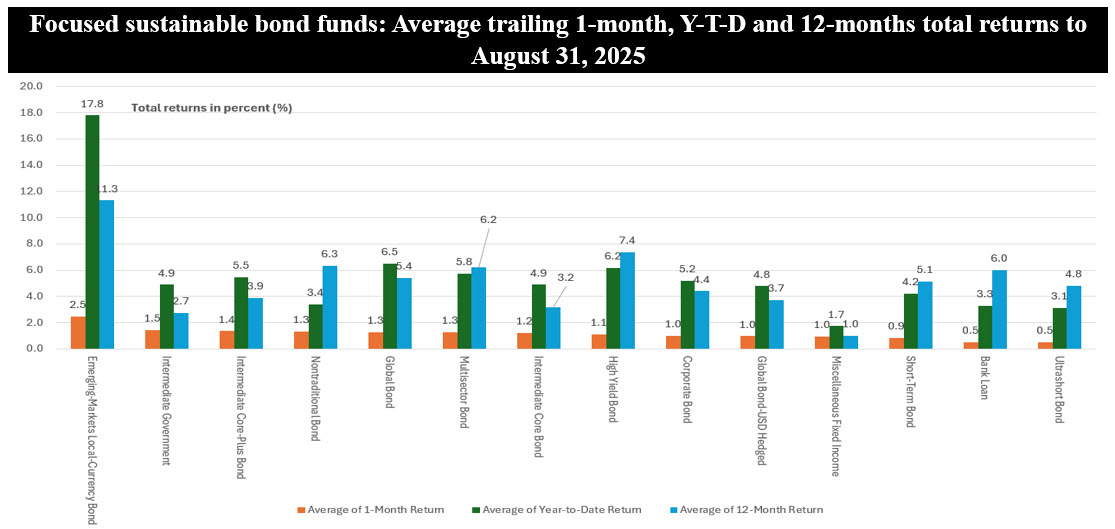

Sustainable Bottom Line: A 12-month rally in EM-local currency debt, which is expected to continue, lifted the performance of the only focused sustainable bond fund.

Notes of Explanation: Sustainable bond fund categories listed in order of descending average fund returns posted for the month of August 2025. Sources: Fund documents, Morningstar and Sustainable Research and Analysis LLC.

Observations:

• Focused sustainable taxable and municipal bonds posted average returns of 1.15% in August, 5.23% year-to-date and 4.66% over the trailing twelve months. In each instance, sustainable emerging-market (EM) local currency bond funds delivered results that exceeded these averages. Through August 31, 2025, the segment, which has benefited from a rally in emerging markets debt, posted the strongest average one month, eight- and twelve-month trailing returns in fixed income, registering average gains of 2.5%, 17.8% and 11.3%, respectively. At 2.98% the category is also subject to the greatest risk across bond funds, as measured by the monthly standard deviation of returns over the last three years. That said, the focused sustainable EM local currency bonds segment is populated by only one fund, thus giving sustainable investors a limited opportunity to participate in these results via a U.S. fund. The only listed fund is the $19.1 million Templeton Sustainable Emerging Markets Bond Fund (1) with its five share classes that are offered at high expense ratios ranging from 88 basis points (bps) to 156 bps points and a track record of less than five years. The fund’s investment goal is to seek current income with capital appreciation as a secondary goal. The fund invests at least 80% of its net assets in a non-diversified portfolio of government bonds issued by emerging market countries pursuant to the investment manager’s investment strategy that emphasizes the current and projected sustainability efforts of emerging market countries in certain environmental, social and governance (ESG) categories.

• Three main forces have powered the rally in emerging markets debt, which strategists believe has further room to run on the back of the Federal Reserve Bank’s shift to a posture of lowering interest rates, starting with the drop last week of the federal funds rate by 25 bps to the 4.00%-4.25% range. First, early and aggressive central bank actions in key EM markets created a favorable interest rate environment. Unlike the U.S. Federal Reserve and the European Central Bank, which had held rates at restrictive levels, many EM central banks, particularly in Latin America, began hiking well before their developed market counterparts to contain post-pandemic inflation. As inflation subsided, these central banks pivoted earlier to rate cuts, setting the stage for bond prices to rise. Second, currency strength has amplified returns. Currencies such as the Brazilian real, Mexican peso, and several Asian units have been buoyed by higher commodity prices, robust remittance flows, and comparatively sound fiscal balances. With dollar weakness evident in parts of 2025, local currency appreciation has boosted investor returns beyond the underlying bond gains. Third, global capital flows have tilted in favor of EM debt as investors search for yield. U.S. and developed-market bonds remain hampered by stubborn inflation and relatively flat yield curves, while EM local debt offers a combination of higher real yields and declining inflation. This yield differential has encouraged institutional and retail investors to reallocate capital toward the segment.

The last period of pronounced outperformance for EM local currency bonds occurred in 2016–2017, following the “taper tantrum” and subsequent normalization in U.S. rates. During that time, commodity prices began to recover from a multi-year slump, global growth strengthened, and the U.S. dollar softened. EM local debt returned double digits in 2016 and continued to perform well in 2017 as global investors rotated back into risk assets. The circumstances then and now share some similarities: inflation differentials favoring EM economies, supportive commodity cycles, and a more stable U.S. dollar backdrop. However, today’s context also differs. Climate-related risks and geopolitical tensions are adding new layers of complexity, and the sustainability angle remains underdeveloped in this space compared to traditional fixed income.

• For conventional investors, with 22 EM-local currency mutual funds and ETFs to consider, the message is that EM local debt can offer a way to diversify fixed-income portfolios and capture yield opportunities not available in developed markets. The recent performance validates the segment’s resilience and its potential to deliver outsized returns when global macro conditions align. Of course, levels of exposure within a diversified portfolio will vary, subject to an investor’s financial goals and objectives, investment time horizon and tolerance for risk. For sustainable investors, the implications are more nuanced. The limited availability of focused sustainable EM-local currency bond funds means that eligible and interested sustainable investors will remain underexposed to this source of returns until such time as more asset managers develop sustainable EM local debt fund strategies. In the meantime, however, sustainable investors can gain exposure to Emerging Markets-local currency debt by investing in a conventional fund.

• Still, investors should remain cautious. EM bonds are inherently volatile, with risks tied to political stability, commodity cycles, and global capital flows. Currency swings can magnify losses as quickly as they boost gains. The 2018 reversal in EM debt performance after the Federal Reserve resumed tightening serves as a reminder of how quickly sentiment can shift.

(1) The fund adopted its sustainable investing approach involving the fund’s focus on investing principally in sovereign bonds of emerging markets countries that the investment manager believes exhibit a higher level of, or are progressing toward greater environmental, social, and governance following Board approval on July 14, 2021.