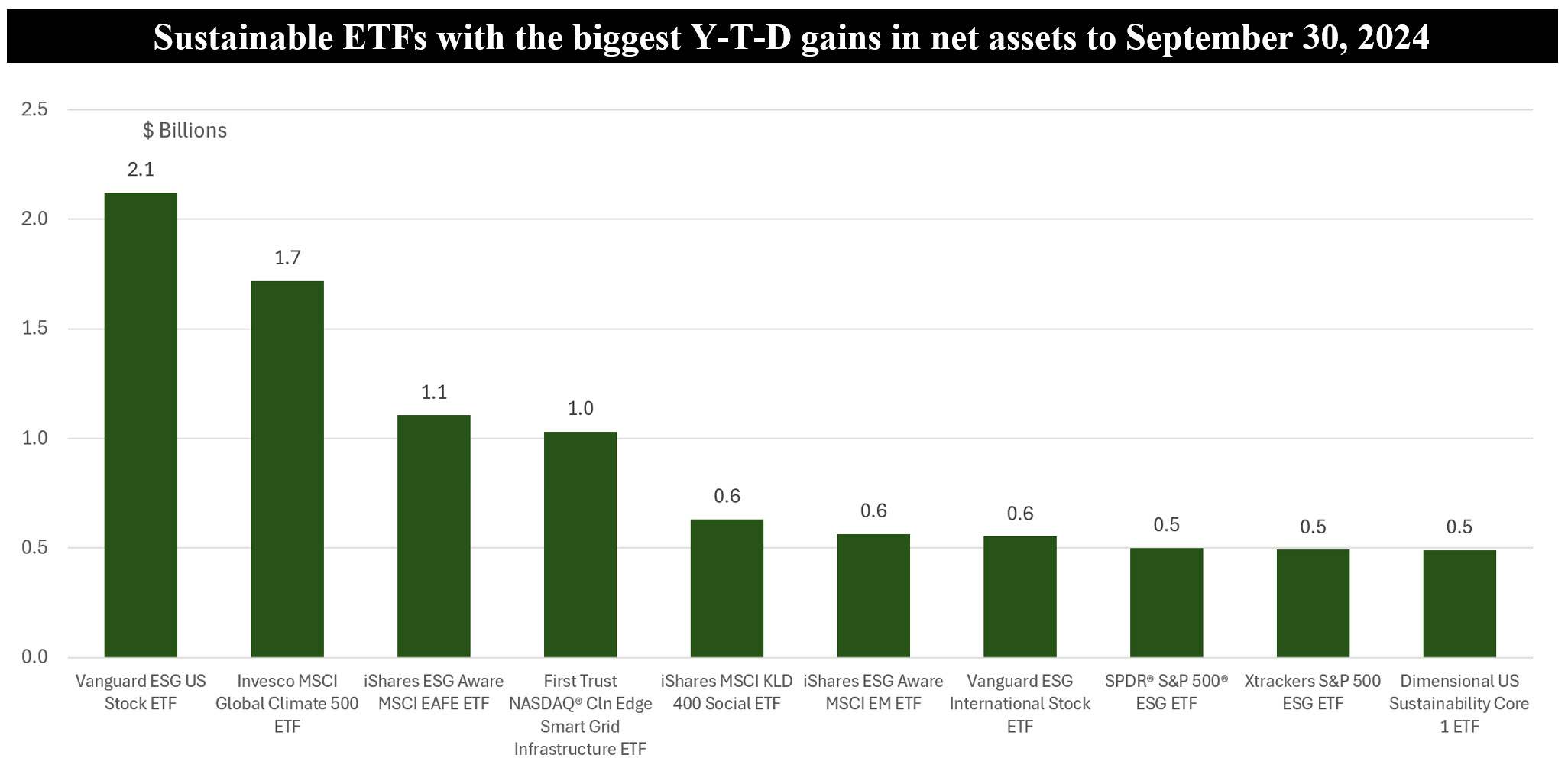

The Bottom Line: The ten sustainable ETFs with the biggest gains in net assets added a combined total of $9.2 billion, or 53.2%, this year.

Notes of explanation: Sources: Yahoo Finance, fund prospectuses and Sustainable Research and Analysis LLC.

Observations:

• With total net assets in the amount of $39.6 billion as of September 30th, the ten sustainable ETFs that saw the biggest gains in net assets since the start of the year through the end of the third quarter added a combined total of $9.2 billion, or 53.2% of all positive net flows so far this year. These include net flows due to market activity as well as cash flows. For context, the entire universe of sustainable ETFs, a total of 237 funds with $111.9 billion in net assets, added $9.9 billion in net assets, or 10%, during the same nine-month interval.

• The largest beneficiaries of net flows are dominated by index tracking funds. Moreover, broad-based US equity funds account for five of the ten funds, followed by three international funds and two thematic funds that pursue environmental mandates.

• The largest of these ten funds, and also the largest sustainable ETF across the 237 listed ETFs at the end of September, is the $9.6 billion Vanguard ESG US Stock ETF (ESGV). This index tracking fund that seeks to track the performance of large-, mid-, and small-capitalization stocks of U.S. companies screened for certain environmental, social, and corporate governance criteria, added a net of $2.1 billion year-to-date.

• Of the two thematic funds, Invesco MSCI Global Climate 500 ETF (KLMT) which was launched on June 27, 2024, gained $1.7 billion in net assets, including seed capital. According to published accounts seed funding in the amount of $1.6 billion was provided by Finland’s Varma Mutual Pension Insurance Company that also specified the parameters around which the underlying index was constructed. The MSCI ACWI Select Climate 500 Index includes companies in the market-capitalization weighted MSCI ACWI ex Select Countries Index that are screened to identify those with greenhouse gas emissions reduction targets that fit Varma’s goal of backing a shift away from fossil fuels. The second thematic fund, the $1.8 billion First Trust NASDAQ Clean Edge Smart Grid Infrastructure Index ETF (GRID) invests in companies that are primarily engaged and involved in electric grid, electric meters and devices, networks, energy storage and management, and enabling software used by the smart grid and electric infrastructure sector.

• The $1.2 billion Dimensional US Sustainability Core 1 ETF (DFSU) is the only actively managed fund in the group of the ten sustainable ETFs with the largest gains in net assets. It is also the second largest actively managed sustainable ETF and the top net flows achiever with a net gain of $489.6 million year-to-date.