Sustainable Bottom Line: Green bond funds have a place alongside an asset allocation to core sustainable bonds in diversified sustainable portfolios and even conventional ones.

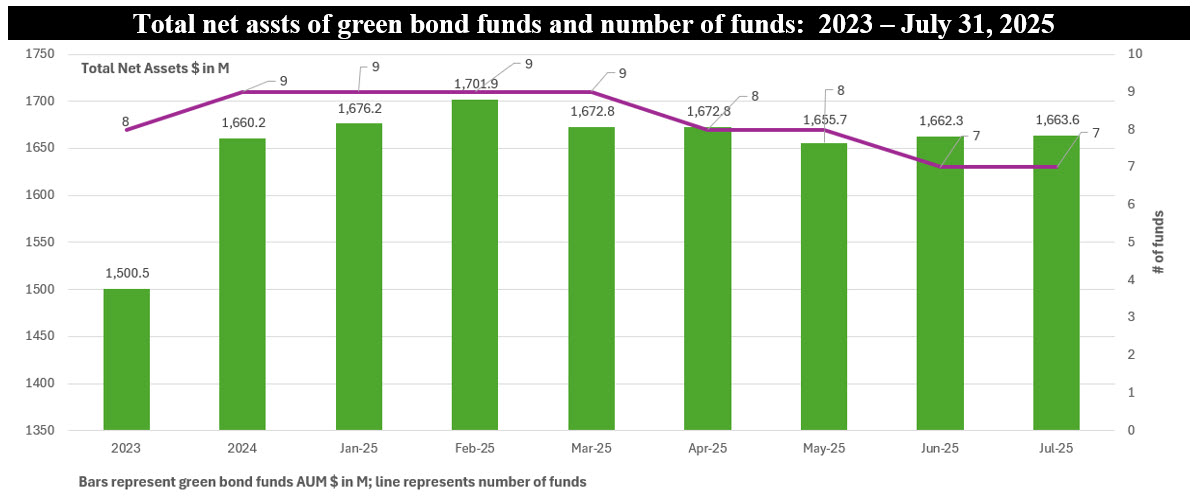

Notes of Explanation: Green bond funds include the Calvert Green Bond Fund, Carbon Collective Short Duration Green Bond ETF, Franklin Green Municipal Bond ETF, iShares USD Green Bond ETF, Nuveen Green Bond Fund, PIMCO Climate Bond Fund and VanEck Green Bond ETF. Sources: Fund documents, Morningstar and Sustainable Research and Analysis LLC.

Observations:

• After two fund closures since the start of the year, the small segment of thematic green bond mutual funds and ETFs has been reduced to seven funds and 17 share classes with $1.7 billion in assets under management (AUM) as of July 31, 2025. These thematic bond funds invest in sustainable bonds, such as bonds issued by corporations, sovereigns, municipalities or in the form of asset-backed securities, whose proceeds are allocated to projects or investments intended to achieve positive environmental or social outcomes or some combination of the two. So far this year, about $452.4 billion in sustainable bonds have been issued and around $900 billion in sustainable bonds could be issued during 2025.

• The latest liquidation of a green bond fund, which occurred as of June 25, 2025, involved the $32.4 million Mirova Global Green Bond Fund with its three share classes. The fund’s investors were dominated by institutional investors that accounted for $19.2 million or 59% of the fund’s assets. Previously, in April of the year, Lord Abbett liquidated the $5.6 million Lord Abbett Climate Focused Bond Fund. The fund, with its five share classes, couldn’t seem to achieve traction. That said, assets attributable to the green bonds segment have remained stable this year, averaging some $1.7 billion throughout 2025, due in part to a large institutional shareholder base that accounts for a minimum of 51% of assets.

• The segment is led by four funds that represent $1.5 billion in assets under management, or 91% of the segment’s AUM. The four funds include two actively managed and passively managed funds each, led by the Calvert Green Bond Fund ($795.9 million), iShares US Dollar Green Bond ETF ($404.1 million), Nuveen Green Bond Fund ($176.8 million) and Van Eck Green Bond ETF ($133 million). Of these, the Calvert Green Bond Fund is the oldest fund as well as the largest, accounting for 46% of the segment’s assets. Across these four funds and their share classes, expense ratios range from a low of 2 basis points to a high of 76 basis points. The average expense ratio across all green bond funds is 63 basis points.

• The average performance of all taxable green bond funds exceeds the Bloomberg US Aggregate Bond Index in each of the preceding 1-month, year-to-date, trailing 12-months, 3-years and 5-year time intervals to July 31 with average results posting gains of 4.72%, 3.04% and 0.10% over the trailing 12 months, 3-years and 5-years. This is the case even if the performance of the Cabon Collective Short Term Green Bond ETF is excluded for the entire period of operation due to its shorter average maturity mandate as well as the Franklin Green Municipal Bond ETF that has experienced lower returns with higher volatility.

• The thematic nature of these funds with their focus on achieving positive environmental or social outcomes, competitive financial results relative to the broad-based investment-grade intermediate- term Bloomberg US Aggregate Bond Index, lower risk, based on the monthly standard deviation of returns over the trailing three years, and in some cases, lower cost options, continue to support the view that investors should consider some level of exposure to a green bond fund alongside an asset allocation to core sustainable bonds in diversified sustainable portfolios and even conventional ones. Levels of exposure will vary based on individual circumstances.