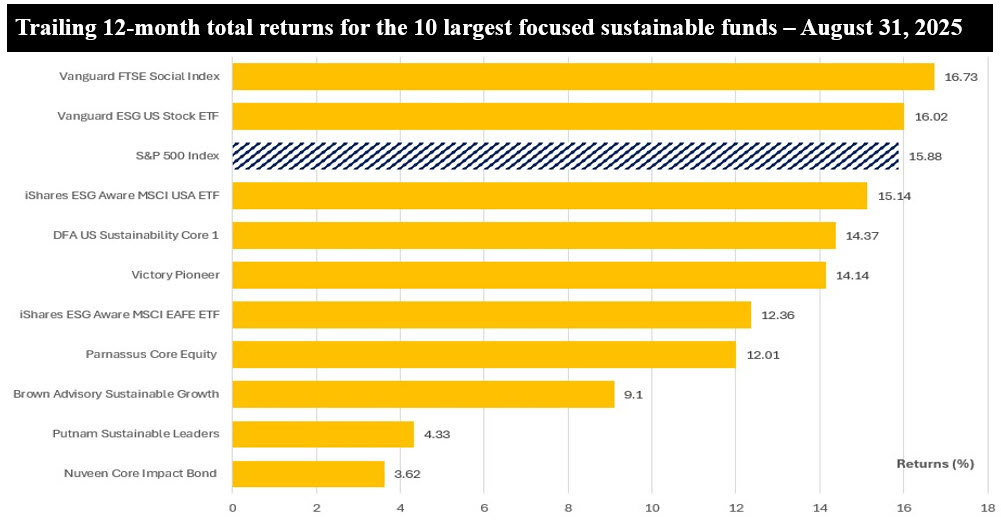

Sustainable Bottom Line: Largest passive focused sustainable index funds outperformed active peers powered most recently by mega-cap technology stocks which have been crucial performance drivers.

Notes of Explanation: Funds listed in order of descending fund returns. Trailing 12-month performance results for mutual funds apply to the best performing share class. For example, the 16.73% return attributed to the Vanguard FTSE Social Index applies to the I share class. Index tracking funds investing in US securities include the Vanguard FTSE Social Index Fund, Vanguard ESG US Stock ETF and iShares ESG Aware MSCI USA ETF. Sources: Fund documents, Morningstar and Sustainable Research and Analysis LLC.

Observations:

•With one exception, the ten largest focused sustainable funds at the end of August 31, 2025 consist of active and passively managed equity-oriented mutual funds and ETFs. Eight equity funds invest in U.S.-based companies while the ninth invests in stocks of companies in developed markets overseas. These include four index tracking and four actively managed funds. The exception is the Nuveen Core Impact Bond Fund, an actively managed core bond that invests across the investment grade, U.S. dollar fixed income market in securities that demonstrate environmental, social and governance (ESG) leadership and/or direct and measurable environmental and social impact.

• Seven of the funds investing in U.S. companies are classified as Large Cap Blend funds while the eighth, the Brown Advisory Sustainable Growth Fund, invests in large cap growth companies. In total, the ten funds, including all share classes in the case of mutual funds, manage $127.3 billion in net assets and account for 34.1% of the focused sustainable funds segment that reached $373.1 billion at the end of August 31, 2025.

• Over the trailing twelve months, the U.S. based funds posted an average return of 12.7%. At the same time, index funds investing in U.S. companies generated an average return of 15.6% while active funds delivered an average return of 9.9%, for a 5.7% differential. The past twelve months highlighted a divide across the largest funds between passive sustainable index strategies and actively managed sustainable equity funds. While all of the largest sustainable equity offerings posted positive returns, the degree to which they participated in the equity market’s strong rally was driven largely by their exposure—or lack thereof—to a handful of mega-cap technology stocks that defined the market’s trajectory.

• Passive ESG index leaders such as the Vanguard FTSE Social Index funds (+16.7%), Vanguard ESG U.S. Stock ETF (+16.0%), and iShares ESG Aware MSCI USA ETF (+15.1%) either exceeded or closely tracked the performance of the S&P 500 Index (1) , which was propelled by the extraordinary performance of the so-called “Magnificent Seven”—Nvidia, Microsoft, Apple, Meta, Alphabet, Amazon, and Tesla. In general, the sustainable investing approach pursued by broad-based index funds relies on exclusions of companies doing business in certain industries or are involved in business controversies as well as ESG screening based on ESG scores, for example, while at the same time maintaining the risk and return characteristics of the fund’s underlying index. Often, this means that portfolios retain full exposure to these market-driving names. Their results illustrate how sustainability-aligned index products can deliver market-like returns narrow or reduced tracking errors.

• Among active managers, performance was more uneven. Parnassus Core Equity Institutional (+12.0%) benefited from its quality-growth emphasis, with positions in Microsoft and Apple helping results. Still, its defensive tilt and underweight exposure to Nvidia and other AI leaders left it trailing passively managed sustainable index trackers. Victory Pioneer A (+14.1%) fared better, aided by semiconductor exposure, though it too was hampered by healthcare and utility holdings. DFA U.S. Sustainability Core 1 posted a surprisingly strong +14.4%, reflecting its diversified factor-based approach across large and mid-cap stocks. While not as concentrated in mega-cap growth as the index trackers, it captured enough exposure to market leaders to keep pace. This made DFA one of the stronger active performers in the sustainable equity universe.

• In contrast, Brown Advisory Sustainable Growth I (+9.1%) and Putnam Sustainable Leaders A (+4.3%) underperformed peers. Brown Advisory’s focus on forward-looking “sustainable compounders,” or high-quality companies that can generate attractive returns over the long term by leveraging what Brown Advisory refers to as Sustainable Cash Flow Advantage (SCFA), provided pockets of strength in healthcare and technology, but its underweight to Nvidia and other AI-driven names, coupled with concentrated bets in renewable energy and consumer sustainability, weighed heavily. Putnam’s broad diversification and mid-cap tilt left it poorly positioned in a market dominated by the largest U.S. growth stocks, producing the weakest equity return among the group.

• Taken together, these results emphasize that in today’s narrow market environment, exposure to a small cohort of mega-cap growth names is the defining driver of performance. Broad-based passively managed sustainable funds have the advantage of full participation, while active managers face the challenge of aligning sustainability convictions with the concentrated leadership of the U.S. equity market. For sustainable investors, the period serves as a reminder that portfolio design—active versus passive, growth versus value, U.S. versus global—can be as consequential as the sustainable investing approach being pursued by the respective funds.

(1) It should be noted, however, that these index funds seek to replicate the performance of different indices.