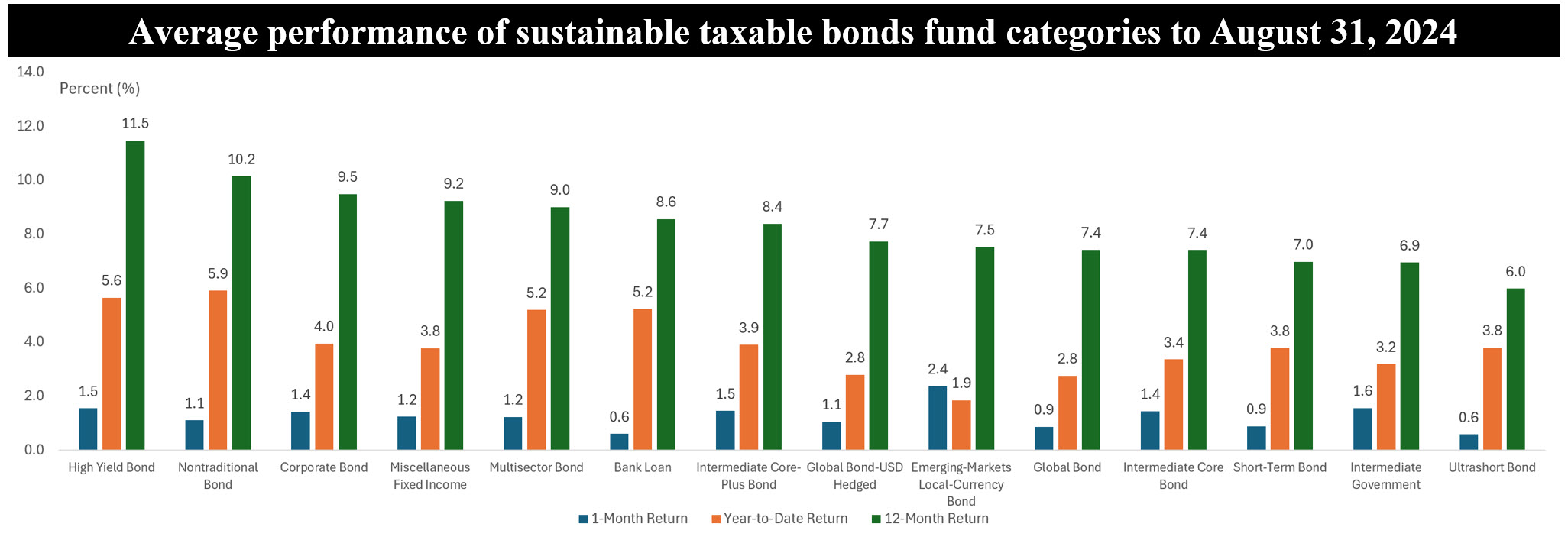

The Bottom Line: Sustainable high yield bonds funds have been a rewarding option for investors over the last twelve months on a risk adjusted basis.

Notes of explanation: Taxable bond funds exclude municipal bond funds. Returns are to August 31, 2024. Average performance listed in order of 12-month returns to August 31, 2024. Sources Morningstar Direct, fund prospectuses, Sustainable Research and Analysis LLC.