The Bottom Line: Actively managed sustainable US equity and international mutual funds and ETFs had been increasing their cash allocations during the last 18 months.

Notes of explanation: All funds exclude money market mutual funds but include passively managed funds. Sustainable actively managed US equity and international mutual funds and ETFs, based on Morningstar classifications, are limited to actively managed funds. Taxable bond funds exclude Global Bonds USD Hedged due to outsized average cash allocation attributable to holdings of futures contracts that require cash collateral. Sources: Morningstar Direct, Sustainable Research and Analysis LLC.

Observations:

In Nuveen’s recently released fourth annual Equilibrium survey that polled the views of 800 institutions globally, across North America, Europe, Middle East and Africa, conducted during October and November 2023, the firm reported that institutional investors expressed a greater-than normal level of uncertainty. Most investors believe that “we’ve entered a period of greater-than-normal macroeconomic uncertainty. Higher interest rates, rising geopolitical tensions and a lack of clarity around the fiscal and monetary policy response to more volatile growth and inflation have upended long-held assumptions about primary risk factors, diversification and expected returns.”

According to Nuveen’s survey, the greater level of uncertainty expressed by institutional investors has led to the reallocation of assets from equities to fixed income. In addition, cash holdings have increased for the second year in a row.

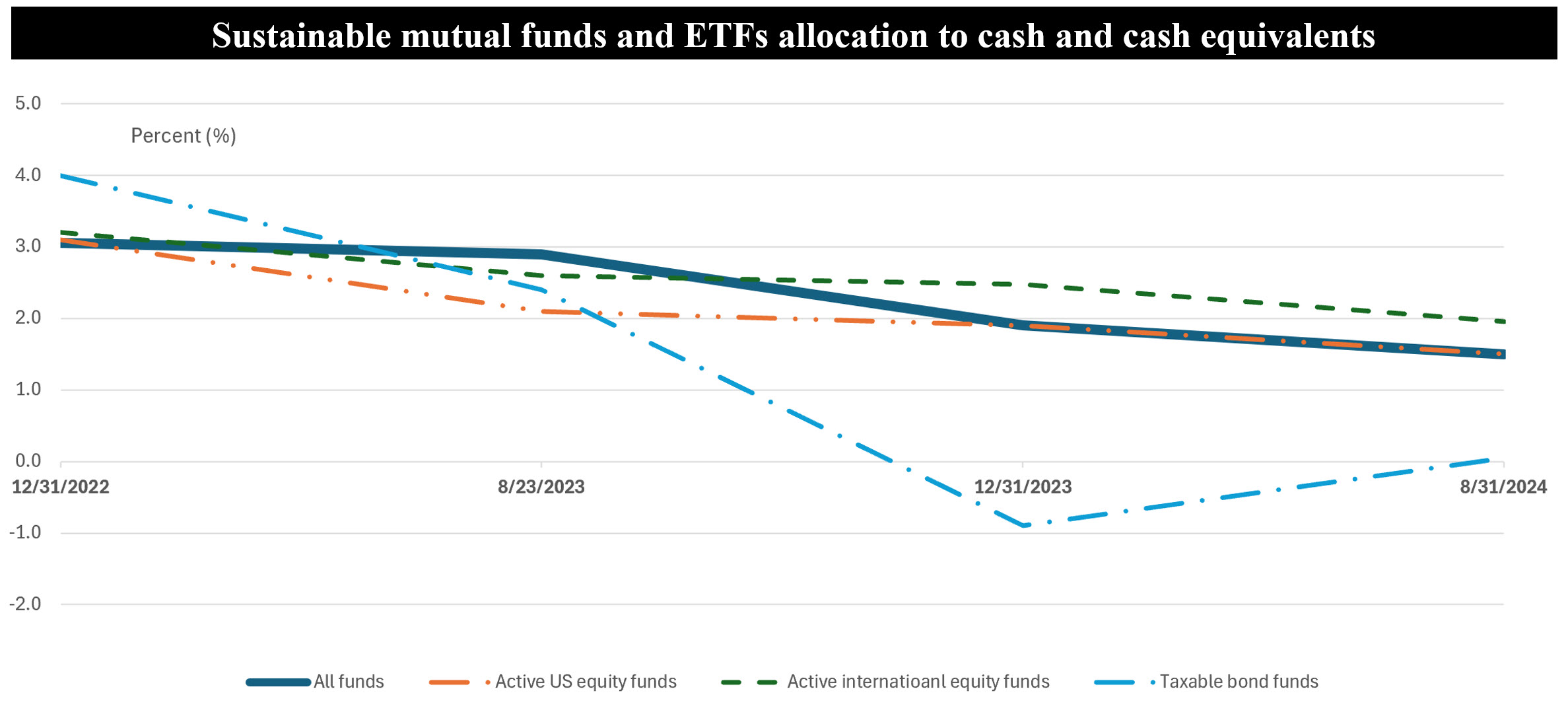

The increase in cash holdings by institutional investors as reported by Nuveen stands in contrast with observations involving sustainable mutual funds and ETFs that have reduced their cash holdings over the last 18-months, based on Morningstar data analyzed by Sustainable Research and Analysis. While dominated by institutional investors, sustainable funds also include investments by retail investors. During the same period, the S&P 500 registered a cumulative total return gain of 51% while the MSCI ACWI ex US added 28.6%.

In the aggregate, long-term sustainable mutual funds and ETFs (excluding money market funds), a total of 1,433 funds/share classes and $355.9 billion in assets under management, lowered their exposure to cash and cash equivalents over the course of the last eighteen months as actively managed equity funds, including US equity funds and international equity funds, leaned into the rising stock market and, in the process, benefited from higher stock returns. At the same time, taxable bond funds lowered their cash exposure through the end of 2023 but added to their cash position during the first eight months of 2024.

According to reported cash and cash equivalents holdings in sustainable funds, the average cash allocations by actively managed sustainable US equity funds dropped from 3.1% at the end of 2022 to 1.5% as of August 31, 2024, for a drop of about 50% over the course of the latest 18-months. Actively managed international equity funds also gravitated toward a more fully invested portfolio, dropping average cash positions from 3.2% to 2.0% over the same time interval. This shift was largely driven by actively managed funds versus index funds.

There was little change in cash allocations over the course of 2022. 2. Average cash positions in bond funds may be skewed due to derivative positions.