The Bottom Line: Sustainable large cap value funds reflect greater variations in their holdings and broader diversification than their sustainable large cap growth funds counterparts.

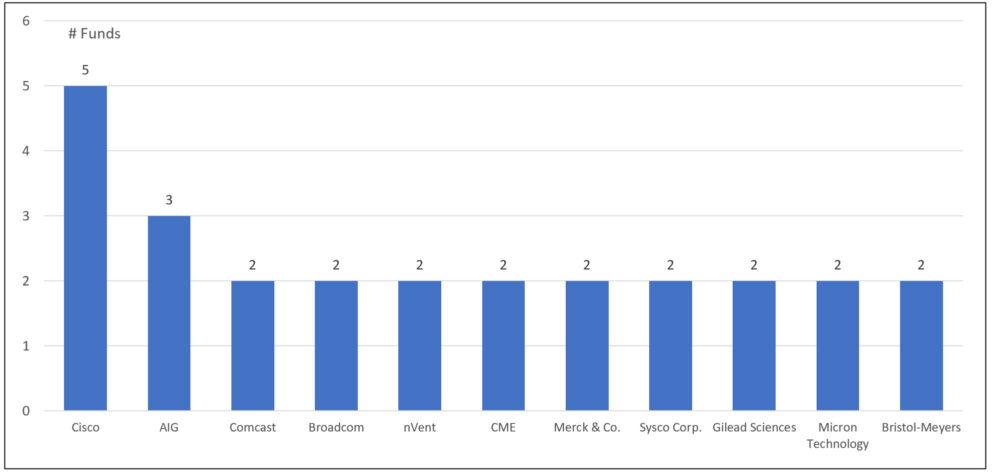

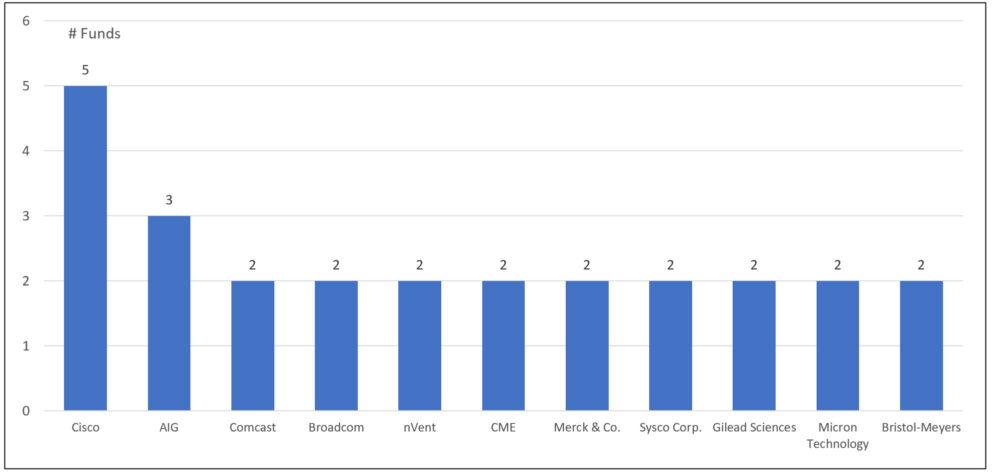

Top 11 stocks most widely held by sustainable large cap value funds: September 30, 2023 Notes of Explanation: Sustainable funds based on Morningstar’s classification. Data as of September 30, 2023. Sources: Sustainable Research and Analysis, Morningstar Direct.

Notes of Explanation: Sustainable funds based on Morningstar’s classification. Data as of September 30, 2023. Sources: Sustainable Research and Analysis, Morningstar Direct.

Notes of Explanation: Sustainable funds based on Morningstar’s classification. Data as of September 30, 2023. Sources: Sustainable Research and Analysis, Morningstar Direct.

Notes of Explanation: Sustainable funds based on Morningstar’s classification. Data as of September 30, 2023. Sources: Sustainable Research and Analysis, Morningstar Direct. Observations:

- Unlike the commonality across a limited number of stock holdings that characterized the performance of sustainable large cap growth funds since the start of the year (refer to :https://sustainableinvest.com/chart-of-the-week-october-9-2023), the top investments of large cap value funds display a significant dispersion of investments.

- The segment of sustainable large cap value funds comprised of mutual funds and ETFs is considerably smaller than large cap growth funds, consisting of only nine funds and 19 share classes with almost $5.0 billion in assets. This compares to 23 sustainable large-cap growth funds and 76 funds/share classes and ETFs with $27.1 billion in net assets.

- Sustainable large cap value funds registered an average 4.2% decline in September when the S&P 500 Index gave up 4.9%. At the same time, average year-to-date and trailing 12-month returns were -1.3% and 10.9%, respectively. Average trailing twelve-month returns were just about 50% lower than the average performance of sustainable large cap growth funds.

- Among the nine sustainable large cap value funds, Cisco Systems Inc., which designs, manufactures, and sells Internet Protocol based networking and other products related to the communications and information technology industry, is the most widely held stock. The stock was up almost 13% since the start of the year through the end of September. Five funds reported that Cisco was one of their top 10 holdings, accounting for investments ranging from 2.81% to 4.41% of portfolio assets.

- AIG followed, with holdings reported by three funds while nine funds held two positions common across the funds. On the other hand, the remaining 79 positions making up the roster of the top 10 holdings, were unique to the nine sustainable large cap value funds.

- Value funds reflect a greater variation in their holdings, they are more broadly diversified and less concentrated than their sustainable large cap growth fund counterparts, with 10% lower volatility profiles based on monthly 3-year standard deviations of returns.