The Bottom Line: Short-term performance results in the volatile renewable energy sector may be poised for gains due to demand surge in the coming years.

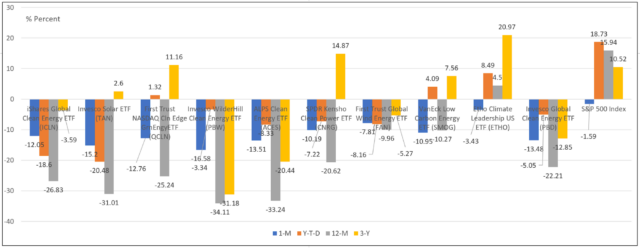

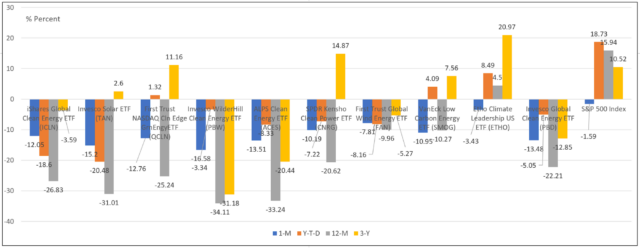

Top 10 clean energy funds by assets under management and performance to August 31, 2023 Notes of Explanation: Funds listed in size order. Top 10 funds by assets under management selected from universe of mutual funds and ETFs that focus on clean energy-related businesses, but excluding from this segment funds that invest in companies that are positioned to benefit, directly or indirectly, from efforts to mitigate the long-term effects of global climate change. Data as of August 31, 2023. Sources: Morningstar Direct and Sustainable Research and Analysis.

Notes of Explanation: Funds listed in size order. Top 10 funds by assets under management selected from universe of mutual funds and ETFs that focus on clean energy-related businesses, but excluding from this segment funds that invest in companies that are positioned to benefit, directly or indirectly, from efforts to mitigate the long-term effects of global climate change. Data as of August 31, 2023. Sources: Morningstar Direct and Sustainable Research and Analysis.

Notes of Explanation: Funds listed in size order. Top 10 funds by assets under management selected from universe of mutual funds and ETFs that focus on clean energy-related businesses, but excluding from this segment funds that invest in companies that are positioned to benefit, directly or indirectly, from efforts to mitigate the long-term effects of global climate change. Data as of August 31, 2023. Sources: Morningstar Direct and Sustainable Research and Analysis.

Notes of Explanation: Funds listed in size order. Top 10 funds by assets under management selected from universe of mutual funds and ETFs that focus on clean energy-related businesses, but excluding from this segment funds that invest in companies that are positioned to benefit, directly or indirectly, from efforts to mitigate the long-term effects of global climate change. Data as of August 31, 2023. Sources: Morningstar Direct and Sustainable Research and Analysis. Observations:

- Climate Week NYC, an event held between September 17 and September 24, 2023 in partnership with the United Nations General Assembly, brought together business leaders, political change makers, local decision takers and civil society representatives of all ages and backgrounds, from all over the world, to drive climate action. According to the International Energy Agency, the reduction of greenhouse gas emissions to limit the effects of climate change is not happening fast enough but at least one climate model forecast, unveiled during Climate Week on September 20th, predicts that the world will likely achieve the Paris Agreement goal of limiting the increase in the global average temperature to well below 2°C above pre-industrial levels¹. This is according to the Inevitable Policy Response (IPR) latest forecast based on global climate policies expected to be put in place in major economies between now and 2050.

- Investors interested in advancing the climate transition agenda and potentially benefiting from long-term opportunities by investing in clean energy related businesses can do so via an expanding list of mutual funds and ETFs. These are funds investing in clean energy related businesses that generate their power from renewable sources, renewable energy companies which may include, for example, wind, solar, hydro, hydrogen, bio-fuel or geothermal technology, lithium-ion batteries, electric vehicles and related equipment, waste-to-energy production, smart grid technologies, or building or industrial materials that reduce carbon emissions or energy consumption.

- The top 10 equity funds by size that invest in line with this narrowly drawn theme are all index tracking ETFs. These funds manage a combined total of $8.6 billion in assets, including the largest sustainable ETF—the $3.5 billion iShares Global Clean Energy ETF (ICLN). This fund, along with the other top funds, experienced declines in assets recently due to a combination of performance related factors as well as investor redemptions.

- Performance in the volatile clean energy sector suffered in August, not only in the light of the broader market sell-off but, to an even greater degree, in response to rising interest rates that may remain elevated for longer and the effects of this on technology-oriented stocks. The top ten funds were down an average of 10.7% in August as compared to the S&P 500 which was down 1.59%. Trailing twelve-month results were even worse, as the 10-fund cohort gave up an average of 21%. In the intermediate-term, the funds posted a negative 3-year average annual return of 1.6%, with returns ranging from a low of -31.2% to a high of 21%.

- Notwithstanding short-term results, the renewable energy sector is poised to see demand surge in the coming years, driven by government incentives and urgency to combat climate change. A significant tailwind for the US green industry comes from the Inflation Reduction Act which was signed into law in August 2022 and carries about $370 billion in subsidies and credits for clean energy investment.

¹The Paris Agreement goes on to state that the parties to the agreement will pursue efforts “to limit the temperature increase to 1.5°C above pre-industrial levels.”