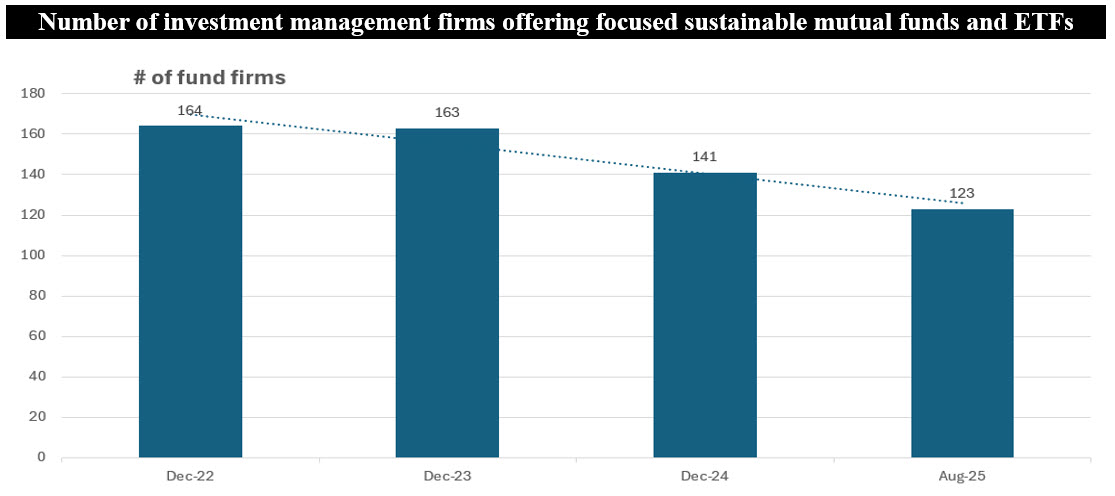

Sustainable Bottom Line: Turbulence around ESG investing since about 2022 has reduced the number of investment management firms offering focused sustainable mutual funds and ETFs.

Notes of Explanation: Sources: Fund reports, Morningstar and Sustainable Research and Analysis LLC.

Observations:

•Financial, political, legal and regulatory turbulence around ESG investing since about 2022 is altering the sustainable investing landscape in the US. Shifts in the sustainable investing landscape can be observed, in part, by the withdrawals of asset managers from the Asset Managers Net Zero Alliance, the increased volume of fund liquidations, reorganizations and rebrandings since around May 2023, outflows from focused sustainable mutual funds and ETFs and the dramatic drop in new focused sustainable fund formations or listings. Also affected are the number of fund management firms offering focused sustainable mutual funds and ETFs which has declined from 164 firms at the end of 2022.

• The number of fund managers offering focused sustainable mutual funds and ETFs stood at 123 firms that, at the end of August 31, 2025, managed 1,238 funds/share classes, including 208 ETFs, with $367.7 billion in assets under management. The number is down from 141 firms at the end of 2024, a decline of 18 firms or 13%, and a drop of 22 firms that offered focused sustainable mutual funds and ETFs at the end of 2023, for a drop of 13.5%. Exits during the current year could still match or exceed last year’s level.

• Notable exits so far this year include Charles Schwab, Lord, Abbett and Tortoise Capital that have reorganized or liquidated their sustainable funds. That said, these firms as well as other firms, especially the larger ones, continue, in varying degrees, to operate their investment advisory franchises pursuant to a set of investment stewardship principles or guidelines that embody the integration of financially material environmental, social, and governance (ESG) factors into their fundamental research and investment processes. This also extends to ESG related engagement and proxy voting practices.

• While focused sustainable funds experienced cash outflows in 2022, 2024 and year-to-date, capital appreciation has sustained their asset levels and long-term assets have been rising since the end of 2022 following significant declines that year. Throughout this period, the segment of focused sustainable funds has become more concentrated while the largest funds have grown larger. At the same time, the expense ratios of the largest funds have declined on average. Whereas the reduced number of funds offer sustainable investors fewer investment options, this development is offset by the availability of bigger funds that, on average, enjoy scale economies that show up as lower ongoing fees and (for ETFs) better trading frictions. For large actively managed funds, scale helps costs but can also hurt alpha generation.