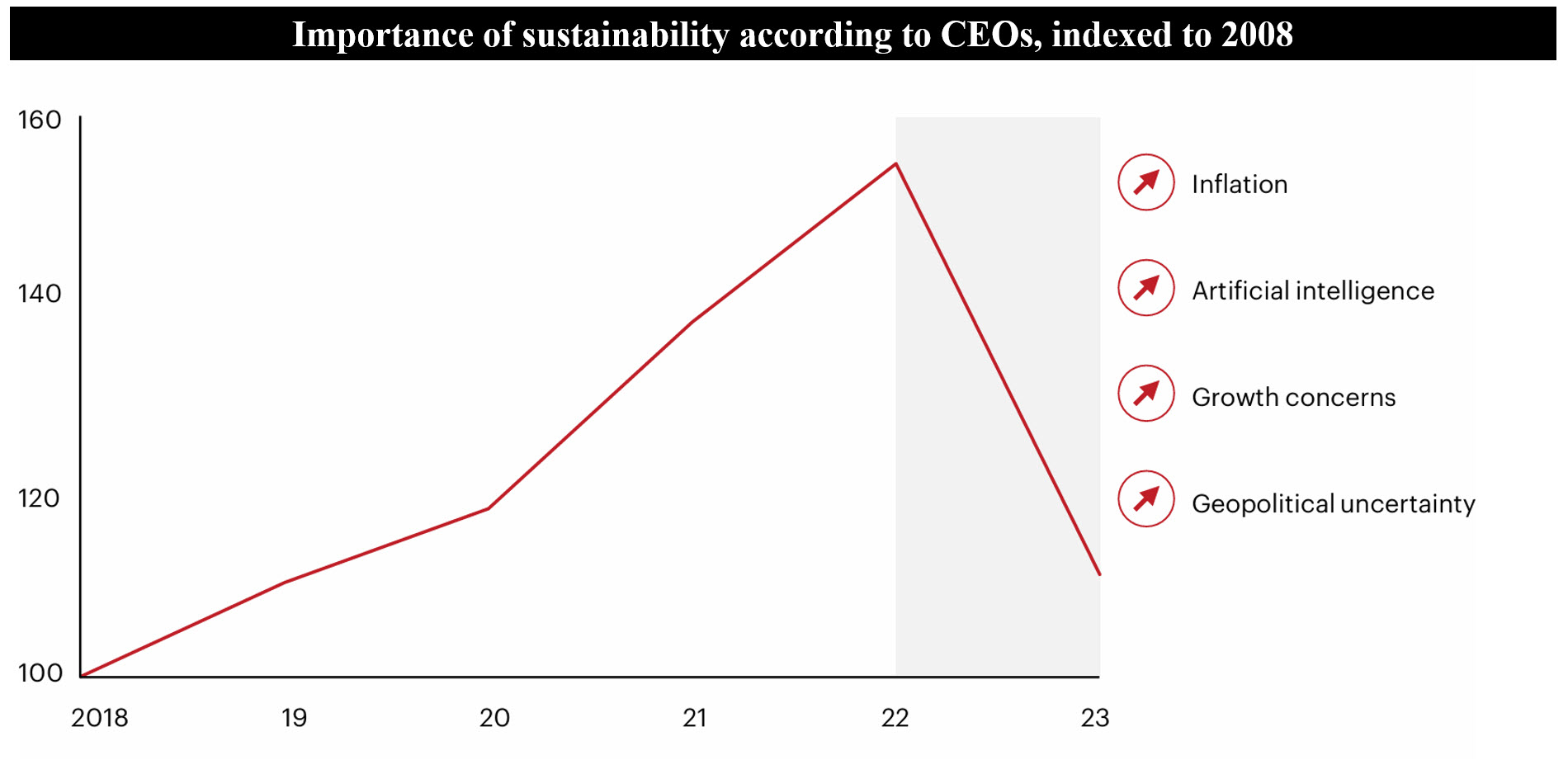

The Bottom Line: While prioritization of sustainability shifted, sustainability remains important according to Bain & Company research findings that may be extrapolated to sustainable investing.

Notes of explanation: Source: Bain & Company. Surveys based on separate CEO surveys conducted by IBM, Gartner, PwC, KPMG and Bain Analysis.

Observations:

- A just released Bain & Company research report entitled The Visionary CEO’s Guide to Sustainability 2024 that relies on third party research and surveys from IBM, Gartner, PwC and KPMG, combined with Bain & Company research and analysis, reveals that CEOs and consumers still value sustainability.

- The report shows that the prioritization of sustainability has undergone a sharp decline following a number of years of “near boundless excitement, bold commitments and mobilizations.” The past twelve months, according to Bain, have “brought a hefty dose of reality about sustainability as CEOs juggle an increasing number of sweeping, systemic challenges. Global surveys reveal a sharp decline in CEOs’ prioritization of sustainability relative to other topics. Disruptive technology, growth, inflation, and geopolitical uncertainty have taken the top spots on their agendas.”

- At the same time, Bain & Company observes that sustainability remains important to executives and consumers. Based on responses from nearly 19,000 consumers surveyed by Bain, roughly 60% are more concerned about climate change than they were two years ago, often due to personal experience of extreme weather.

- However, consumers have trouble figuring out how to live sustainably and look to brands and retailers, in addition to government, to help them.

- These findings can be extrapolated to sustainable investing and investors who continue to be attracted to this investment approach but have a difficult time implementing such a strategy in their portfolios. This follows some years up through 2021 during which enthusiasm and bold predictions regarding investment performance results, in particular, gave way to disappointments on the part of investors. In the absence of more realistic expectations, clearly defined sustainability terms, fund classifications and stronger disclosures across fund complexes with sustainability focused funds, it turned out that investors did not necessarily know what they are getting when they bought funds with labels such as “ESG” or “Sustainable” or “Impact,” to name a just a few. Given continuing interest in sustainable investing, investors in the US would benefit from a widely adopted classification framework for funds along with consistent definitions around sustainable investing terms and disclosure practices.