The Bottom Line: ESG litigation is on the rise worldwide while ESG investment practices in the US have faced fewer lawsuits, but this could change.

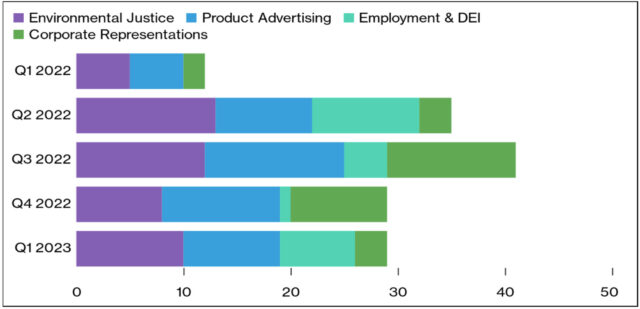

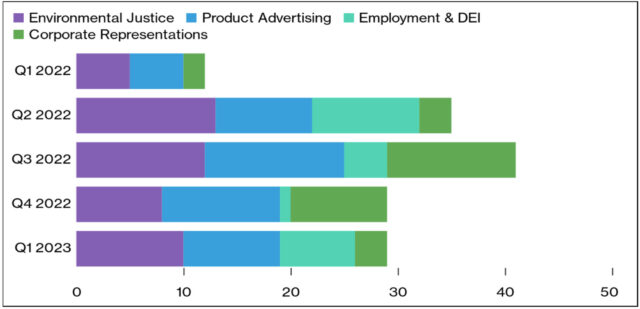

Quarterly totals for ESG-related lawsuits in the US federal district courts: Q1 2022 – Q1 2023 Notes of Explanation: Source: Source: Bloomberg Law docket search of complaints filed in federal district courts: Q1 2022 – Q1 2023.

Notes of Explanation: Source: Source: Bloomberg Law docket search of complaints filed in federal district courts: Q1 2022 – Q1 2023.

Notes of Explanation: Source: Source: Bloomberg Law docket search of complaints filed in federal district courts: Q1 2022 – Q1 2023.

Notes of Explanation: Source: Source: Bloomberg Law docket search of complaints filed in federal district courts: Q1 2022 – Q1 2023. Observations:

- According to Bloomberg Law, the scope of US Federal ESG-related lawsuits since the beginning of 2022 isn’t yet huge, with fewer than 150 complaints in the past five quarters.

- At the same time, according to the Grantham Institute 2021 Global Trends in Climate Change Litigation Policy Report, the number of climate change-related cases alone has more than doubled since the adoption of the Paris Climate Agreement. As of May 2022, there were 2,002 cases of climate change litigation globally.

- Litigation in the US has largely focused on four emerging categories of ESG risk. These include environmental justice, product advertising, employment and diversity, equality and inclusion, and corporate representations.

- A fifth category surrounding ESG investment practices has been involved in fewer lawsuits so far, but this could change in the future. For example, investors in sustainable funds may bring claims against investment management companies based on false or misleading statements regarding their funds-specific sustainable investing practices and outcomes. Or even actions against individual firms in connection with representations made in connection with firm-wide practices, such as Net Zero Investment initiatives. Also, actions may be brought against financial advisers because of their questionable recommendations to invest in certain sustainable mutual funds and ETFs.

- On the other hand, the limited number of actions and number of funds involved taken by the SEC against investment management firms to-date, which includes actions against BNY Mellon Investment Adviser, Inc., Goldman Sachs Asset Management, L.P. and Deutsche Bank subsidiary DWS Securities, relating to ESG quality reviews and policies, or procedures involving ESG research performance or failure to adequately implement certain ESG policy provisions, may suggest that the number of future lawsuits in this area may not change much.