have been more stable.

Notes of explanation: Long-term sustainable fund assets exclude money market fund assets. Funds and share classes that pursue explicitly stated environmental or social mandates are estimated at about $100 billion. Sources: Morningstar Direct and Sustainable Research and Analysis LLC.

Observations:

• In the aggregate, focused sustainable long-term mutual fund assets have now surpassed the year-end level achieved in 2021 when assets reached $247.2 billion. ETFs bring another $111.9 billion, for a combined total of $361.3 billion. The assets of institutional investors have also recorded a new high and contributed most significantly to the milestone, ending September with $142.9 billion versus $134.9 billion at the end of 2021. This is not yet the case for retail funds that are still falling short by $5.8 billion as well as ETFs that are still off by $14.4 billion versus year-end 2021 levels.

• Institutional investors in mutual funds account for $142.9 billion in net assets, or 57% of sustainable mutual fund assets under management. Institutional investors are measured based on their designated institutional share classes. This is up slightly from 55% at the end of 2021, but down from 59% at the end of 2023.

• Both retail and institutional investors were behind the redemptions in 2022, when the S&P 500 recorded a decline of 18.11% and the Bloomberg US Aggregate Bond Index dropped by 13.01%. That said, institutional share class outflows were about a third lower than retail investor outflows. Moreover, institutional investor inflows in 2023, when both markets rebounded, significantly outpaced retail inflows while the reverse is true over the first nine months of 2024. Cash flows are calculated using a back of the envelope approach by which cash flows reflect the change in net assets adjusted for capital appreciation/depreciation over the time interval.

• Since the end of 2021 and on a cumulative basis to September 30, 2024, shifts in assets attributable to sustainable institutional investors were less volatile as compared to retail-oriented mutual fund investors. ETF shifts in assets during the same period were even more volatile that retail-oriented mutual funds, perhaps reflecting a more retail-oriented shareholder base.

*Long-term sustainable fund assets exclude money market fund assets. Funds and share classes that pursue explicitly stated environmental or social mandates are estimated at about $100 billion.