The Bottom Line: A dilemma for sustainable investors, recently surging nuclear technology companies represent a two-edged opportunity to invest in a source of clean energy.

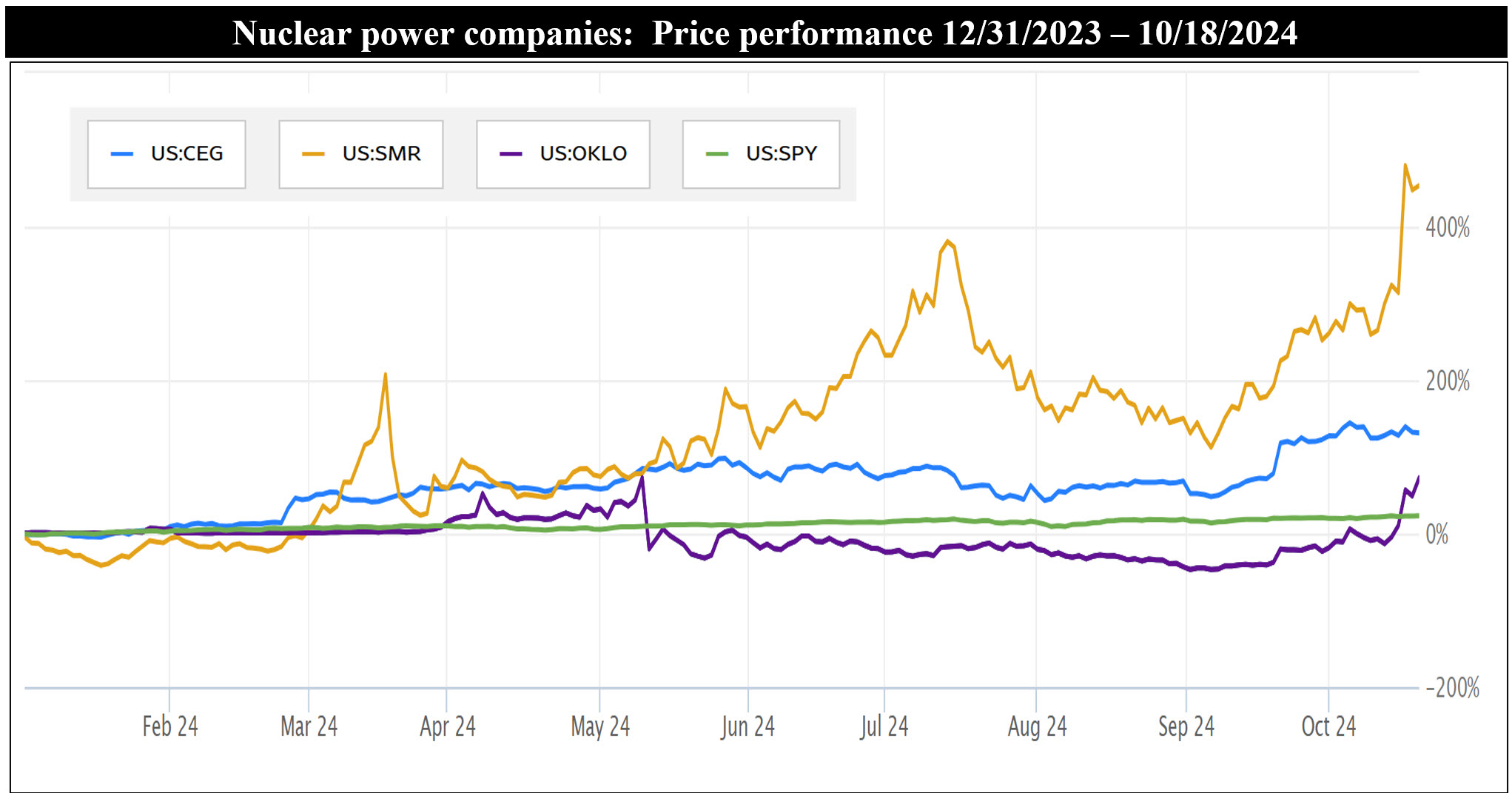

Notes of explanation: Constellation Energy Corp. (CEG), NuScale Power Corp. (SMR), Oklo Inc (OKLO), and S&P 500 SPY ETF. Sources: Yahoo Finance and Sustainable Research and Analysis LLC.

Observations:

• Recent developments in the field of nuclear technology and, in particular, small modular reactors (SMR), are stimulating this sector of the energy market. The share prices of nuclear power companies have been surging. Since the start of the year and continuing through October 18, 2024, shares of NuScale Power Corp. (SMR), Constellation Energy Corp. (CEG) and Oklo Inc. (OKLO), for example, are up an average of 354.9%, ranging from an increase of 72.6% recorded by OKLO, a start-up fast fission clean power technology and nuclear fuel recycling company backed by OpenAI head Sam Altman, to 453% registered by SMR, a small modular reactor designer. By way of comparison, the S&P 500 SPY ETF is up 22.9% during the same interval.

• In recent weeks, Microsoft, Alphabet Inc. and Amazon have truck deals with operators and developers of nuclear power plants to power their operations with emissions-free power. Microsoft entered into an agreement with Constellation Energy to restart the shuttered Three Mile Island nuclear power plant in Pennsylvania. Oracle plans to use new technology in the form of small modular nuclear reactors to power its data centers, while Alphabet announced last week that it was purchasing nuclear energy from small modular reactors being developed by Kairos Power, a privately held start-up that expects its SMRs to be running by 2030. Also last week on Wednesday, Amazon reported that it would invest in the development of SMRs by another start-up, X-Energy. Earlier this year, Amazon also bought a data center powered by nuclear energy in Pennsylvania; and some years earlier, Bill Gates launched TerraPower, in partnership with GE Hitachi Nuclear Energy to develop advanced nuclear energy while NuScale Power, a provider of proprietary and innovative advanced small modular nuclear reactor technology that has already received US Nuclear Regulatory Commission certification for its small modular reactor design.

• Three key forces are driving the resurgence in nuclear energy. First, rapidly growing electricity demand due to the rise of AI technology and data centers, electric vehicles and cryptocurrency. Second, demand for reliable, clean energy sources in global effort to reduce greenhouse gas emissions. Third, renewed regulatory support from global governments leading to extended plant life, expanding capacity and investment in advanced technologies. In fact, the demand for reliable and sustainable energy sources like SMRs is expected to triple by 2030.

• Nuclear energy, which today provides about 20% of US electricity, represents an important component in the transition to a low-carbon energy system. Nuclear power plants produce minimal greenhouse gas emissions during operation, making them a low-carbon energy source. The energy source has a high energy density, meaning a small amount of nuclear fuel can produce a large amount of energy. It also provides a stable and reliable source of energy, which can complement intermittent renewable energy sources like wind and solar and with advancements in technology, nuclear energy can provide a long-term solution for energy needs, contributing to energy security.

• These positive factors, however, are offset by several negative environmental and social considerations and risks. In particular, these include radioactive waste in the form of spent nuclear fuel that needs to be carefully managed and stored for thousands of years, safety concerns, and reliance on large amounts of water for cooling. That said, SMR technology could potentially mitigate some, but not all, of these negative consequences.

• For these as well as other reasons, such as the environmental and social impact associated with uranium mining, nuclear technology represents a dilemma for sustainable investors. In fact, some guidelines restrict altogether the use of nuclear technology in sustainable portfolios. Still, investors whose sustainable preferences allows them to consider investments in nuclear technology may be best served by considering selected, “pure play,” direct stock and bond investments as a way to achieve exposure to the sector while limiting but not entirely eliminating ESG related concerns. That said, investments in companies that are engaged in developing new technologies with long lead times can be volatile and risky investments, especially at this time when their valuations may be stretched.

• Mutual funds and ETFs can mitigate individual company risks via diversification, however, investment company options are limited. Excluding three funds that target uranium mining companies*, only one fund, an ETF, offers exposure to the nuclear sector—broadly defined. This is the $244.5 million VanEck Uranium and Nuclear ETF (NLR) that provides access to companies expected to generate at least 50% of their revenues or assets from uranium, including mining, nuclear plant construction and maintenance, electricity production, and equipment, technology and services for the industry. Because of the fund’s exposure to mining companies, sustainable investors face additional conflicts because of the fund’s potential exposure to social concerns attributable to public health hazards linked to exposures to radioactive materials with severe health impacts on miners and local communities, including increased cancer risks, impacts on indigenous communities and other marginalized groups as well as the potential for the displacement due to mining operations of local communities that cause social and economic disruptions.

*These include, for example, the recently launched Direxion Daily Uraneum Industry Bull 2X Shares (URAA), the $3.3 million Defiance Daily Target 2X Long Uranium ETF (URAX), and the $1.6 billion Sprott Uranium Mines ETF (URNM).