The Bottom Line: For investors contemplating sustainable high yield funds, firms with strong credit research teams have shown that they can outperform high yield indices.

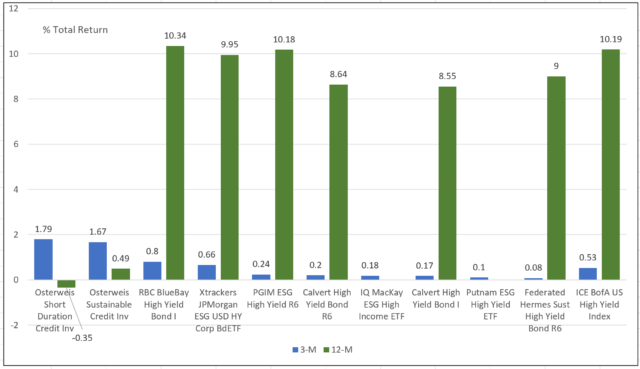

Top 10 performing sustainable high yield mutual funds and ETFs, based on Q3 2023 results Notes of Explanation: Top performing sustainable funds listed based on Q3 2023 results, limited to the best performing share class, based on Morningstar’s classification. List Data as of September 30, 2023 and performance results represent the arithmetic average. Sources: Morningstar Direct and Sustainable Research and Analysis.

Notes of Explanation: Top performing sustainable funds listed based on Q3 2023 results, limited to the best performing share class, based on Morningstar’s classification. List Data as of September 30, 2023 and performance results represent the arithmetic average. Sources: Morningstar Direct and Sustainable Research and Analysis.

Notes of Explanation: Top performing sustainable funds listed based on Q3 2023 results, limited to the best performing share class, based on Morningstar’s classification. List Data as of September 30, 2023 and performance results represent the arithmetic average. Sources: Morningstar Direct and Sustainable Research and Analysis.

Notes of Explanation: Top performing sustainable funds listed based on Q3 2023 results, limited to the best performing share class, based on Morningstar’s classification. List Data as of September 30, 2023 and performance results represent the arithmetic average. Sources: Morningstar Direct and Sustainable Research and Analysis. Observations:

- Sustainable high yield funds, a segment investing in un-rated or rated below investment grade securities consisting of 11 active and six passively managed mutual funds and ETFs with $2.6 billion in net assets as of September 30, 2023, recorded an average decline of 1.29% in September versus a narrow 0.11% gain over the third quarter. Year-to-date, 12-month and 3-year average annual results came in at 4.2%, 8.4% and 0.20%, respectively. The top 10 performing funds registered a Q3 average return of 0.60%.

- The US and global high yield markets got off to a strong start in July, with sustainable high yield funds adding 1.3% on average, as investor expectations for a soft economic landing gained momentum. But expectations moderated in August and weakened further in September as investors came to realize that rates may remain “higher for longer.” Global interest rates moved sharply higher and, in the US, 10-year Treasury yields rose by 50 basis points in September to end the month at 4.59%. The average performance of sustainable high yield funds finished August on a still positive note but turned negative in September.

- Returns in Q3 ranged from a high of 1.79% recorded by the $73.5 million Osterweis Short Duration Credit Inv Fund, a fund that combines fundamental analysis to construct a portfolio consisting primarily of selected, short duration fixed-income securities issued by companies who prioritize making progress in key areas of sustainable business practices. Relative sustainable practices and exclusions based on specific environmental, social and governance (ESG) risks are both considerations in the adviser’s fundamental and sustainable credit research process. The fund benefited from its short duration mandate. That said, Osterweis Capital Management, LLC, the fund’s adviser, announced on September 29, 2023 that new purchases are suspended effective as of that date and the fund will be terminated after the close of business on December 15, 2023. According to the fund’s SEC filing, the decision was made due to the funds inability to obtain a level of assets necessary for it to be viable.

- At the other end of the range with a 3-month total return of -0.67% was the very small $3.2 million AXS Sustainable Income I Fund.

- For investors contemplating intermediate to long-term investments in high yield funds, actively managed investment options should be considered. Actively managed funds outperformed the six passively managed ETFs and mutual funds in Q3 by 5 basis points, on average, confirming a view that active management in less liquid lower quality bonds can best even low-cost index funds. While the average results over the last 3 years don’t support this thesis, individual fund firms with strong credit research teams operating at scale have shown that they can outperform high yield indices.