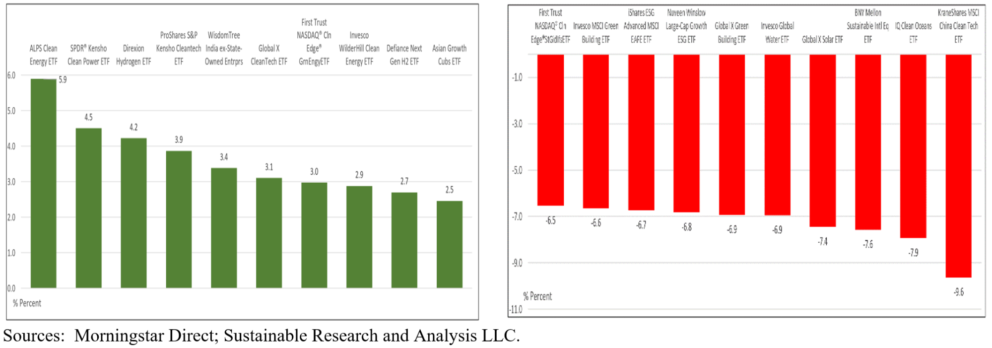

The Bottom Line: Divergence in the August 2022 performance of the top and bottom clean energy funds due to foreign holdings reinforces benefits of diversification.

Divergence in performance of top and bottom 10 performing ETFs in August 2022

Observations:

- With two exceptions, the top sustainable ETF performers in August 2022 were focused on clean energy. Whereas the universe of 231 listed sustainable ETFs posted an average return of -3.1%, the top ten performing ETFs recorded an average gain of 3.6%. Excluding the two non-clean energy focused funds, the average performance of the eight remaining funds is 3.8%.

- Clean energy funds, led by the top performing $801.8 million ALPS Clean Energy ETF (ACES) that was up 5.9% in August, benefited from the passage of the Inflation Reduction Act (IRA). The Act is designed to spur investment in electric cars and clean energy in the United States by providing $369 billion in direct funding, loans and loan guarantees aimed at reducing greenhouse gas emissions. Still, the same funds are down 15.9% over the trailing twelve months.

- At the other end of the range, the ten worst performing funds in August registered an average decline of 7.3%, stretching from a low of -9.6% to a high of -6.5%. Included in the mix were seven funds invested in clean energy, water and green buildings. Taken together, these seven funds registered a decline of 7.4%. The disparity in August’s results is attributable to the fact that these seven funds were almost 2X more exposed to foreign securities in markets that didn’t perform as well as their domestic US counterparts in August and that are less likely to benefit directly from IRA unless investments are made in the US.

- The divergence in performance illustrates the benefits of diversification, which continues to apply to stocks and bonds longer-term, notwithstanding recent negative returns posted by both asset classes, as well as across geographies.