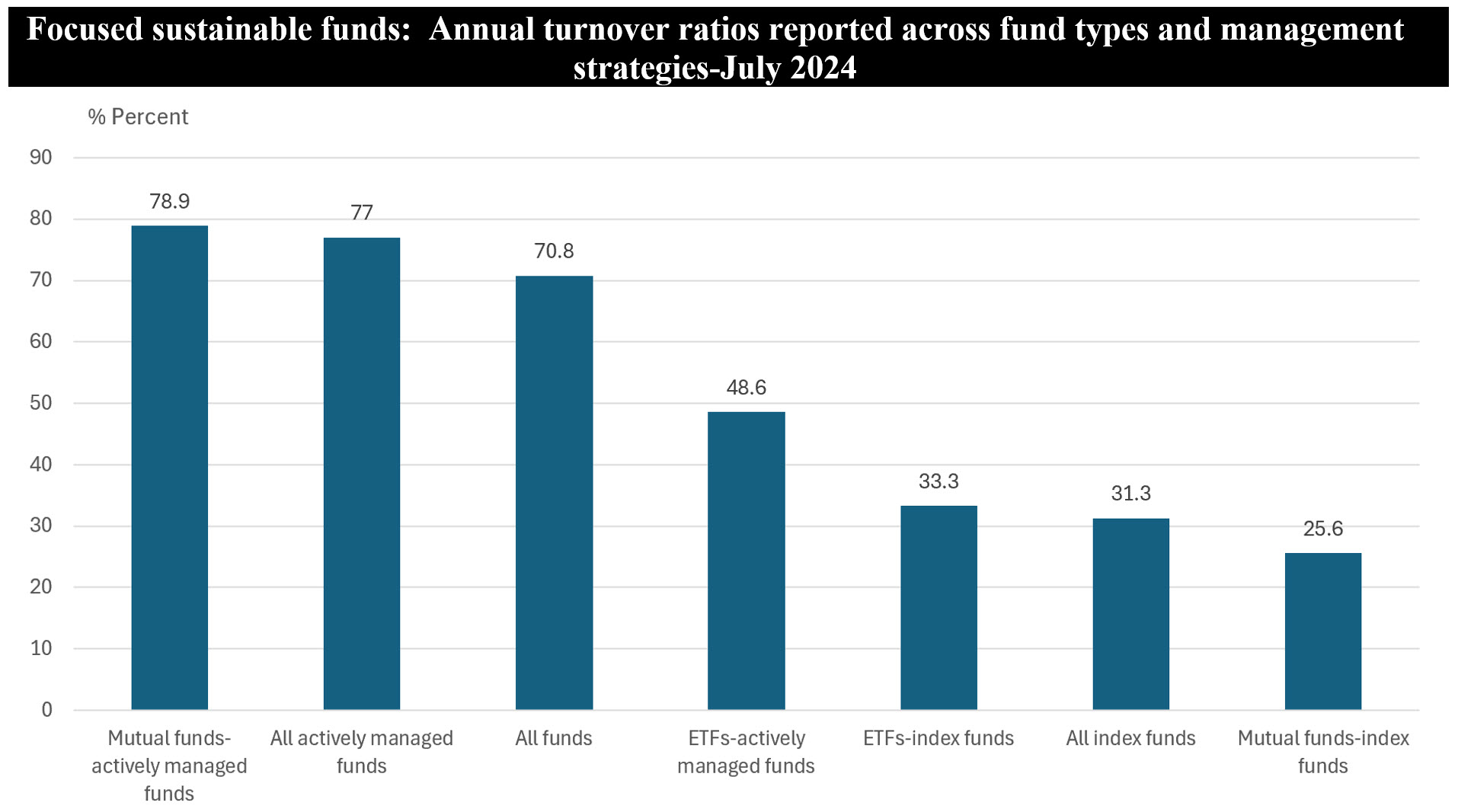

The Bottom Line: Turnover ratios for focused sustainable funds, recently averaged 70.8%, can vary considerably and helps investors make more informed decisions about their investments.

Notes of explanation: Notes of explanation: Turnover ratios over twelve-month intervals and are expressed in percentage terms as of July 31, 2024. Sources: Morningstar Direct and Sustainable Research and Analysis LLC.